A car crash can change your life in seconds—but you don’t have to face recovery alone. When you're trying to heal and put your life back together, the last thing you need is a confusing legal document from an insurance company.

One of the first, and most critical, documents you'll encounter is a liability release form. This is a legal contract the insurance company asks you to sign before they’ll give you a settlement check. By signing it, you are agreeing to give up your right to pursue any more money for the accident—forever. It's the final, binding document that closes the book on your claim for good.

Your First Look at a Liability Release Form

After a car accident in Texas, it’s not uncommon to get a settlement offer and a liability release form much faster than you’d expect. Imagine you're a Houston driver rear-ended on I-45. Within days, you might get a call from the other driver’s insurance adjuster offering a quick check to cover your initial medical bills. But that offer comes with a big string attached: the release form.

Make no mistake, this document is designed entirely to protect the insurance company, not you. Its only purpose is to end their financial responsibility for the crash.

Understanding the Key Players

The form will use specific legal language to identify everyone involved. Understanding these terms is the first step toward protecting your rights. Here’s a plain-English definition for the jargon you’ll see and what it really means for you.

Key Terms in a Liability Release Form Explained

| Legal Term | What It Means for You (in Plain English) |

|---|---|

| Releasor | This is you, the injured person. By signing, you are "releasing" the other party from any future claims. |

| Releasee | This is the at-fault driver and their insurance company. They are the ones being "released" from liability. |

| Consideration | This is the settlement money the insurer is paying you in exchange for your signature. It's the "price" of your release. |

| Covenant Not to Sue | This is your legally binding promise not to file any more lawsuits related to this accident once you've signed. |

| Indemnify and Hold Harmless | This means you agree to protect the insurance company from any other claims that might pop up from this accident, like from your own health insurer. |

This distinction between "Releasor" and "Releasee" is absolutely crucial. Once you sign as the releasor, you can't go back and ask for more compensation—not even if your injuries turn out to be far more severe than you first thought.

A liability release form legally and permanently ends your ability to seek further compensation for an accident. Signing it means you accept the settlement as the full and final payment for all your damages, both present and future.

Why Insurers Use These Forms

Insurance companies use liability release forms to achieve finality and control their costs. Statistics show that about 95% of personal injury cases are settled before ever going to trial, and these forms are what make those settlements official.

These waivers are meticulously drafted by their lawyers to cover every possible angle—including all known and unknown injuries related to the incident. It’s all about protecting their bottom line.

This document is a critical milestone in your auto insurance claim, often appearing right after you’ve sent a demand letter outlining your damages. If you're not familiar with that process, you can check out our guide on how to write a demand letter for personal injury to get a better handle on this step.

Rushing to sign a release without fully understanding what you’re giving up is one of the biggest and most costly mistakes an accident victim can make.

The Hidden Dangers of Signing a Release Too Soon

After an accident, the pressure to sign a liability release form can be intense. The insurance adjuster might sound friendly and empathetic, offering what seems like a fair amount of money to help you put the whole ordeal behind you. But signing that document too quickly is one of the most serious mistakes you can make for your future.

