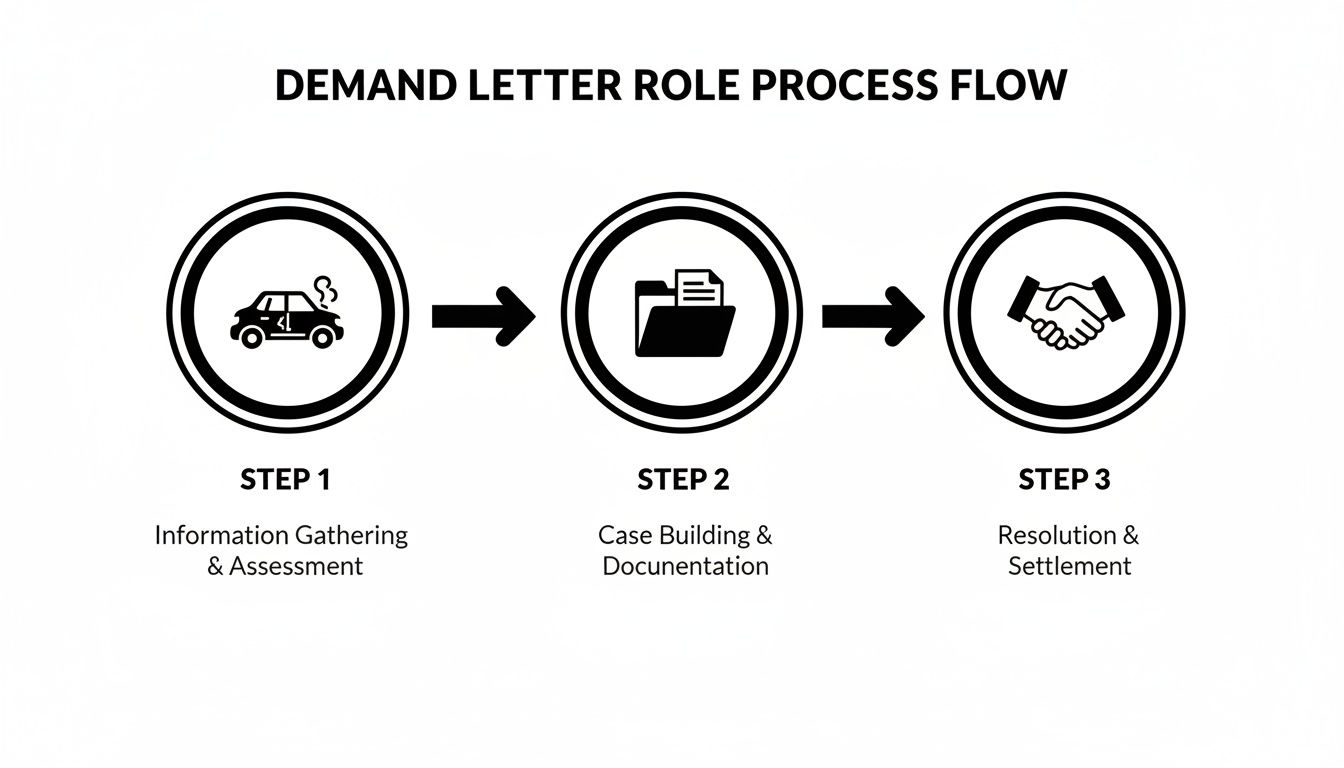

A car crash can change your life in seconds—but you don’t have to face recovery alone. A well-written demand letter for your auto accident claim is one of the most important first moves you can make toward getting the compensation you need to recover. This document is your official story, presented to the at-fault driver's insurance company. It lays out the facts, details your injuries, and calculates the financial damages you've suffered.

Your First Step Toward Fair Compensation After a Crash

The moments after a Texas car wreck are often a blur of confusion and stress. Before you know it, the medical bills start piling up, and lost time from work adds to the financial pressure. It’s easy to feel overwhelmed and wonder how you’ll ever get back on your feet.

This is exactly where a strong demand letter becomes your most powerful tool. It’s not a lawsuit. Instead, it’s a professional and necessary first step to kick off settlement negotiations and firmly assert your rights.

