A car crash can change your life in seconds — but you don’t have to face recovery alone. The moments after a collision, whether on a packed Houston freeway or a quiet side street, are a blur of confusion, adrenaline, and stress. The last thing you should have to worry about is how you'll pay for an ambulance ride or cover your bills if you can't work.

This is exactly where Personal Injury Protection (PIP) coverage steps in. Think of it as your financial first aid kit—it’s designed to cover your immediate medical costs and lost wages after an accident, no matter who was at fault.

Your Financial First Aid After a Texas Car Crash

PIP provides a critical lifeline for you and your family right when you need it most. It's the coverage that allows you to get the medical care you need without hesitation, giving you a financial safety net to fall back on.

This is so important because figuring out liability—who is legally responsible for the accident—is rarely a quick process. It can take weeks, sometimes even months, for insurance companies to sort it all out. Without PIP, you could be stuck with mounting medical bills while you wait for the other driver's insurance to pay up.

How PIP Provides Immediate Support

Let's say a Houston driver rear-ended you on I-45, and you have to go to the emergency room. Instead of waiting for the other driver's insurance adjuster to approve the payment, your own PIP coverage kicks in right away. It ensures your doctors get paid and you get the treatment you need to start healing, no questions asked about fault.

This kind of immediate coverage is more essential than ever. For those trying to figure out who pays for medical bills after a Texas car accident, PIP provides the first and fastest answer. Recent insurance data shows an 11% surge in PIP claim payouts per injured person since late 2023, highlighting just how many people rely on this coverage.

After a crash, your number one job is to get better. It shouldn't be fighting with insurance adjusters over who's going to cover the initial hospital visit. PIP gives you the breathing room to focus on your physical and emotional recovery.

By understanding what Personal Injury Protection is, you're taking the first step toward regaining control after a traumatic event. It's about empowering yourself with the knowledge to secure the resources you and your family need to move forward. A skilled Houston car accident lawyer can make sure you get every single benefit you're entitled to under your policy.

What Does PIP Actually Cover?

After a car wreck, the last thing you want to do is decipher confusing insurance jargon. Personal Injury Protection (PIP) is designed to be straightforward, cutting through the red tape to get you benefits for your most immediate needs. Think of it less as a complicated policy and more as a financial first-aid kit for your recovery.

The best part? Unlike other types of insurance that make you wait to prove who was at fault, PIP is your own coverage that you can tap into right away. It focuses on three key areas to help you and your family get back on your feet.

Your Medical Expenses

The first thing on anyone's mind after an accident is getting the right medical care. PIP is built specifically for this, covering all reasonable and necessary medical bills that stem from the crash.

This goes far beyond just the initial trip to the emergency room. PIP can cover a whole spectrum of treatments and services that are essential to a full recovery, including:

- Hospital Stays and Ambulance Fees: Covers the cost of emergency transport and any time you need to be hospitalized.

- Doctor and Specialist Visits: This includes follow-ups with your family doctor or appointments with specialists like orthopedists or neurologists.

- Surgical Procedures: If your injuries are serious enough to require surgery, PIP is there to help with those major expenses.

- Rehabilitation Services: Physical therapy, chiropractic adjustments, and other therapies you need to regain strength and mobility.

- Diagnostic Imaging: Covers the MRIs, X-rays, and CT scans required to figure out exactly what’s wrong.

Just a quick look at the average cost of doctor visits without insurance shows how quickly medical bills can spiral out of control. PIP provides a critical safety net, ensuring you don't have to choose between your health and your finances.

Your Lost Wages

A serious injury almost always means time away from work, which puts an incredible amount of financial pressure on a family. PIP was created to solve this problem by reimbursing you for lost income while you heal.

In Texas, your PIP benefits will typically cover up to 80% of your lost wages. This gives you a reliable source of income to keep up with your mortgage, utilities, and other bills. It allows you to focus on what really matters—getting better—without the constant worry of falling behind.

Imagine you're a construction worker in Houston injured in a crash on I-45. Your doctor orders you to stay home for six weeks to recover. Your PIP coverage would kick in to replace the majority of your lost paychecks during that time, providing critical stability for your family when you need it most.

Essential Services for Daily Life

Sometimes, an injury doesn't just keep you from your job—it stops you from managing your own household. If you’re hurt so badly that you can’t perform the essential tasks you normally handle, PIP can step in to help.

This benefit reimburses you for the cost of hiring someone to take care of those crucial "non-income-producing" services you can no longer do yourself. Some common examples include:

- Housekeeping and Yard Work: If you can no longer manage basic home maintenance.

