A car crash can change your life in seconds—but you don’t have to face recovery alone. That sudden, violent jolt from behind is a shock no driver wants. One second you're stopped in traffic on a busy Houston street, the next you're reeling from an impact that changes everything. These crashes, known as a rear end collision, happen when one vehicle slams into the one directly in front of it. On Texas roads, they're one of the most frequent types of accidents we see.

While it’s easy to dismiss them as simple “fender benders,” the reality is often far more serious, leading to debilitating injuries, unexpected financial burdens, and a long, difficult road to recovery. This guide is here to provide clear, practical advice on your rights and the steps you can take to protect yourself and your family.

What to Know About a Rear End Collision

The jarring impact of a rear end collision is a daily risk for anyone navigating the stop-and-go chaos of Texas highways, whether you're on I-45 in Houston or stuck on I-35 through Austin. Even at what seems like a low speed, the physics at play can unleash a massive amount of force on your body, causing injuries that might not even show up for hours or days.

Think of what happens to your head and neck during one of these crashes. Your car is shoved forward violently, but your head, due to inertia, lags behind for a split second. This forces your neck to hyperextend backward before snapping forward, creating a violent, whip-like motion. That’s the classic mechanism for whiplash, a painful injury that can damage muscles, ligaments, and even the discs in your spine.

Common Injuries and Modern Safety Features

The violent forces in a rear end collision can cause a wide spectrum of injuries, and it's critical to know the signs, as many can have delayed symptoms.

- Whiplash and Neck Injuries: This is the hallmark injury, leading to pain, stiffness, and trouble turning your head.

- Concussions and Traumatic Brain Injuries (TBIs): The impact can cause your brain to slam against the inside of your skull, resulting in headaches, dizziness, confusion, and other cognitive problems.

- Back and Spinal Cord Injuries: Herniated discs or even spinal fractures can occur, potentially leading to chronic pain or, in the worst cases, paralysis.

- Facial and Dental Injuries: Hitting the steering wheel, dashboard, or even a deploying airbag can cause broken facial bones, deep cuts, and damaged teeth.

The good news? Technology is catching up and actively helping prevent these accidents. Advanced safety features are making a real difference on the roads.