Think of it as the organized, official version of everything that happened. It takes all the chaotic details from the crash—like the facts found in an official report of a Houston accident—and weaves them into a clear, persuasive case for the insurance adjuster.

Why a Demand Letter Is So Important

A powerful demand letter does more than just ask for a check; it sets the tone for the entire claim. It immediately signals to the insurance company that you are serious, organized, and have meticulously documented every single one of your losses. In many cases, a well-crafted letter from a Texas injury attorney can lead straight to a fair settlement offer without ever having to think about going to court.

Here’s what a good demand letter really accomplishes:

- Establishes Liability: It clearly spells out exactly why the other driver was at fault under Texas negligence laws.

- Documents Your Damages: It provides a comprehensive breakdown of your losses—from medical bills and lost income to the physical pain and emotional toll you've endured.

- Initiates Negotiation: It opens a formal line of communication with the insurance company, but it does so on your terms.

- Demonstrates Preparedness: It lets the insurer know that you have built a solid case and are fully prepared to take further legal action if they don't offer a fair settlement.

A demand letter is your chance to control the narrative. It makes sure your side of the story is heard clearly and professionally, stopping the insurance company from downplaying your injuries or the very real impact the crash has had on your life.

This guide is here to empower you. We'll break down exactly how to draft, format, and send an effective demand letter, step by step. Our goal is to give you the knowledge you need to pursue the full and fair compensation you rightfully deserve.

Who Is Liable in a Texas Car Accident?

After a car crash, you're drowning in paperwork and dodging calls from insurance adjusters. A demand letter is how you start to take back control. So, what is it? Think of it as a formal, professional document you send to the at-fault driver's insurance company to officially kick off settlement negotiations.

But it's so much more than just a letter. A powerful demand letter lays out a persuasive, evidence-backed argument explaining exactly why their client is legally responsible—or liable—for your injuries and financial losses under Texas law. It takes the mess of police reports, medical bills, and lost pay stubs and weaves it into a clear, compelling story that an insurance adjuster can't just brush aside.

Picture a multi-car pile-up on I-10 during Houston's rush hour. Your demand letter connects the dots, drawing a straight line from the other driver's mistake to your injuries and the bills piling up on your kitchen table. This is your chance to tell your side of the story and set the stage for a serious negotiation.

Getting the Legal Lingo Right

To really understand the punch your demand letter packs, you need to be familiar with a few key terms that are the foundation of any Texas personal injury claim.

- Liability: This is a simple but critical concept. It just means legal responsibility. Your demand letter’s main job is to prove, without a doubt, why the other driver is legally responsible for the wreck and everything that followed.

- Damages: In the legal world, "damages" is the word for the total amount of money you’re asking for to cover your losses. This isn't just for the dent in your bumper. It includes every single medical bill, the income you lost from being out of work, and compensation for the physical pain and emotional stress you've been through.

- Negligence: This is the heart of most personal injury cases. Negligence is when someone fails to act with reasonable care, and that failure hurts someone else. For car accidents, that could be anything from texting while driving to speeding or blowing through a red light.

Your demand letter is where you put it all together for the insurance company. You’re essentially stating, "Your client was negligent when they ran that red light, which makes them liable for my damages—including my hospital bills and lost wages."

Here in Texas, our busy highways like I-45 see devastating accidents every single day. The National Highway Traffic Safety Administration reported a staggering 29,135 traffic deaths in just the first nine months of a recent year, and Texas is always near the top of that list. Distracted driving alone contributed to 3,308 deaths and injured 289,310 people that same year. For victims, a well-crafted demand letter is the first real step toward getting justice. You can read more about these personal injury law statistics to see just how common these situations are.

By clearly establishing liability and meticulously documenting every dollar of your damages, your letter becomes more than a simple request—it becomes a powerful legal tool. It sends a clear message to the insurance company: you know your rights, and you're ready to fight for the full and fair compensation you deserve.

Building a Powerful and Persuasive Demand Letter

An effective demand letter is so much more than just a request for money. It's your story, backed by cold, hard facts. You're building a structured argument that walks the insurance adjuster through every detail, from the moment of the crash to the dollar amount you're demanding.