- Childcare: If your injuries prevent you from properly caring for your children.

- Transportation to Medical Appointments: If you are unable to drive yourself to the doctor or physical therapy.

This is a vital, often-overlooked part of what personal injury protection coverage includes. It’s one of the key things that sets it apart from other policies like MedPay. To see how they differ, check out our guide on what is medical payments coverage.

To give you a clearer picture, here’s a quick breakdown of what you can generally expect PIP to cover versus what it won't.

What PIP Covers vs What It Does Not

| Coverage Type | What PIP Typically Covers | What PIP Typically Does Not Cover |

|---|---|---|

| Medical Treatment | ER visits, surgery, doctor's appointments, physical therapy, ambulance fees, medication. | Experimental treatments, procedures unrelated to the accident injuries. |

| Lost Income | Up to 80% of your documented lost wages while you are unable to work due to injuries. | Lost business opportunities, future promotions, or speculative income. |

| Essential Services | Cost to hire help for childcare, housekeeping, or yard work if you can no longer perform these tasks. | Services that were already being paid for before the accident (e.g., a pre-existing cleaning service). |

| Funeral Expenses | Reasonable costs associated with funeral and burial services if the accident is fatal. | Costs exceeding the policy's specific limit for funeral benefits. |

| Property Damage | None. | Damage to your vehicle, the other driver's vehicle, or any personal property. |

| Pain and Suffering | None. | Compensation for emotional distress, physical pain, or mental anguish. |

This table should give you a good starting point, but remember that every policy is a little different. It's always a good idea to review your specific insurance documents.

How PIP Works With Your Other Insurance

After a car wreck, you might feel like you're drowning in a sea of insurance paperwork. It's completely normal to feel confused about which policy pays for what and when. The key is to stop thinking of your different coverages as a puzzle and start seeing them as layers of protection, all designed to work together.

Personal Injury Protection (PIP) is your financial first responder. It's the first policy you should turn to for immediate medical bills and lost wages because it pays out quickly, no matter who caused the crash. But it’s just the first piece of your financial safety net.

PIP vs. Liability Coverage

The biggest difference between PIP and liability insurance comes down to one simple question: who is it for?

- Your PIP Coverage: This is for you and your passengers. It covers your medical bills and lost income after an accident, regardless of who was at fault.

- The Other Driver's Liability Coverage: This is for covering the damage they caused to other people. If the other driver is to blame for your wreck, their liability insurance is what ultimately pays for your remaining medical bills, car repairs, and non-economic damages like pain and suffering.

Think of it this way: PIP is your immediate relief fund. A claim against the other driver's liability policy is for making you whole in the long run. They work in sequence, not in competition.

PIP vs. Health Insurance

A lot of people assume their regular health insurance will handle everything after a crash, but it's not that simple. In Texas, PIP is considered the primary payer for car accident injuries. This means you have to use your PIP benefits before your health insurance company will even look at a claim.

PIP is specifically designed for auto accidents and often covers things your health insurance won't, like lost wages and the cost of hiring someone for household chores you can no longer do. Your health plan also comes with deductibles and copays you have to pay upfront, while PIP typically doesn't.

Using your PIP first is a huge advantage. It saves your health insurance benefits for other medical needs and helps you avoid the out-of-pocket costs that can drain your bank account. To get a better handle on this, you can learn more about whether medical insurance covers car accidents in our detailed guide.

PIP vs. Uninsured and Underinsured Motorist Coverage

What happens when the driver who hit you has no insurance at all, or not enough to cover your bills? This is exactly why Uninsured/Underinsured Motorist (UM/UIM) coverage is so critical.

While UM/UIM is part of your own policy just like PIP, it serves a completely different purpose. It steps into the shoes of the at-fault driver's missing or inadequate liability insurance.

Here’s how they fit together:

- First, use PIP: Your PIP coverage pays for your initial medical bills and lost income right away, up to your policy limit.

- Then, use UM/UIM: Once your PIP is maxed out, your UM/UIM coverage kicks in to pay for remaining medical costs, future care, and damages for pain and suffering that the other driver should have covered.

Imagine you're hit by a driver on Loop 610 in Houston who only has the bare-minimum liability coverage. If you're seriously injured, your medical bills could easily blow past their policy limits. Your UIM coverage would then bridge that gap, making sure you aren't left holding the bag for someone else's mistake. Understanding how these policies interact is crucial for protecting your financial future.

Who Is Liable in a Texas Car Accident?

