A car crash can change your life in seconds—but you don’t have to face recovery alone. When another driver’s negligence causes you harm, you shouldn't have to carry the financial burden. Their insurance is responsible for covering your damages, and the process for getting that compensation is called a third-party insurance claim.

This is the most common path for victims to get back on their feet after a Texas auto accident. Understanding how it works is the first step toward protecting your rights.

Your Guide to a Third Party Insurance Claim

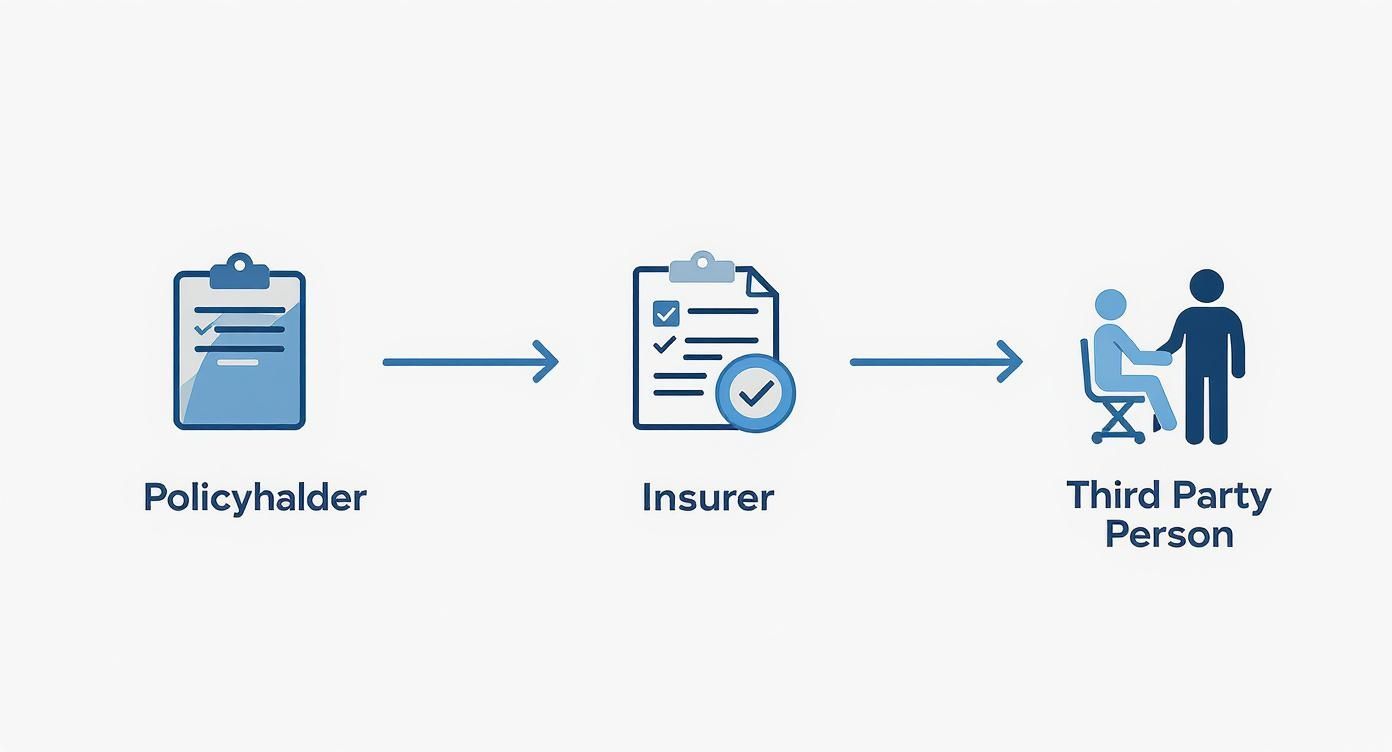

After a collision that wasn't your fault, you will need to deal with the other driver's insurance company. In this situation, you are the “third party.” You are filing a claim against the policy belonging to the at-fault driver (the “first party”), who is insured by their company (the “second party”).

Think of it like this: You are an outsider seeking payment from a contract between the driver who hit you and their insurance provider. That insurer has a legal duty to pay for the damages their client caused, but only up to the limits of their policy.

Understanding this dynamic is critical. The other driver's insurance adjuster isn't on your team; their job is to protect their company's bottom line by paying out as little as possible. This is exactly why having a seasoned Houston car accident lawyer fighting for you can make all the difference.

Who Are the Parties Involved?

The terms can sound formal, but the roles are straightforward. When you hear "first," "second," and "third" party, it's a way to keep track of everyone involved in the claim.