Think of it this way: the accident was chaos, but your demand letter brings order to that chaos. It organizes the facts into a compelling case that lays the groundwork for serious settlement talks.

This process turns a jumble of police reports, medical bills, and painful memories into a clear, undeniable claim.

Start with a Clear and Concise Introduction

Get straight to the point. The opening paragraph isn't the time for a long, winding narrative. It needs to immediately state the essentials: who you are, who their insured is, the date and location of the crash, and your claim number.

This sets a professional tone from the get-go and helps the adjuster pull up your file instantly. It shows you're organized and serious. For example: "This letter is a formal demand for settlement for the injuries I sustained in a car accident on January 15, 2024, at the intersection of Westheimer Road and the 610 Loop in Houston. The accident was caused by your insured, John Smith, under claim number [Your Claim Number]."

Present a Detailed Factual Summary of the Crash

Now you tell the story of what happened, but stick strictly to the facts. Describe the events leading up to, during, and right after the collision. Your goal is to paint a picture so clear there's no room for misinterpretation.

Be specific and objective. Include details like:

- The direction you were traveling.

- Weather and road conditions.

- What you saw the other driver do (e.g., "I was fully stopped at a red light when Mr. Smith's vehicle violently struck my car from behind without any sign of braking.").

- Any admissions or statements the at-fault driver made at the scene.

Referencing the official police report is non-negotiable here. State the report number and quote key findings that back up your story, especially the officer's determination of fault or any citations issued to the other driver.

Build an Undeniable Argument for Liability

After you've laid out the facts, you need to connect them to Texas law to show why the other driver is legally responsible. This is your legal argument in plain English. You can cite specific Texas traffic laws the other driver broke, like failing to yield the right-of-way or following too closely.

For instance, if you were rear-ended on I-45, you'd point out that Texas law creates a presumption that the rear driver is at fault. Simply connecting the facts of your case to the law makes it incredibly difficult for an insurance adjuster to dispute liability. You're not just telling them what happened; you're explaining why their client is legally on the hook for your damages.

Meticulously Document Your Injuries and Medical Journey

This is where you detail the human cost of the crash, and it's one of the most critical parts of your letter. Start from the moment of impact and describe your physical injuries, the medical treatment you've endured, and how it all affects your daily life.

List every single medical provider you’ve seen—from the ER doctors to your chiropractor and physical therapist. For each injury, describe the diagnosis, the treatment plan, and the pain and suffering it has caused. For example: "As a direct result of the collision, I was diagnosed with a herniated disc at C5-C6, which has required ongoing physical therapy and two epidural injections just to manage the chronic, radiating pain."

Don't just list injuries; explain their impact. Talk about how the pain keeps you from sleeping, working effectively, or enjoying hobbies you once loved. This narrative is absolutely essential for justifying your demand for non-economic damages like pain and suffering.

Organize and Itemize Every Single Damage

Finally, it’s time to translate all your losses into a specific dollar amount. You need an itemized list of all your economic damages—the tangible, out-of-pocket financial losses you've suffered. And remember, every single line item must be backed up by a document.

Essential Documents to Attach to Your Demand Letter

Here is a quick checklist of the critical evidence you need to gather. Including these documents builds a strong, undeniable claim that's much harder for an insurer to fight.

| Document Type | Why It's Important |

|---|---|

| Police Accident Report | Provides an official, objective account of the crash and often indicates fault. |

| Medical Bills & Records | Proves the extent of your injuries and the exact cost of your treatment. |

| Photos & Videos | Visual evidence of vehicle damage, the accident scene, and your injuries. |

| Proof of Lost Wages | A letter from your employer or pay stubs verifying income lost due to the accident. |

| Repair Estimates | Documents the cost to repair or replace your vehicle and other damaged property. |

Having this documentation organized and ready to go shows the adjuster you mean business.

After listing these hard costs, you'll state your total settlement demand. This final figure should include your economic damages plus a calculated amount for your non-economic damages (pain and suffering). Mastering this last part is key, and understanding how to negotiate an insurance settlement can make a huge difference in your final outcome. Your demand should be firm but reasonable, signaling that you are ready to negotiate in good faith to resolve your claim.