Every state plays by its own rulebook when it comes to car insurance. Here in Texas, understanding those rules is the first step to protecting your rights after a wreck. While Texas is what’s known as an "at-fault" state—meaning the person who caused the crash is on the hook for the damages—our laws have a special provision for PIP that puts you, the victim, in a much better position.

Here’s the most important thing you need to know: Texas law requires every auto insurance company to automatically include Personal Injury Protection in your policy. They have to offer it, and it covers you by default unless you go out of your way to sign a form rejecting it in writing. This is a powerful, built-in protection designed to give you immediate access to funds when you need them most.

The Minimum Is Just a Starting Point

By law, the absolute minimum PIP coverage an insurer must offer you is $2,500. Let's be honest, though. A single trip to the emergency room after a serious pile-up on I-45 can blow past that amount in a heartbeat.

This is exactly why we almost always tell our clients to think bigger. Bumping your PIP limits up to $5,000, $10,000, or even more is one of the smartest financial moves you can make. A few extra dollars a month buys you a massive safety net to handle medical bills and lost wages, giving your family a little breathing room when everything feels uncertain.

How Comparative Fault Still Shapes Your Claim in Texas

Even though you’ll use your no-fault PIP benefits right away, the concept of liability—who was legally at fault for the crash—is still the single most important factor in your overall injury claim. This is where Texas's rule of comparative fault comes into play.

You’ll find this rule in Chapter 33 of the Texas Civil Practice & Remedies Code, but it’s often just called "proportionate responsibility." In plain English, it means that if you’re found to be partially to blame for the accident, any money you’re awarded can be reduced by your percentage of fault.

For example, let's say a jury determines your total damages—that’s everything from medical bills and lost income to pain and suffering—are worth $100,000. If that same jury decides you were 10% responsible for the collision, your final award gets cut by 10%, leaving you with $90,000. But here’s the kicker: if you are found to be 51% or more at fault, you get nothing. Zero.

Why PIP Is Your Shield, No Matter Who's at Fault

This is precisely why PIP is so critical. It pays for your immediate, necessary expenses without getting stuck in the mud of a "he said, she said" argument over fault. While the insurance adjusters are off investigating and pointing fingers, your PIP benefits are already paying your doctor and covering a chunk of your missed paychecks.

Think of your PIP claim as separate from the personal injury claim you'll file against the driver who hit you. Using your PIP benefits doesn't stop you from going after the at-fault party for full compensation later. In fact, it gives you the financial stability you need to build a strong case without feeling pressured into taking a lowball settlement just to pay the bills.

An experienced Texas injury attorney can help you manage both your PIP claim and your liability claim at the same time. We make sure you get the maximum from every possible source and that the tricky rules of comparative fault don’t unfairly slash the compensation you deserve.

Steps to File an Insurance Claim

The aftermath of a car crash is a whirlwind of stress and confusion. The last thing you want to deal with is a mountain of complicated insurance paperwork. Filing for your Personal Injury Protection (PIP) benefits is supposed to be simple, but insurance companies can make it feel like an uphill battle.

Knowing the right moves from the start is the best way to protect yourself and get the financial support you need without unnecessary delays. Following these steps can help you avoid the common mistakes that insurers often use to deny or lowball an auto insurance claim.

Step 1: Seek Immediate Medical Attention

Your health comes first. Always. Even if you feel perfectly fine right after the accident, you need to get checked out by a doctor as soon as you can. Some of the most serious injuries, like concussions or internal damage, don't show symptoms right away.

Getting prompt medical care does two crucial things: it gets you the treatment you need, and it creates an official medical record that ties your injuries directly to the accident. That documentation is absolute gold for your PIP claim.

Step 2: Notify Your Insurance Company

As soon as you’re able, call your own insurance company to report the accident. Make it clear that you plan to file a PIP claim. Don't put this off. Most policies have very strict deadlines for reporting an accident, and if you miss that window, you could lose your right to benefits.

When you make the call, just stick to the basic facts: where and when it happened and which cars were involved. Don't guess about who was at fault or agree to give a recorded statement until you’ve had a chance to speak with a Houston car accident lawyer.

Step 3: Complete and Submit the PIP Application

Your insurer will send you a PIP application form. This is your formal request for benefits, so it needs to be filled out completely and accurately. You’ll be asked for details about the crash, your injuries, your doctors, and your job if you’re claiming lost wages.

Be meticulous with this paperwork. Any missing information or inconsistency can give the insurance adjuster a reason to delay or question your claim. An experienced Texas injury attorney can review your application to make sure it’s solid before you send it in.