Let's break down exactly who's who in a typical car accident claim.

Who Are the Three Parties in a Car Accident Claim?

| Party | Who They Are | Their Role in the Claim |

|---|---|---|

| The First Party | The at-fault driver | The person whose negligence caused the accident and who holds the insurance policy. |

| The Second Party | The at-fault driver’s insurer | The company responsible for paying for the damages their policyholder caused. |

| The Third Party | You—the injured person | The individual filing a claim to get compensation for their injuries, lost wages, and other losses. |

This three-party system is the foundation for how nearly all personal injury claims are handled in Texas. State law requires drivers to carry liability insurance specifically so that victims like you have a clear path to seek fair compensation. For a general overview of the claims process, you can explore guides on how to file an auto insurance claim.

How a Third-Party Insurance Claim Works in Texas

Dealing with the claims process after a wreck is confusing and exhausting, especially when you’re trying to heal. But once you understand the basic steps, the process feels less intimidating. Knowing what to expect helps you feel more in control and ready to protect your rights.

Let's walk through a real-world example. A Houston driver is rear-ended on I-45 during their commute. Their car is badly damaged, and they suffer a serious neck injury. Since the other driver was clearly at fault, their insurance company is responsible for the victim’s losses.

This is where the third-party claim begins. You, as the injured person, are the "third party" making a claim against the at-fault driver's policy.

As you can see, the claim starts with the crash and moves toward a resolution with the at-fault driver's insurance company. You are at the center of this process.

Steps to File an Insurance Claim

While every accident is unique, a third-party claim almost always follows these critical stages. Getting these steps right is key to building a strong case for the compensation you deserve.

The first step is to report the accident. Knowing how to report an accident to insurance officially starts the process. This involves calling law enforcement to the scene and notifying the at-fault driver's insurance company that a claim will be filed.

From there, the practical, step-by-step process unfolds:

- Open the Claim: You or your attorney will contact the other driver’s insurance provider to officially open a claim. You’ll be given a claim number and assigned an adjuster.

- Gather Evidence: This is where you build your case. Collect everything: the official police report, photos and videos from the scene, witness statements, and all of your medical records and bills.

- Prove Fault (Liability): Your attorney will use the evidence to prove the other driver was legally responsible for the crash. In legal terms, this is called establishing liability.

- Calculate Your Losses (Damages): Next, you must document all your losses. These are your damages—the total harm you suffered. This includes medical bills, lost income from missing work, vehicle repair costs, and your physical pain and emotional suffering.

- Negotiate a Fair Settlement: Once your damages are fully calculated, your lawyer sends a formal demand letter to the insurer. This kicks off negotiations to reach a fair settlement.

A common mistake is accepting the first offer from an insurance company. These initial offers are almost always lowball amounts that fail to cover your future medical needs or long-term pain.

Why You Need an Attorney on Your Side

Make no mistake: the insurance adjuster’s job is to save their company money by paying you as little as possible. They are skilled negotiators who may try to trick you into admitting partial fault, downplay your injuries, or get you to sign away your rights for a quick, inadequate payout.

A Houston car accident lawyer from The Law Office of Bryan Fagan, PLLC, takes over completely. We handle every communication with the insurer, build a rock-solid case based on Texas law, and fight for every penny you're entitled to. We level the playing field so you can focus on your recovery while we handle the legal battle.

Who Is Liable in a Texas Car Accident?

Before you can recover a single dollar from a third-party insurance company, you must prove the other driver was at fault. In Texas, this means proving their negligence—a legal term for carelessness—was the direct cause of your injuries and damages. This is the cornerstone of your entire claim.

Negligence simply means a driver failed to act as a reasonably careful person would have under the same circumstances. For example, they were texting, speeding, or ran a red light. When you prove they were negligent, you establish their legal responsibility, or liability.

Understanding Comparative Fault in Texas

But what happens if the crash wasn't 100% one person's fault? Texas law recognizes that real-world situations can be complex. The state follows a rule called modified comparative fault, also known as the “51% bar rule,” which is outlined in the Texas Civil Practice and Remedies Code, Chapter 33.

Here’s how it works for you:

- You can still recover damages even if you were partially to blame for the accident.

- Your final compensation award will be reduced by your percentage of fault.

- Crucially, if you are found to be 51% or more at fault, you are barred from recovering any compensation at all.

For example, imagine a driver in San Antonio swerves into your lane and hits you, but you were driving a few miles over the speed limit. A jury might find the other driver 80% responsible and you 20% responsible. If your total damages are $100,000, you could recover $80,000 ($100,000 minus your 20% share of fault).