Annotated Sample Demand Letter for a Texas Auto Accident

It’s one thing to list the parts of a demand letter, but seeing how they all fit together in a real-world context is much more effective. To really show you how it's done, we've put together a sample demand letter for a car wreck. This isn't some generic fill-in-the-blank document. It’s based on a scenario we see all the time: a rear-end collision on a packed Dallas freeway, loaded with the specific details that make an insurance adjuster take a claim seriously.

We'll walk through this letter section by section, from the opening lines to the final dollar amount. For each part, I'll add some commentary explaining the strategy behind the language, the structure, and the evidence we’ve included. This approach helps you see why certain details are crucial and how they anchor your claim in Texas law.

The Sample Letter: A Section-by-Section Breakdown

Below is a realistic demand letter. The blockquotes explain the purpose of each section and why the details matter to the person on the other side of the table—the insurance adjuster.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Adjuster's Name]

[Insurance Company Name]

[Insurance Company Address]

RE: Demand for Settlement

Claimant: [Your Name]

Insured: [At-Fault Driver’s Name]

Claim Number: [Your Claim #]

Date of Loss: [Date of Accident]

FOR SETTLEMENT PURPOSES ONLY

Dear [Mr./Ms. Adjuster's Last Name],

As you are aware, I am represented by The Law Office of Bryan Fagan, PLLC in connection with the significant injuries I sustained in a motor vehicle collision on [Date of Accident]. This accident was caused by the clear negligence of your insured, [At-Fault Driver’s Name]. This letter serves as a formal demand for settlement of my personal injury claim.

Why This Works: The introduction gets straight to the point. It's professional, establishes representation, and lists all the key identifiers—names, claim number, date—so the adjuster can pull the file immediately. Marking it "FOR SETTLEMENT PURPOSES ONLY" is a critical legal step that prevents the letter from being used against you in court if you can't reach a deal.

Facts of the Collision

On [Date of Accident], at approximately [Time of Accident], I was driving my 2022 Toyota RAV4 northbound on the North Central Expressway (US-75) in Dallas, Texas. As traffic slowed for the Mockingbird Lane exit, I brought my vehicle to a complete and safe stop.

Without warning, your insured, [At-Fault Driver’s Name], slammed his 2019 Ford F-150 into the rear of my vehicle. There was no attempt to brake. The impact was violent, whipping my head and neck forward and back. The Dallas Police Department responded, and Officer [Officer’s Name] cited your insured for Failure to Control Speed (Citation No. [Citation Number]). The official police report (Report No. [Report Number]) confirms these facts.

Why This Works: This section lays out a clear, factual narrative. It isn't emotional; it's precise. Including specifics like the exact location, vehicle models, and police report number gives your story instant credibility. Highlighting the traffic citation is huge—it's powerful proof that their driver was officially deemed at fault right at the scene.

Liability

Under Texas law, the negligence of your insured was the sole and proximate cause of this collision and all my resulting injuries. Your insured had a clear duty to maintain a safe speed and following distance, as mandated by the Texas Transportation Code. He failed to do so. As you know, Texas law creates a presumption that the rear driver is at fault in a rear-end collision. Since I was fully stopped in traffic, there is absolutely no basis for a claim of comparative fault on my part.

Why This Works: Here, we pivot from storytelling to legal argument. We explicitly use the word "negligence" and connect the driver's actions directly to a violation of Texas law. By tackling comparative fault head-on and dismissing it, we shut down one of the insurance company's favorite tactics before they even have a chance to bring it up.

Damages Sustained

The collision caused by your insured resulted in significant physical injuries, economic losses, and non-economic damages.

1. Medical Treatment and Expenses: I was taken by ambulance to Texas Health Presbyterian Hospital Dallas with severe pain in my neck and back. The diagnosis was a cervical strain (whiplash) and a herniated disc at L4-L5. My medical care has included:

* Emergency Room Treatment: $3,500.00

* Orthopedic Specialist Consultations: $1,800.00

* MRI and X-rays: $2,200.00

* Physical Therapy (12 weeks): $4,500.00

* Prescription Medications: $450.00

My total medical bills to date are $12,450.00. All corresponding medical records and itemized bills are attached for your review.