Step 4: Document Everything Meticulously

From the second the crash happens, start a file. Keep track of every single expense and document related to your recovery. Think of it as building your case—strong documentation is your best weapon against an insurer trying to pay you less than you deserve.

Your file should include:

- Medical Bills: Keep copies of every single bill from the hospital, your doctors, physical therapists, and even the pharmacy.

- Proof of Lost Wages: You'll need pay stubs and a letter from your employer confirming your pay rate and the exact time you missed from work.

- Receipts for Essential Services: If you had to hire someone to help with childcare or housekeeping because of your injuries, keep those detailed receipts.

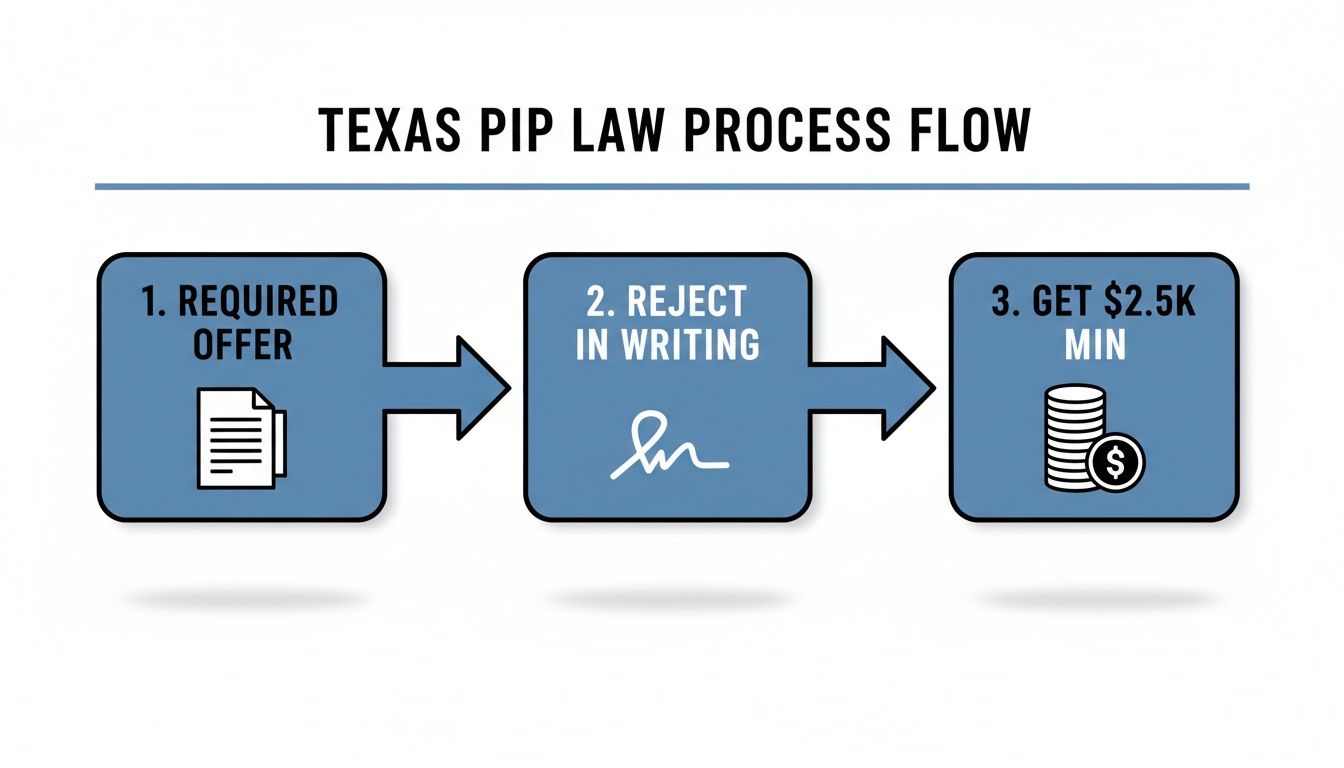

This simple flowchart breaks down how PIP coverage is handled under Texas law—it's designed to protect you.

As you can see, Texas law requires insurers to offer you PIP. You have to actively reject it in writing, which ensures most drivers have at least this minimum layer of protection by default.

Why You Still Need a Lawyer Even With PIP

It’s one of the most dangerous myths we hear: "I have PIP, so I don't need a lawyer." It’s an easy mistake to make. Personal Injury Protection is an incredible tool for getting immediate medical bills paid, but it's only the first step on a much longer road to recovery. Thinking of it as a complete solution can cost you dearly down the line.