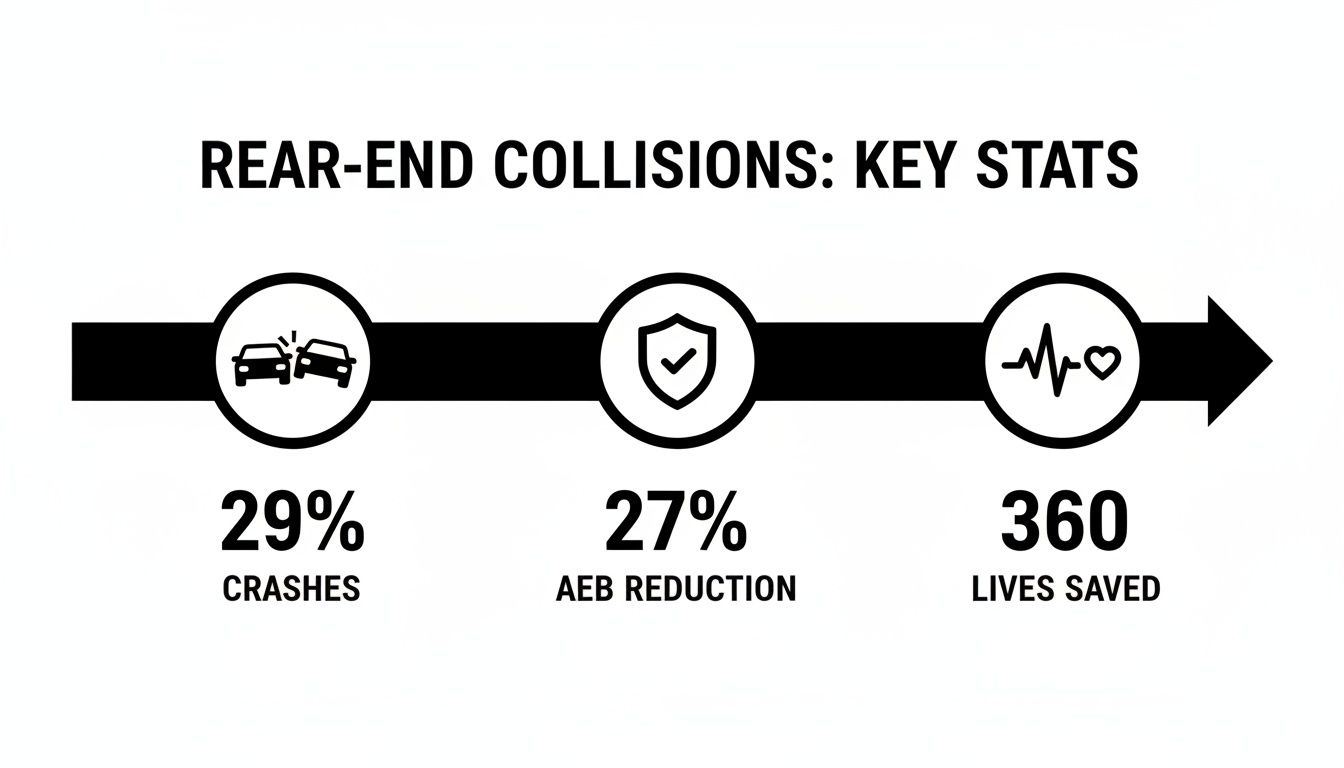

This data paints a clear picture. While rear-end collisions are incredibly common, new technologies like Automatic Emergency Braking (AEB) are proving to be lifesavers.

Below is a table summarizing some of these key findings.

Rear End Collision Overview Table

| Statistic | Value |

|---|---|

| Percentage of All Crashes | 29% |

| Crash Reduction with AEB | 27% |

| Estimated Lives Saved Annually (by 2029 Mandate) | 360 |

| Estimated Injuries Prevented Annually (by 2029 Mandate) | 24,000 |

As you can see, the numbers are significant and underscore both the scale of the problem and the effectiveness of modern safety solutions.

In fact, these crashes are so pervasive that they account for nearly 29% of all police-reported accidents. But there's hope. The Insurance Institute for Highway Safety (IIHS) found that vehicles equipped with AEB see these specific types of crashes reduced by a whopping 27%. This technology is so effective that the federal government is now mandating AEB on all new passenger cars by September 2029. This single move is projected to save at least 360 lives and prevent 24,000 injuries every single year. You can read the full NHTSA report about traffic fatality trends and safety measures for more details.

Who Is Liable in a Texas Rear End Collision?

After the shock of a rear end collision wears off, one of the first questions that pops into your head is probably, "Who's going to pay for this?" In Texas, the law generally presumes that the driver who hit you from behind is the one at fault, or "liable."

This is all rooted in a basic rule of the road: every driver has a duty to keep a safe following distance and stay in control of their vehicle. But while this presumption is a powerful tool for your injury claim, it isn't an automatic win. You still have to prove the other driver was negligent.

Plain-English Legal Terms:

- Liability: This is the legal term for being responsible for causing an accident. The liable party is the one required to pay for the damages.

- Negligence: This is when someone fails to act with the same care that a reasonably cautious person would in a similar situation. For a driver, that could mean anything from texting while driving to following too closely on the 610 Loop during rush hour.

To build a successful case, a Houston car accident lawyer helps you connect the dots, showing that the other driver's careless actions directly caused the crash and all the damages that followed.

The Strong Presumption Against the Rear Driver

Texas law places the burden on the trailing driver to explain why they couldn't stop in time. After all, they have a clear view of the car ahead and should be ready for sudden stops—it’s just part of driving.

The most common reasons a driver fails this basic duty come down to a few key forms of negligence:

- Distracted Driving: Texting, messing with the GPS, or getting lost in a phone call.