The 51% bar rule is a critical factor in every Texas injury claim. Insurance adjusters will try to exploit this rule by shifting as much blame as possible onto you to either reduce their payout or deny your claim completely.

How Insurance Companies Try to Shift Blame

Insurance adjusters are not on your side. Their primary goal is to protect their company's profits, and a common tactic is to use your own words to pin more fault on you. They are trained to ask tricky, leading questions designed to get you to admit something that makes you sound partly responsible, even when you weren't.

This is why having a dedicated Houston car accident lawyer is so important. We know these tactics and how to counter them. We gather hard evidence—police reports, witness interviews, accident reconstruction data—to build a powerful case that places liability squarely on the other driver. Our job is to ensure your story is told correctly and that the blame lands where it belongs.

Recovering All Your Damages After an Accident

The true cost of a car crash goes far beyond a damaged vehicle. The physical, emotional, and financial fallout can impact every part of your life for years to come. When you file a third-party insurance claim, the goal is to get compensation for every single loss you have suffered.

In legal terms, these losses are called damages. Under Texas personal injury law, you have the right to demand payment for all the harm caused by another's negligence. Understanding the full scope of what you can claim is the first step toward a fair settlement.

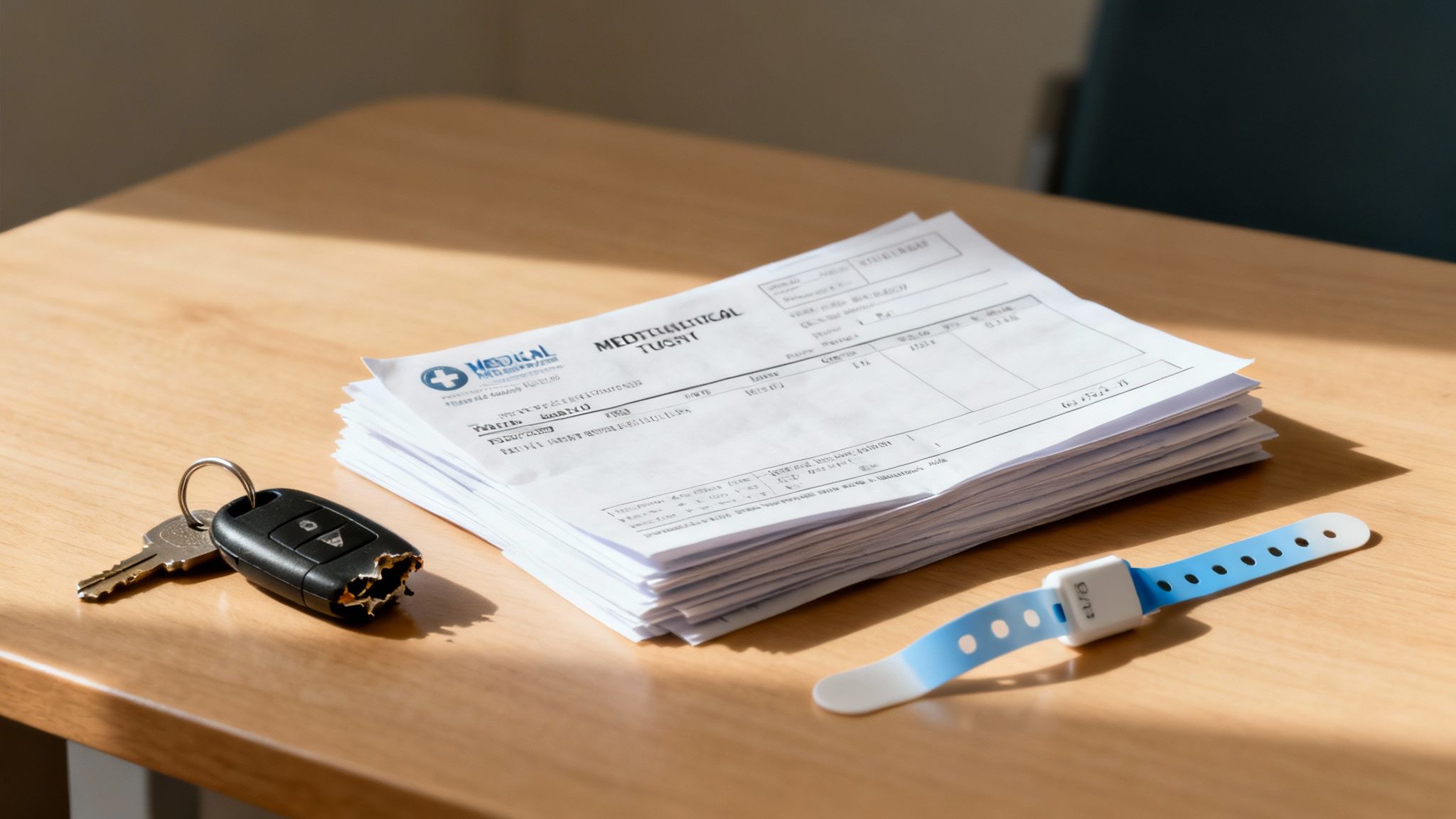

Economic Damages: Tangible Financial Losses

The most straightforward losses are economic damages. These are the tangible, out-of-pocket costs that have a clear price tag. You can prove these expenses with receipts, invoices, or pay stubs.

Your auto insurance claim should account for every penny of these losses, including:

- Medical Bills: This includes everything from the ambulance ride and emergency room visit to surgery, physical therapy, medications, and any future medical care you may need.

- Lost Wages: If your injuries prevent you from working, you are entitled to compensation for that lost income. This also includes the loss of future earning capacity if you can no longer perform your job.

- Property Damage: This is the cost to repair or replace your vehicle and any personal property damaged in the crash.

Non-Economic Damages: The Human Cost of a Crash

Just as real, but harder to calculate, are non-economic damages. These compensate you for the immense personal suffering that doesn’t come with a bill. They acknowledge the human toll of the accident.

In Texas, non-economic damages are meant to compensate you for how the crash has diminished your quality of life. This includes physical pain, emotional distress, mental anguish, scarring, and the loss of enjoyment of daily activities.

Imagine a Dallas construction worker who suffers a permanent back injury. He can no longer lift his children or enjoy his weekend hobbies. That pain and suffering is a very real—and compensable—part of his claim.

Punitive Damages: For Extreme Negligence