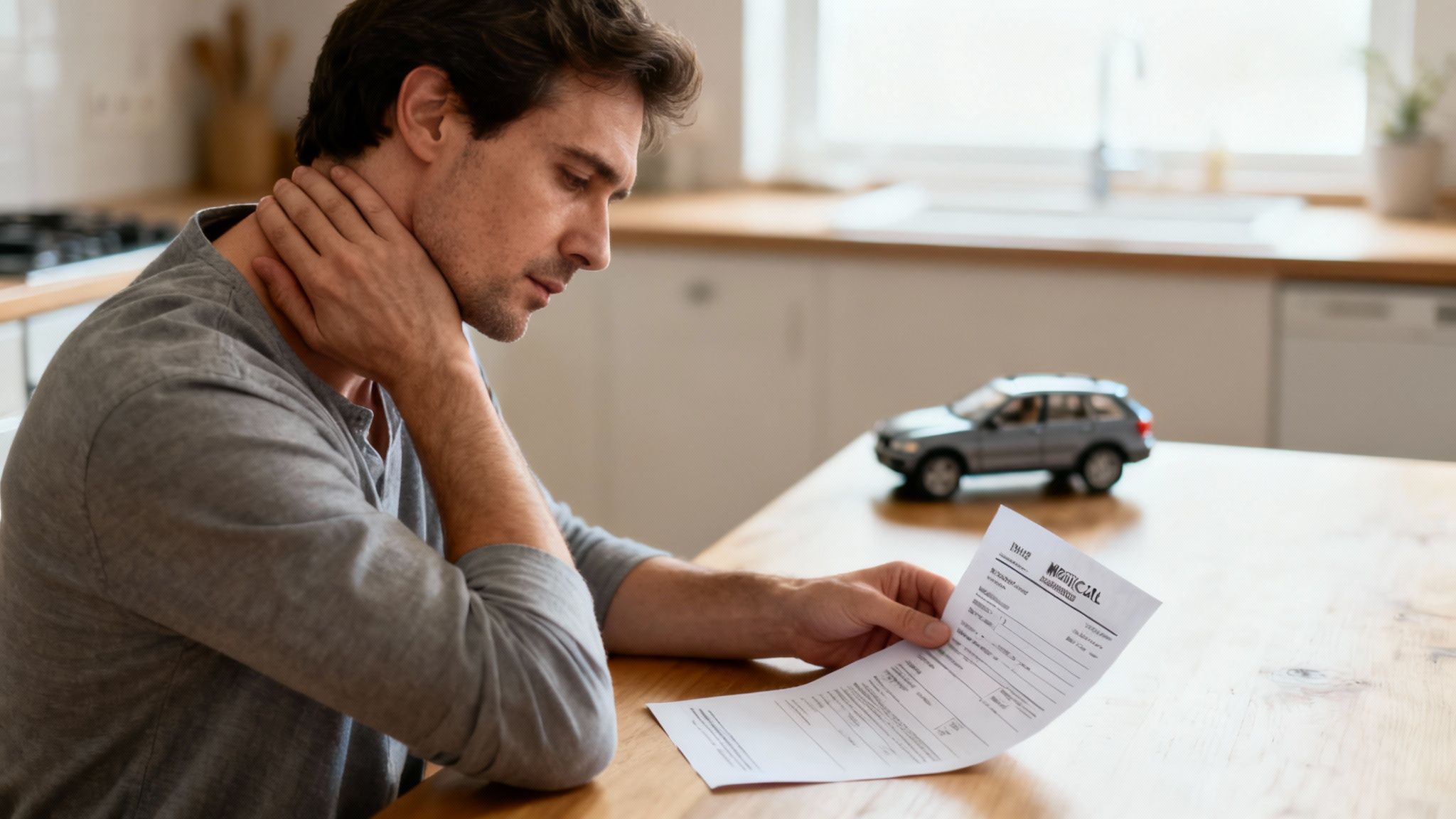

The single biggest risk? Signing before you know the true extent of your injuries. What feels like minor whiplash right now could easily become chronic neck pain that requires months of physical therapy—or even surgery—down the road.

Injuries That Appear Later

Let’s use a real-world example. Imagine you were in a multi-car pileup on I-45 here in Houston. You’re sore and bruised, but the ER doctor says you have no broken bones. The at-fault driver’s insurance company calls, offers you a check for a few thousand dollars, and you sign the release, just happy to be done with it.

A month later, you start getting severe back pain and a numbing sensation in your legs. An MRI reveals a herniated disc, and your doctor says you need spinal surgery. Because you signed that release, you have permanently forfeited your right to get a single penny for this new, life-altering medical expense. The insurance company owes you nothing more.

Signing a release is a final act. It closes the door on your claim forever, even if your injuries worsen or new ones develop weeks or months after the crash.

More Than Just Medical Bills

The risks of signing too early go far beyond your initial medical treatment. A liability release form is written to be incredibly broad, and it’s designed to stop you from claiming compensation for all sorts of future damages.

Once you sign, you typically give up your right to recover money for things like:

- Future Lost Wages: If that herniated disc keeps you out of work for months or forces you into a lower-paying job, you can't claim those lost earnings.

- Long-Term Care Costs: Should your injury require ongoing rehab, in-home nursing care, or special medical equipment, those costs will come straight out of your own pocket.

- Claims Against Other Parties: Sometimes, more than one person or company is to blame for a crash. A poorly worded release could prevent you from pursuing a claim against another negligent driver you didn't even realize was involved.

Insurance adjusters are trained negotiators. Their main goal is to protect their company's bottom line by closing your case for the lowest amount possible. Offering a quick settlement before you've had time to grasp the full impact of the accident is a classic strategy. It's why understanding every part of a car accident settlement is so critical before you agree to anything.