- Following Too Closely (Tailgating): This is a classic, leaving zero room to react if the car in front brakes suddenly.

- Speeding: Driving too fast for the conditions makes it impossible to stop safely, whether it's raining or traffic is thick.

- Driving While Fatigued: A drowsy driver’s reaction time can be just as impaired as someone who’s been drinking.

Imagine a Houston driver rear-ended on I-45 by a tailgater who was looking down at their phone. It’s a tragically common story. In fact, safety experts point to distracted, drowsy, and drunk driving as the "big three" culprits behind a significant number of these avoidable crashes.

Can the Front Driver Ever Be at Fault?

It’s rare, but yes. The driver in front can sometimes be partially or even fully responsible for a rear end collision. You can bet the other driver's insurance company will be looking for any excuse to pin some of the blame on you to lower or deny your claim.

Some exceptions to the rear-driver-at-fault rule include situations where the front driver:

- Suddenly throws their car in reverse.

- Slams on their brakes for no reason (often called "brake checking").

- Has broken or non-working brake lights.

- Makes an unsafe lane change, cutting someone off.

When this happens, Texas applies a rule called comparative fault.

Plain-English Legal Terms:

- Comparative Fault: Under Texas Civil Practice & Remedies Code Chapter 33, this rule allows you to still recover damages as long as you aren’t found to be 51% or more responsible for the accident. However, your total compensation gets reduced by your percentage of fault. If you're found 10% at fault, your final payout is cut by 10%.

This is exactly why it's so critical to fight back against any attempt to shift the blame. You can learn more about comparative negligence in Texas in our article.

Immediate Steps to Take After a Crash

The moments after a rear end collision are a chaotic mix of adrenaline, confusion, and shock. It's incredibly easy to feel overwhelmed, but what you do in these first few minutes can make a huge difference for both your physical recovery and your ability to get fair compensation down the road.

Knowing how to react can protect your health and your legal rights from the very start.

Your first priority, without question, is safety. If your car is still drivable, pull over to the shoulder or a safe spot away from traffic. The last thing you want is to cause another accident. Flip on your hazard lights as soon as you're safely stopped.

What to Do at the Accident Scene

Once you're out of harm's way, take a moment to check on yourself and anyone else in your car. Adrenaline is a powerful painkiller, so even if you feel okay, don't just brush it off. From there, try to be as methodical and calm as possible with this step-by-step advice:

- Call 911 Immediately: This is non-negotiable. A police report is one of the most critical pieces of evidence for any insurance claim or lawsuit. When officers arrive, they create an official, unbiased record of what happened, which is invaluable for establishing the facts.

- Seek Medical Attention: Even if you only feel a little sore, get checked out by a doctor as soon as you can. Serious injuries like whiplash or even a concussion often have delayed symptoms that won't show up for hours or days. A medical record creates a clear link between the crash and your injuries, which you'll need for your claim.

- Exchange Information Calmly: You'll need the other driver's name, contact info, insurance policy details, and license plate number. Give them your information, too, but keep the conversation limited to just that. Don't get into a discussion about what happened or who was at fault.

- Do Not Admit Fault: A simple "I'm sorry" can be twisted by an insurance adjuster and used against you as an admission of guilt. Stick to the facts when talking to the other driver and the police. Let the investigation and the evidence speak for themselves.

Document Everything You Can

While you wait for the police to arrive, your smartphone is your best friend. The more evidence you can gather right there at the scene, the stronger your case will be.

Remember, the at-fault driver's insurance company will be looking for any reason to downplay your claim. Detailed documentation is your best defense against their tactics.

Here’s a quick checklist of what to capture:

- Photos of Both Vehicles: Get pictures from every angle, making sure to show all points of damage on both cars.

- Photos of the Scene: Snap photos of the cars' positions, any skid marks on the road, nearby traffic signs or signals, and the general surroundings.

- Witness Information: If anyone stopped and saw what happened, get their name and phone number. An independent witness can be incredibly helpful.