2. Lost Wages: As a project manager, my injuries kept me out of work for four weeks. This resulted in a total lost income of $6,000.00. A verification letter from my employer is attached.

3. Pain and Suffering: This entire ordeal has been draining. The chronic pain from the herniated disc ruins my sleep and stops me from doing things I love, like running or just playing with my kids. The emotional stress from an accident that was completely unprovoked has been immense.

Why This Works: This is the heart of your demand letter. It breaks down every economic loss with hard numbers, showing you’ve done your homework. But just as importantly, it gives a personal, human account of the pain and suffering. This narrative justifies the demand for non-economic damages and transforms your claim from a simple stack of bills into a compelling story of real-world impact.

Settlement Demand

Based on the clear liability of your insured and the significant damages I have sustained, I hereby demand the sum of $55,000.00 to resolve this claim in full.

This figure is calculated as follows:

- Economic Damages (Medical + Lost Wages): $18,450.00

- Non-Economic Damages (Pain & Suffering): $36,550.00

This offer to settle is made in good faith and will remain open for 30 days from the date of this letter. If we cannot reach a fair agreement within that time, we are prepared to file a lawsuit to protect my rights. Please direct all future correspondence to my attorney at The Law Office of Bryan Fagan, PLLC.

Sincerely,

[Your Name]

Why This Works: The final demand is firm, clear, and backed by the evidence already presented. Setting a 30-day deadline creates a sense of urgency, prompting the adjuster to act. The closing reinforces that you have a Texas injury attorney ready to escalate the fight, signaling that lowball offers will be a waste of everyone's time.

Think about a chaotic T-bone crash in Austin traffic. Your demand letter is what brings order to that chaos. It establishes liability—like that of a drunk driver, a factor in 1,419 alcohol-impaired deaths in Texas in a single year—spells out the damages, and puts a firm number on the table that an insurer can't just brush aside. While personal injury filings can be common, most cases settle before ever seeing a courtroom, especially when a letter like this presents undeniable numbers for lost wages, medical bills, and human suffering. You can learn more about how settlement amounts are determined in personal injury cases.

How to Accurately Calculate Your Settlement Demand

This is the single most important part of the entire process: figuring out the right number to demand from the insurance company. This isn't about pulling a number out of thin air. It’s a methodical calculation based on every single loss you've suffered. Under Texas law, your damages fall into two distinct buckets, and you need to get both right to make sure your demand is fair.

The first bucket contains your economic damages. These are the tangible, real-world costs with a clear price tag. Think of them as anything you can prove with a receipt, an invoice, or a pay stub.

The second is for non-economic damages. These are the intangible losses that don’t come with a bill but are just as real and devastating. We're talking about your physical pain, emotional trauma, and the overall hit your quality of life has taken since the crash.

Tallying Your Economic Damages

First things first, you need to meticulously add up every single dollar you've lost because of this accident. This number is the bedrock of your entire demand letter. Don’t estimate—calculate.

Your list of economic damages should include:

- All Past and Current Medical Bills: This means everything. The ambulance ride, the ER visit, follow-up appointments with specialists, physical therapy, prescription drugs, and even medical equipment like crutches or braces.

- Estimated Future Medical Care: If your doctor says you're going to need more treatment down the road—like another six months of physical therapy or a future surgery—you absolutely must include the projected cost of that care.

- Lost Wages: Tally up every dollar of income you lost because you couldn't work. This covers salary, hourly wages, missed overtime, and even lost bonuses.

- Loss of Earning Capacity: This one is a big deal. If your injuries permanently limit your ability to earn a living at the same level as before, you have a right to claim damages for that future lost income.

- Property Damage: This is the cost to either repair or replace your vehicle. When you're getting estimates, it’s smart to understand the debate between aftermarket parts vs. OEM to ensure you're demanding enough money to get quality repairs, not cheap fixes.