The principle holds true in other areas of life, too. It’s vital to understand the potential consequences of signing other critical agreements, like a prenup, especially if not fully understood. Signing any legal document without complete information can have financial consequences that last a lifetime.

Decoding the Fine Print in a Texas Release Form

At first glance, a liability release form is just an intimidating wall of dense legal text. Let's pull back the curtain and break down what these documents actually say. Understanding the fine print is the best way to spot the red flags and protect yourself from an unfair settlement.

Make no mistake, these forms are not written to be easily understood. They are crafted by insurance company lawyers with one goal in mind: to end their financial obligation to you as cheaply and completely as possible.

Key Clauses to Watch For

While the exact wording can vary, nearly all Texas release forms contain a few critical sections. The language used is intentionally broad to cover every possible scenario, leaving you with absolutely no future recourse.

Here are the most important parts of the document you need to pay close attention to:

- The Scope of the Release: This is the heart of the document. It details exactly what rights you are giving up. The language is often incredibly sweeping, releasing the at-fault party from all known and, more importantly, unknown claims.

- Consideration: This section specifies the settlement amount you are receiving in exchange for signing away your rights. The initial figure offered is almost never enough to cover the full, long-term costs of a serious injury.

- Released Parties: The form will name the "releasee," which usually includes not just the at-fault driver but their insurance company, their family members, and anyone else remotely connected to them. This is designed to prevent you from pursuing claims against other potentially liable parties down the road.

The scope of the release is where victims are most at risk. Insurers use vague, all-encompassing language to ensure you can never come back for more money, no matter what happens with your health.

You will likely see language like this:

"…the undersigned does hereby release and forever discharge [the at-fault party and their insurer] from any and all claims, demands, damages, actions, causes of action, or suits of any kind or nature whatsoever, and particularly on account of all injuries, known and unknown, both to person and property…"

In plain English, this means you are giving up your right to sue for anything related to the accident—including injuries you haven't even discovered yet.

Crafted by insurers, these forms are designed to be airtight. For families dealing with the tragedy of a wrongful death, signing too early could mean forfeiting fair wrongful death compensation. You can discover more insights about personal injury statistics on CasePeer.com.

Given the permanent consequences, having an experienced Houston car accident lawyer review any liability release form isn't just a good idea—it's essential to protecting your rights and your family's future.

Your Legal Rights Under Texas Negligence Laws

Before you can even think about whether a settlement offer is fair, you need to know what you're actually entitled to recover after a crash. The entire foundation of your personal injury claim is built on Texas negligence laws. These are the rules that hold at-fault drivers financially responsible for the harm they cause.

Getting a handle on these basic principles will show you exactly why an insurance adjuster’s first offer is almost never their best one.

Liability is a legal term for responsibility. In a Texas car accident, the person whose negligence caused the crash is liable for the harm that follows. Negligence is simply a failure to use reasonable care—like texting while driving or running a red light. To have a successful claim, you must show that the other driver's carelessness directly caused your injuries and all the costs that came with them.