After a crash, it's also essential to follow the proper procedures for filing an official report. You can learn more about how to report a car accident in Texas to make sure you're covering all your legal bases. A Texas injury attorney can walk you through this process, ensuring no detail is missed. The aftermath of a collision is stressful, but taking these simple, deliberate actions will build a solid foundation for your recovery.

Gathering Evidence to Build Your Case

After a rear end collision, your word against the other driver’s is rarely enough to get the compensation you deserve. A strong personal injury claim is built on a foundation of solid, undeniable evidence.

Think of yourself as the first investigator on the scene of your own case. The details you capture right after the crash can become your most powerful tools when you’re up against the at-fault driver's insurance company. Good evidence tells the true story of what happened and shows the real impact the accident has had on your life. Without it, you can bet the insurance adjuster will try to downplay your injuries or, worse, try to pin the blame on you.

Document the Scene and Vehicles Like a Pro

In the moments after a crash, your smartphone is your best friend. Photos and videos create a visual record that’s incredibly difficult for an insurance company to argue with.

Don't just snap one or two pictures and call it a day. Be thorough. Get every angle you can think of.

- Damage to Both Cars: Start with wide shots showing both vehicles in relation to each other. Then, get up close. Capture every single dent, scratch, and broken piece of glass on both cars. This is crucial for showing the force of the impact.

- The Big Picture: Pan out and photograph the entire scene. Get shots of the road, any skid marks on the pavement, nearby traffic signs or signals, and even the weather conditions. If you were hit on a rainy Houston street, a photo showing the wet road provides critical context.

- License Plates and VINs: Get a crystal-clear photo of the other driver's license plate. While you’re at it, find their Vehicle Identification Number (VIN) on the dashboard or inside the driver’s side door and snap a picture of that, too. This ensures there’s no confusion about who was involved.

Get Official Reports and Talk to Witnesses

Your own photos are vital, but official documents and what other people saw add a whole new level of credibility. These are the pieces of evidence that are seen as unbiased, and they carry a ton of weight.

An official police report is often the cornerstone of a personal injury claim. It provides an objective summary of the accident and sometimes includes the officer's initial thoughts on who was at fault, which can be incredibly persuasive.

Make sure you also grab these key items:

- The Police Report: Before you leave the scene, always ask the responding officer for the police report number. You can usually pick up a copy from the police department a few days later. This document is absolutely essential for your auto insurance claim.

- Witness Information: If anyone stopped to help or saw the crash happen, politely ask for their name and phone number. An independent witness who can confirm the other driver was tailgating or looking down at their phone is worth their weight in gold.

- Your Medical Records: This is non-negotiable. Keep a detailed file of everything—every doctor's visit, every medical bill, every prescription receipt, and notes from every physical therapy session. This meticulously tracks your financial losses and proves just how serious your injuries are.

Every piece of evidence you collect helps your Houston car accident lawyer build a rock-solid case, protecting your rights and getting you one step closer to a fair recovery.

How to File an Insurance Claim and Deal with Adjusters

Dealing with an insurance company after a rear end collision can feel like you’ve been thrown into a game where the rules are stacked against you. It's important to remember their primary goal: protecting their profits by paying you as little as possible. This is where a little preparation and knowledge can become your greatest asset.

Once you file an auto insurance claim, you’ll be assigned an insurance adjuster. Let’s be clear: this person may sound friendly and concerned, but they are not on your side. Their job is to investigate the claim with one objective in mind—to find ways to minimize the payout for their company.

Interacting with the Insurance Adjuster

The adjuster will almost certainly ask you to give a recorded statement about the accident. You are not legally obligated to provide one, and it's almost always a bad idea to agree before you've spoken with a Texas injury attorney.

Why? Because adjusters are trained to use specific tactics to get you to say something that can weaken your claim. Even a simple, polite response like, "I'm feeling a little better today," can be twisted to imply your injuries are minor and not worth significant compensation.

Here are a few essential tips for handling these conversations:

- Stick to the Facts: Provide only basic, objective information about the crash. Don’t guess, don't offer opinions, and don’t speculate about your injuries or who was at fault.