In rare cases involving extreme recklessness, such as a drunk driver causing a catastrophic wreck, a Texas court may award punitive damages. As defined in the Texas Civil Practice & Remedies Code, Chapter 41, these are not meant to compensate you. They are intended to punish the wrongdoer and deter others from similar behavior.

A skilled Texas injury attorney can help you meticulously document all your damages to build a powerful case. It is critical to account for every loss, especially since the at-fault driver's policy might not be enough to cover everything. This is why it is vital to also understand insurance policy limits in Texas car accidents.

First Party vs. Third Party Insurance Claims Explained

After a car crash, the first question is always, "Whose insurance pays?" Getting the financial support you need to recover depends on understanding this crucial difference. The path you take is determined by who was at fault, which dictates whether you will deal with your own insurance company or the other driver's.

In Texas, auto insurance claims fall into two main categories: first-party and third-party. While both are designed to get you compensation, the process and your relationship with the insurer are worlds apart. Knowing the difference is the first step in protecting your rights.

First-Party Claims: Dealing With Your Own Insurer

A first-party claim is filed with your own insurance company. You are the "first party" to the insurance contract you signed and pay premiums for.

Think of it as using the benefits you’ve already paid for. These claims typically involve coverages meant to protect you and your property, often regardless of who caused the accident.

Common examples include:

- Personal Injury Protection (PIP): This helps cover immediate medical bills and a portion of lost wages, up to your policy limit, no matter who was at fault.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This essential coverage steps in if the at-fault driver has no insurance or not enough to cover all of your damages.

- Collision Coverage: This pays for repairs to your vehicle after an accident.

Third-Party Claims: Going After the At-Fault Driver’s Insurer

In contrast, a third-party claim is filed against the other driver’s insurance company. In this scenario, you are the "third party"—an outsider to the insurance contract between the at-fault driver and their insurer. This is the claim you make when someone else’s negligence leaves you injured and facing bills.

Here’s the problem: the at-fault driver's insurance company has no loyalty to you. Their legal duty is to their own client—the person who hit you. Their primary goal is to protect their company's bottom line by paying you as little as possible.

This creates a fundamental conflict of interest. The adjuster assigned to your case is not there to help you. They are a trained negotiator whose job is to find reasons to devalue your injuries, question your medical treatment, and minimize your losses.

Having a Texas injury attorney from The Law Office of Bryan Fagan, PLLC, is how you level the playing field. We take over all communications, build a powerful, evidence-based case, and fight back against the tactics insurers use to deny you fair compensation.