Your PIP benefits are designed to put a bandage on the immediate financial bleeding—covering your first medical bills and a chunk of your lost wages, but only up to a set limit. What they absolutely do not—and cannot—do is account for the full, devastating impact of a serious car crash.

Going Beyond Your PIP Policy Limits

Most drivers in Texas carry the minimum $2,500 in PIP coverage. That amount can vanish after a single trip to the emergency room. Even if you have a higher limit, your policy won’t touch some of the most significant losses you'll face after an accident.

For example, your PIP benefits offer nothing for critical damages like:

- Pain and Suffering: This is compensation for the physical agony and emotional trauma you’ve been forced to endure.

- Long-Term Medical Care: What about future surgeries, ongoing physical therapy, or permanent disabilities? PIP doesn’t cover that.

- Full Lost Wages: PIP only covers a percentage of your lost income. It does nothing to address your future diminished earning capacity.

- Property Damage: Your PIP policy won’t pay a dime to repair or replace your wrecked vehicle.

To get compensation for these losses, you have to file a personal injury claim against the at-fault driver’s insurance company. That’s a completely different and far more adversarial process than just using your own PIP benefits.

How an Attorney Manages Your Entire Recovery

This is where a skilled Texas injury attorney becomes your greatest asset. While you use your PIP funds to handle the immediate crisis, our team at The Law Office of Bryan Fagan is already hard at work building a powerful case against the driver who hurt you.

Your PIP benefits are a start, but we are here to finish the fight. We take over all communication with both your insurance company and the at-fault driver’s insurer, making sure every deadline is met and every piece of evidence is perfectly documented.

Our job is to prove the other driver's liability and fight for every penny of compensation you are entitled to under Texas law. We go head-to-head with insurance adjusters whose only goal is to minimize their payout. We shield you from their lowball settlement offers and are always prepared to take your case to court if that's what it takes to get you justice.

Let us handle the legal battle. While you focus on healing, we'll focus on holding the responsible party accountable for the full scope of the harm they caused. Your PIP benefits are just a bridge to the full and fair recovery you truly deserve.

Frequently Asked Questions About PIP Insurance

It's completely normal to feel overwhelmed by insurance questions after a car crash. You're not alone. We've put together some of the most common concerns we hear from our clients about Personal Injury Protection coverage to give you the clear, straightforward answers you deserve. Understanding your rights is the first step toward getting your life back on track.

Will My Rates Go Up If I Use My PIP?

This is a huge worry for most people, and for good reason. The good news is that in Texas, the law is on your side. Insurers are legally prohibited from jacking up your rates for filing a claim if you weren't at fault for the crash.

Because PIP is a no-fault benefit, using it shouldn't hit your wallet with higher premiums, especially when another driver was the one who caused the accident.

What If My Bills Exceed My PIP Limit?

It happens more often than you'd think. The costs of medical care can quickly blow past the minimum PIP coverage limit, particularly after a serious collision. Once your PIP is maxed out, you have to look elsewhere to cover the rest.

This usually means filing a personal injury claim against the at-fault driver’s liability insurance. That claim is meant to cover your remaining medical bills, any future treatments you'll need, and other damages like pain and suffering. This is exactly why having a lawyer in your corner is so critical.

In Texas, your own insurance company generally cannot take your PIP benefits back from your final settlement. This is called the "no subrogation" rule, and it means you get to keep both your PIP payments and the compensation you win from the at–fault party. An attorney will fight to protect this right.

Do I Have to Pay My PIP Benefits Back?

Here’s another key protection for accident victims in Texas: PIP benefits are not typically subject to subrogation. In plain English, this means that unlike health insurance, your car insurance company can't demand you repay the PIP funds you received out of your final settlement from the at-fault driver.

This is a massive advantage, allowing you to "stack" the benefits and maximize your financial recovery by keeping the full amount from both sources.

While your main focus is on Personal Injury Protection, it's also smart to understand other factors that influence your overall auto insurance costs. For example, you can potentially save on premiums with anti-theft devices for cars insurance. Every bit of knowledge empowers you to make better decisions about your financial protection on the road.

A car crash can leave you with more questions than answers, and trying to figure it all out while you're recovering is an uphill battle. You don't have to find those answers alone. The compassionate team at The Law Office of Bryan Fagan, PLLC is here to listen to your story, explain your rights in plain English, and build a powerful strategy to get you the full compensation you deserve.

Contact us today for a free, no-obligation consultation to learn how we can help you move forward. Your recovery is our priority. Visit us at https://houstonaccidentlawyers.net.