- Never Admit Fault: Avoid saying anything that sounds like an apology, such as "I'm so sorry this happened." Those words can be used against you.

- Keep Injury Details Brief: Simply state that you are getting medical treatment and that the full extent of your injuries is still being determined.

- Politely Decline a Recorded Statement: You can say, "I'm not comfortable providing a recorded statement at this time." It's your right.

Getting a handle on your own car insurance options is also a smart move. Understanding your own policy helps you know the landscape you're operating in.

Countering Lowball Settlement Offers

It’s standard practice for insurance companies to make a quick, low settlement offer soon after the crash. They’re banking on the fact that you're stressed about medical bills and car repairs and will jump at the first offer just to make it all go away.

Do not accept the first offer. It is almost certainly far less than what your claim is actually worth. This initial offer rarely accounts for future medical needs, lost earning capacity, or the full extent of your pain and suffering.

Think about it this way: a driver who gets rear-ended on I-45 in Houston might get an initial offer of $5,000. That might cover the first ER visit, but it completely ignores the months of physical therapy, lost wages from being unable to work, and the chronic pain they might live with for years.

When you get a lowball offer, the best response is a detailed demand letter prepared by your lawyer. This letter should clearly lay out:

- Liability: A straightforward explanation of why their insured driver was at fault.

- Damages: A complete list of all your losses, both economic and non-economic, backed by the evidence you gathered. This means medical bills, repair estimates, proof of lost income, and a valuation of your pain and suffering.

- A Counteroffer: A specific, justified amount that reflects the true value of your claim.

Negotiating with an insurance adjuster is a strategic dance. Having an experienced Houston car accident lawyer from The Law Office of Bryan Fagan, PLLC, handle these talks means you're negotiating from a position of strength, not desperation.

Understanding Your Potential Compensation

After the shock of a rear end collision wears off, the financial pressure can start to feel overwhelming. Medical bills show up in the mail, your car is stuck in the shop, and you might be losing income because you can’t work. It’s only natural to ask the most pressing question: what is my personal injury claim actually worth?

In Texas, the law is set up to help you recover your losses, which are legally called “damages.” This isn’t about pulling a random number out of thin air. It’s a calculated process designed to make you whole again by compensating you for both the tangible and intangible ways the crash has turned your life upside down.

The Different Types of Damages

Compensation is typically broken down into two main categories. Understanding both is the first step to knowing what a fair settlement looks like for you.

Plain-English Legal Terms:

- Damages: This is the legal term for the money awarded to a victim to compensate for their losses. Texas law (Texas Civil Practice & Remedies Code, Chapter 41) defines different types of damages you can recover.

- Economic Damages: Think of these as the black-and-white losses. They are the straightforward, calculable costs you’ve racked up because of the accident, all backed by receipts, invoices, and pay stubs.

- Non-Economic Damages: This category is more personal. It’s designed to compensate you for the harm that doesn’t come with a price tag, like the physical pain and emotional toll the crash has taken on you.

Here’s a clearer look at what falls under each umbrella:

| Economic Damages | Non-Economic Damages |

|---|---|

| All current and future medical bills | Physical pain and suffering |

| Lost wages and income | Mental anguish and emotional distress |

| Lost earning capacity (if you can't return to your old job) | Loss of enjoyment of life |

| Vehicle repair or replacement costs | Physical impairment or disfigurement |

| Cost of rehabilitation and therapy | Loss of consortium (the impact on your spousal relationship) |

Let's put this into perspective. Imagine a Houston driver gets rear-ended on I-10. He ends up with $30,000 in medical bills and misses enough work to lose $10,000 in wages. Those are his economic damages. But what if he also now suffers from chronic neck pain that keeps him from playing catch with his kids? That pain, and the loss of that simple joy, is exactly what non-economic damages are meant to cover. In the most tragic cases, a family may be able to seek wrongful death compensation.