Comparing First-Party and Third-Party Insurance Claims

To make it clear, let's break down the key differences between filing a claim with your own insurer versus the at-fault driver's. The distinction shapes the entire claims process, from your first phone call to the final settlement.

| Feature | First-Party Claim (Your Insurer) | Third-Party Claim (At-Fault Driver's Insurer) |

|---|---|---|

| Who You File With | Your own insurance company. | The at-fault driver's insurance company. |

| Relationship | You have a contractual relationship. They have a duty of good faith toward you. | You are an adversary. You have no direct contract with them. |

| Primary Goal | To get the benefits you paid for under the terms of your policy. | To prove the other driver's negligence and recover damages from their liability coverage. |

| Coverage Involved | PIP, UM/UIM, Collision, MedPay. | The other driver's Bodily Injury Liability and Property Damage Liability. |

Understanding this table is key. In a first-party claim, you're a customer. In a third-party claim, you're an opponent. This is why having a strong legal advocate is so critical when you're the third party.

Navigating Common Insurance Company Tactics

When you file a third-party claim, it’s crucial to remember who you're dealing with. The at-fault driver's insurance adjuster is a professional negotiator, and their primary job is to protect their company's bottom line—which means paying you as little as possible.

They are trained in specific tactics designed to devalue or deny even the most legitimate claims. Recognizing these strategies is your first line of defense.

The Recorded Statement Trap

One of the first things an adjuster will do is ask for a recorded statement. They will sound friendly and concerned, but their goal is to get you to say something they can use against you. They might try to twist your words to suggest you were partially at fault or that your injuries are not as serious as you claim.

You are not legally required to give them a recorded statement. It is almost always in your best interest to politely decline until you've spoken with a lawyer. An experienced attorney can handle all communications for you, protecting your rights from the start. Learn more in our guide on how to deal with insurance adjusters.

Lowball Offers and Delay Tactics

Another classic move is the quick, lowball settlement offer. The adjuster might call a few days after the crash and offer a few thousand dollars, hoping you'll take the money before you know the full extent of your injuries and future medical costs.

Signing a settlement agreement is final. Once you accept their offer, you lose your right to seek any more money for that accident, even if your injuries turn out to be much worse than you thought.

Insurance companies also use delay tactics. They might take weeks to return your calls or bury you in repetitive paperwork. This is often a calculated strategy to frustrate you into either giving up or accepting a fraction of what your auto insurance claim is worth. They also know that Texas has a statute of limitations—a strict two-year deadline from the accident date to file a lawsuit. If they can delay past that deadline, your claim is lost forever.

The Growing Complexity of Claims

The insurance world is getting more complicated. Beyond car accidents, the market for third-party administrators—the companies that manage claims for everything from health plans to commercial liability—is massive.

This sector is expected to grow from roughly $468.33 billion in 2025 to $886.31 billion by 2033, partly because of the increasing use of AI to process claims. This complexity is exactly why having an expert on your side is so important.

Your Top Questions About Third-Party Claims Answered

When you're dealing with the fallout from a car wreck, you have enough on your plate without trying to decipher insurance jargon. Here are straightforward answers to the questions we hear most often from people in your exact situation.

What if the Other Driver's Insurance Is Not Enough?

This is a common and stressful scenario. The at-fault driver has insurance, but their policy limits are too low to cover all your medical bills, lost wages, and other losses.

In this situation, you may be able to file a claim under your own Uninsured/Underinsured Motorist (UIM) coverage. This is a safety net you have paid for. A skilled Texas injury attorney can investigate all possible sources of compensation, including a potential wrongful death compensation claim if a loved one was lost, to ensure you are not left paying for someone else’s mistake.

Do I Have to Speak With the Other Driver's Insurance Adjuster?

No. You are under no legal obligation to give a recorded statement to the at-fault driver's insurance company. In fact, we strongly advise against it until you have spoken with a lawyer.

Adjusters are trained to ask questions that can get you to unintentionally hurt your claim. Let your attorney handle all communications. It is the best way to protect your rights.

How Long Does a Third-Party Claim Take in Texas?

There is no single answer. A straightforward claim might settle in a few months, while more complex cases can take over a year. The timeline depends on the severity of your injuries, the complexity of the accident, and the insurance company's willingness to negotiate fairly.

The most important thing is not to rush. You should wait until you reach maximum medical improvement (MMI)—the point where your doctors have a clear picture of your long-term prognosis—before settling. This ensures you claim the full amount you are owed.

You don't have to face the insurance giants on your own. The experienced Houston car accident lawyers at The Law Office of Bryan Fagan, PLLC are here to protect your rights and fight for the full and fair compensation you deserve. We will handle the legal complexities so you can focus on healing.

Contact us today for a free, no-obligation consultation to discuss your case. Let's talk about your options.