How Texas Comparative Fault Affects Your Claim

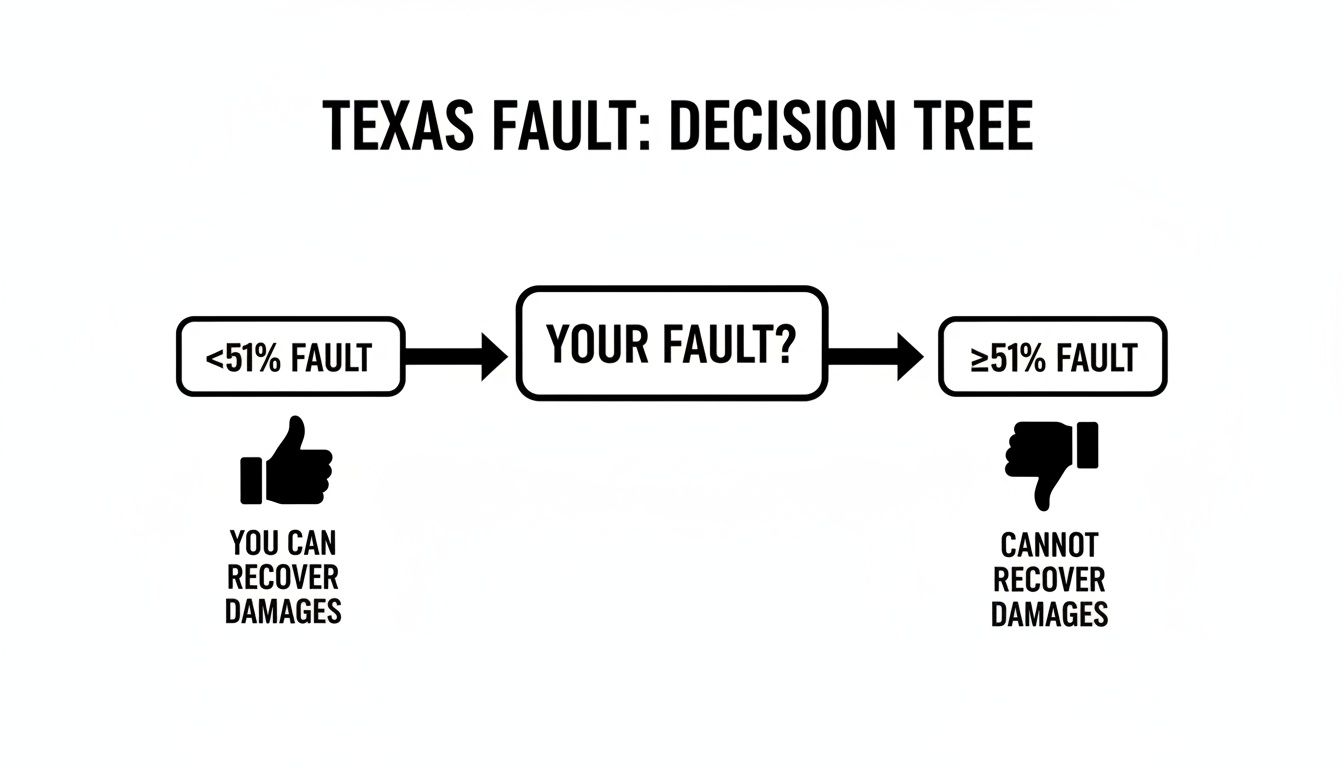

Texas operates under a rule known as comparative fault, which is found in Chapter 33 of the Texas Civil Practice & Remedies Code. This law addresses situations where more than one person might share blame for an accident. In plain English, it means your final compensation can be reduced by your percentage of fault.

For instance, let's say a jury decides you were 10% at fault for the collision and awards you $100,000 in damages. Your final recovery would be cut by that 10%, leaving you with $90,000.

The 51% Bar in Texas: This is the most critical part of the law. You are completely barred from recovering any compensation if you are found to be 51% or more responsible for the accident. This is exactly why insurance companies work so hard to shift blame onto the victim—even a small percentage of fault can save them thousands of dollars.

Understanding the Damages You Can Claim

The money you can recover in a personal injury claim is called damages. This compensation is meant to cover every loss you’ve suffered because of the other driver's negligence. In Texas, damages are split into two main categories:

- Economic Damages: These are the straightforward financial losses you can prove with bills, receipts, and pay stubs. This includes all your medical expenses, lost wages from time off work, future lost earning capacity if you can't return to your old job, and the cost to repair or replace your vehicle.

- Non-Economic Damages: These are the intangible, personal losses that don’t come with a price tag but are just as real and devastating. This category covers your physical pain and suffering, mental anguish, scarring or disfigurement, and the loss of your ability to enjoy life's simple pleasures.

An insurer's initial settlement offer almost never accounts for the full scope of these non-economic damages, which is a major reason why those first offers are often insultingly low. A skilled Texas injury attorney can help calculate the true value of your claim, making sure both your current bills and your future needs are properly addressed.

What to Do When the Insurer Asks You to Sign

When an insurance adjuster presents you with a liability release form, it’s a make-or-break moment for your car accident claim. How you respond can impact your financial future.

Here is a practical, step-by-step guide on what to do:

- Do Not Sign Immediately: This is the most important rule. An adjuster's primary job is to resolve your claim as quickly and cheaply as possible. That goal rarely aligns with what's best for you and your family.

- Stay Calm and Polite: You have every right to take your time. A polite but firm response works best: "Thank you for this offer. I need time to review this document with my family and an attorney before I can make a decision." This simple sentence protects your rights without creating conflict.

- Wait Until You Reach Maximum Medical Improvement (MMI): Never agree to a settlement until your doctor says you have reached MMI. This is the point where your condition has stabilized, and your doctor can finally predict what your future medical needs—and costs—will look like. Sign too early, and you could be on the hook for future surgeries, physical therapy, or long-term care.