In severe cases where injuries require long-term assistance, even the costs associated with learning things like safe patient transfer techniques for caregivers can be factored into a claim. If you're curious about specific injuries, you can learn more by reading our guide on typical settlements for whiplash.

The Clock Is Ticking: The Statute of Limitations

Here’s something you absolutely cannot ignore: you don’t have forever to seek compensation. Texas law puts a strict deadline on personal injury claims, known as the statute of limitations.

Plain-English Legal Terms:

- Statute of Limitations: This is a law that sets a firm deadline for filing a lawsuit. In Texas, you generally have just two years from the date of the accident to file. If you miss this deadline, your right to recover any compensation is almost certainly gone for good—no matter how clear-cut your case is.

Two years might sound like a long time, but it flies by when you’re juggling doctor’s appointments, physical therapy, and just trying to get back on your feet. In that time, crucial evidence can get lost, witnesses’ memories fade, and insurance companies might just be trying to run out the clock.

This is precisely why you need to speak with a Houston car accident lawyer as soon as you can. An experienced Texas injury attorney at The Law Office of Bryan Fagan, PLLC, will make sure every critical deadline is met, protecting your right to pursue the full and fair compensation you’re owed for your medical bills, lost income, and suffering.

Frequently Asked Questions About Rear-End Collisions

When you're dealing with the shock and pain of a rear end collision, a thousand questions can run through your mind. The path forward can feel hazy, but getting clear, straightforward answers is the first step toward taking back control. Here’s some guidance on the most common concerns we hear from victims just like you.

Can I Still Get Money If I Was Partially at Fault?

Yes, in many cases, you can. Texas operates under a comparative fault rule. This means you can still recover compensation as long as you aren't found to be 51% or more responsible for what happened.

Keep in mind, though, your final payment will be reduced by whatever percentage of fault is assigned to you. For instance, if you're awarded $100,000 but are found 10% at fault—maybe for a broken brake light you didn't know about—your recovery is cut by 10%, leaving you with $90,000. Insurance companies are masters at trying to shift blame to lower their payout, which is why it's so important to challenge any claim that you were at fault.

The Other Driver's Insurance Company Wants a Recorded Statement. Should I Give One?

Our strong recommendation is to politely decline giving a recorded statement until you’ve spoken with a Texas injury lawyer. It might seem like a harmless, routine request, but the insurance adjuster has one goal: to find anything they can use to weaken your claim.

These adjusters are trained to ask tricky, leading questions designed to get you to downplay your injuries or accidentally say something that sounds like you're admitting fault. You are not legally required to provide a statement to the other driver’s insurance company. Protecting your rights comes first.

What If the Driver Who Hit Me Was Uninsured?

It’s a frustratingly common scenario, but you still have options. This is exactly where your own auto insurance policy is supposed to kick in, specifically your Uninsured/Underinsured Motorist (UM/UIM) coverage.

UM/UIM coverage is your safety net for this exact situation. It steps up to cover your medical bills, lost wages, and other damages when the at-fault driver either has no insurance or doesn't have enough to cover the full cost of your losses. A Houston car accident lawyer can help you handle the process of filing a claim with your own insurance provider.

How Long Do I Have to File a Lawsuit in Texas?

In Texas, the clock is ticking. The legal deadline for filing a personal injury lawsuit, known as the statute of limitations, is generally two years from the date of the crash. This is a hard-and-fast deadline.

If you miss that two-year window, you will almost certainly lose your right to seek compensation for your injuries, no matter how strong your case is. It’s absolutely critical to act quickly to make sure your legal rights are preserved.

A rear end collision can turn your life upside down, leaving you with serious injuries, overwhelming medical bills, and constant stress. You don't have to face the insurance companies and the legal system on your own. The compassionate attorneys at The Law Office of Bryan Fagan, PLLC are here to fight for the justice and compensation you deserve. We understand what you are going through, and we are here to provide the support and expert legal guidance you need to move forward.

Contact us today for a free, no-obligation consultation to discuss your case and learn how we can help you get back on your feet. Your recovery is our priority. Visit us at https://houstonaccidentlawyers.net to get started.