Valuing Your Pain and Suffering

Now for the hard part: putting a dollar amount on your pain. It feels strange, but it’s absolutely necessary. The insurance adjuster can't feel what you’ve gone through, so you have to translate your suffering into a concrete number they can understand.

A common approach attorneys use is the "multiplier method." Here's how it works: you take your total economic damages (especially the medical bills) and multiply them by a number, usually between 1.5 and 5. The multiplier you choose depends entirely on how severe your injuries are and how badly they’ve wrecked your life.

A minor sprain that heals in a few weeks might get a 1.5 multiplier. But a severe injury, like a herniated disc that requires surgery and leaves you with chronic pain, could easily justify a multiplier of 4 or 5.

For example, imagine a driver in a San Antonio T-bone wreck who ends up with a serious back injury needing months of treatment. Their demand letter is their one shot to get fairly compensated. For these kinds of injuries, demands often climb into the $50,000–$100,000+ range. While every case is different, it’s common to see settlements from $20,000–$30,000 for moderate injuries, but those numbers can skyrocket for catastrophic trauma like brain injuries.

Let’s run through a quick example. Say your total medical bills come out to $15,000. If your injuries were significant and turned your life upside down, you might use a multiplier of 3. That would make your non-economic damages $45,000. Add that to your medical bills, and you have a solid starting point for your total demand.

To get a much deeper understanding of how this works in a Texas claim, check out our guide on how to calculate pain and suffering damages.

Common Traps That Can Wreck Your Demand Letter

Sending a demand letter feels like a simple step, but it’s a minefield for the unwary. Insurance adjusters are not on your side; their job is to protect their company’s money by paying out as little as possible. They are experts at spotting weaknesses in letters written by people without a legal background.

Trying to handle this yourself is a huge gamble. One misplaced word or a single calculation error could cost you thousands of dollars you're entitled to. And remember, once you sign that settlement check, your case is over for good. There are no do-overs.

Asking for Too Little—or Too Much

This is probably the most common mistake we see. People add up their current medical bills and lost paychecks and think that’s their total. They completely forget about the future. What if your doctor says you’ll need physical therapy for another year? Or that a future surgery is a real possibility? Those projected costs must be in your demand.

On the flip side, throwing out an astronomical, pie-in-the-sky number is just as bad. It tells the adjuster you’re not serious about a fair negotiation, and they might just slow-walk your claim or ignore it entirely. A strong demand is built on solid evidence, not wishful thinking.

Accidentally Taking the Blame

You have to understand a critical Texas law called comparative fault, or proportionate responsibility. You can find it in Chapter 33 of the Texas Civil Practice & Remedies Code, and it can make or break your case.

Here’s the bottom line: If you're found partially responsible for the accident, your final payout is reduced by your percentage of fault. If a jury decides you are 51% or more at fault, you get absolutely nothing. Zero.

An innocent comment like, “I just wish I had hit the brakes a second sooner,” can be twisted by an adjuster into an admission of fault. That one sentence could slash your settlement or wipe it out completely. Your letter needs to stick to the facts that prove the other driver was 100% responsible.

Getting Emotional or Aggressive

A car crash is an emotional, frustrating, and often painful experience. We get it. But your demand letter is a business document, not a diary. Using aggressive, threatening, or overly emotional language won’t scare an insurance adjuster—it just makes you look unprofessional and less credible.

Your real power comes from a calm, logical argument backed by cold, hard facts. Let the police report, medical records, and photos do the talking. That approach shows you’re serious and have a solid case, which is far more intimidating to an insurance company than an angry letter.

We can't stress this enough: have an experienced Houston car accident attorney at our firm draft your letter, or at the very least, review it before you send it. An attorney knows the tactics adjusters use and can frame your demand in a way that maximizes its value and avoids these costly mistakes.

The aftermath of a crash is stressful enough. You shouldn't have to battle an insurance company on your own. The legal team at The Law Office of Bryan Fagan, PLLC is ready to take on that fight for you. We’ll build a powerful case, write a demand letter that gets noticed, and negotiate aggressively for every dollar you deserve. Contact us today for a free, no-obligation consultation to see how we can help. Your recovery is our only priority.