- Gather Your Documentation: To put yourself in a position of strength, start gathering every piece of paper related to the crash:

- The initial police accident report

- All your medical records, bills, and diagnoses

- Pay stubs or other documents to prove your lost wages

- Repair estimates for your vehicle

- Consult an Attorney: Before signing anything, have an experienced Houston car accident lawyer review the form and your entire case.

This infographic breaks down how Texas's comparative fault rule works and why it’s so critical to your case.

As you can see, if a court finds you 51% or more at fault, you get nothing. This is exactly why insurance companies work so hard to shift even a little bit of the blame onto you.

Taking these steps flips the power dynamic. It gives you the breathing room to make a calm, informed decision based on facts, not on pressure from an adjuster trying to meet a quota. That pause is your best defense against a lowball settlement.

How a Lawyer Can Help with Your Release Form

You should never have to decode a confusing legal document or take on an insurance company by yourself, especially when you’re supposed to be healing. An experienced Houston car accident lawyer is your strongest ally, making sure you're treated fairly and your rights are fully protected.

At The Law Office of Bryan Fagan, PLLC, our team moves quickly to shield you from the insurance company's pressure tactics. The very first thing we do is meticulously review the liability release form, searching for any unfair, overly broad, or tricky language designed to cheat you out of the recovery you deserve.

Taking Control of Your Claim

Next, we launch our own independent investigation into your accident. This is critical because it allows us to accurately calculate the full and fair value of your claim, accounting for every single loss you’ve suffered—not just the ones the insurance company wants to acknowledge.

We fight to secure compensation for:

- All current and future medical expenses, including surgery, physical therapy, and any long-term care you might need.

- Lost wages and diminished earning capacity if your injuries keep you from working or force you into a lower-paying job.

- Your physical pain and emotional suffering, which are significant damages that insurance adjusters often try to downplay or ignore.

Once we have a clear picture of what your claim is truly worth, we take over all communications and negotiations. We push back hard against lowball settlement offers and present a powerful, evidence-backed case to get the compensation you rightfully deserve. Fully understanding what a car accident lawyer does during this process can give you peace of mind and confidence that your case is in the right hands.

Our goal is simple: to lift the legal burden from your shoulders so you can focus completely on your physical and emotional recovery. We handle the paperwork, the phone calls, and the fight for justice.

We represent our personal injury clients on a contingency fee basis. This means you pay absolutely nothing unless we win your case. You get expert legal representation right away, without any upfront costs or financial risk.

Common Questions About Liability Release Forms

After a car wreck, the paperwork can be just as overwhelming as the accident itself. We get a lot of questions from clients about liability release forms, so let's clear up some of the most common ones.

Can I Cancel a Release Form After Signing It?

Once you sign a liability release form in Texas, it's almost impossible to take it back. Think of it as a legally binding contract. The only way to get it overturned is to prove something extreme happened, like fraud, duress (you were threatened or forced to sign), or that you weren't mentally capable of understanding the document.

This is precisely why you should never sign one without an attorney reviewing it first. The stakes are just too high.

What Is the Difference Between a Liability Release and a Medical Authorization?

These two documents are worlds apart, and confusing them can be a costly mistake.

A liability release is the final step. You sign it, get a check, and your entire claim—for injuries, lost wages, everything—is closed forever.

On the other hand, a medical authorization just gives the insurance company permission to look at your medical records. Be extremely careful here. Adjusters often ask you to sign a broad authorization so they can dig through your entire medical history, looking for old injuries or pre-existing conditions to argue that your current pain isn't their fault.

Does a Property Damage Release Affect My Injury Claim?

It absolutely can if you're not careful. Insurance companies sometimes try to slip tricky language into a property damage release that quietly waives your rights to an injury claim, too.

A proper form should be very specific, stating that it only covers property damage. Before you sign anything just to get your car fixed, you must be certain it doesn't close the door on your right to be compensated for your injuries.

And while you're dealing with the legal side, you'll also need to think about the practical steps, like finding quality auto repair services to get your vehicle properly assessed.

The insurance company has a team of lawyers looking out for their bottom line. You deserve to have someone on your side, protecting yours.

If you’ve been handed a liability release form or any other confusing insurance document after a car, truck, or wrongful death incident, contact The Law Office of Bryan Fagan, PLLC for a free, no-obligation consultation. Let us review the paperwork before you sign and fight for the full compensation you are owed. We are here to inform, reassure, and empower you. Visit us at https://houstonaccidentlawyers.net to see how we can help.