A car crash can change your life in seconds—but you don’t have to face recovery alone. What happens when the driver who hit you has insurance, but their policy isn't nearly enough to cover your medical bills, lost wages, and pain? This is a frighteningly common reality on Texas roads.

That's where underinsured motorist (UIM) coverage comes in. It’s a crucial part of your own auto policy that acts as a financial safety net, bridging the gap between your actual losses and the other driver's minimal insurance policy. It's designed to protect you when another person's mistake leaves you with overwhelming expenses.

Your Financial Shield After a Texas Car Accident

After a wreck, the last thing you should worry about is how you're going to afford to get better. You did the right thing and bought insurance, but here’s the hard truth: countless drivers in Texas only carry the absolute bare minimum liability coverage required by law.

Just one trip to the emergency room or a few weeks of missed work can easily surpass those low policy limits. When that happens, you are often left responsible for the remaining costs.

This is exactly why UIM coverage is one of the most important protections you can buy. It's not an obscure add-on; it's a critical safeguard against the financial hardship a serious collision can cause.

What Is Underinsured Motorist (UIM) Coverage?

Think of your auto policy like a toolkit. Each coverage is a different tool for a specific job. Liability coverage pays for the damage you cause to other people. Underinsured Motorist (UIM) coverage, on the other hand, is there to pay for your injuries when the at-fault driver's insurance just isn't enough to cover your losses.

It’s a crucial distinction that can mean the difference between a full recovery and a mountain of debt.

Plain-English Guide to Texas Auto Insurance

| Coverage Type | Whose Expenses It Pays For | What It Typically Covers |

|---|---|---|

| Liability | Others (when you're at fault) | Medical bills, lost wages, and property damage for people you injure. |

| Uninsured Motorist (UM) | You and your passengers | Your injuries and damages if hit by a driver with no insurance or a hit-and-run driver. |

| Underinsured Motorist (UIM) | You and your passengers | The gap between your total damages and the at-fault driver's low policy limits. |

This table shows how each piece of your policy works to protect you or others. While Liability and UM are vital, UIM is what protects you when the other driver was technically insured, but just barely.

Because Texas state minimums are so low, understanding insurance policy limits after a car accident in Texas is essential for every driver. Your UIM coverage is a direct contract with your own insurance company—it provides a clear path to getting the compensation you deserve when the person who hurt you can't pay what they owe.

Who Is Liable for a Texas Car Accident?

You do everything right. You follow the speed limit and drive defensively. But on the road, your safety is in the hands of every other driver—and many are not as responsible as you are. The hard truth is that Texas highways are filled with drivers who carry just enough insurance to be legal, but not enough to cover the fallout from a serious crash. This puts your family in a dangerous financial position.

Imagine you're a Houston driver rear-ended on I-45. The other driver is clearly at fault, but you soon discover they only have the bare-minimum liability coverage. Suddenly, their mistake has become your crisis. In Texas, the person who caused the crash is legally responsible, or "liable," for the harm they caused. This is based on a legal concept called negligence, which means they failed to act with reasonable care.

Texas Minimum Liability Limits Explained

Texas law requires drivers to carry what’s known as a "30/60/25" policy. While that might sound official, the protection it offers in a real-world collision is shockingly low.

Here’s a breakdown of what those numbers actually mean:

- $30,000 for bodily injury for a single person.

- $60,000 total for bodily injuries per accident, no matter how many people are hurt.

- $25,000 for property damage per accident.

A single ambulance ride and an ER visit can easily surpass $30,000. If your injuries require surgery or cause you to miss significant time from work, your total damages could quickly climb into the six figures. The other driver’s tiny policy will be exhausted almost instantly, leaving you on the hook for the rest.

The Risk of Underinsured Drivers in Texas

This problem is made worse by the staggering number of drivers who have no insurance at all. One in seven Texas drivers—roughly 13.8%—is completely uninsured.

This isn't just bad luck; it's a Texas-sized problem. When you combine the thousands of drivers with rock-bottom liability limits with the millions who carry no coverage whatsoever, the risk becomes clear. Relying on the other driver to have adequate insurance is a gamble you can't afford to take.

This is precisely why having strong underinsured motorist (UIM) coverage in Texas isn't a luxury—it's an absolute necessity. It’s the only reliable way to protect yourself when another driver’s negligence causes a wreck, but their insurance policy falls drastically short.

Your UIM policy is your personal financial safety net. It steps in to cover the difference between your actual costs—medical bills, lost income, and pain and suffering—and the at-fault driver's inadequate policy limit.

If you are ever in a situation where you were hit by an uninsured motorist, your own policy becomes your lifeline for recovery. Understanding how this coverage works is the first step toward shielding your family from the financial devastation a car accident can cause.

How Underinsured Motorist Coverage Works in Texas

One of the most common questions we hear is, "How does my own insurance help me when someone else caused the wreck?" The answer often lies in your Underinsured Motorist (UIM) coverage, but navigating the process can feel overwhelming when you're already stressed from a crash.

Think of UIM coverage as a safety net you bought for yourself. It’s designed to kick in and fill the gap after the at-fault driver's insurance has paid out its policy limits. You can't make a UIM claim until you've completely exhausted the other driver's policy first.

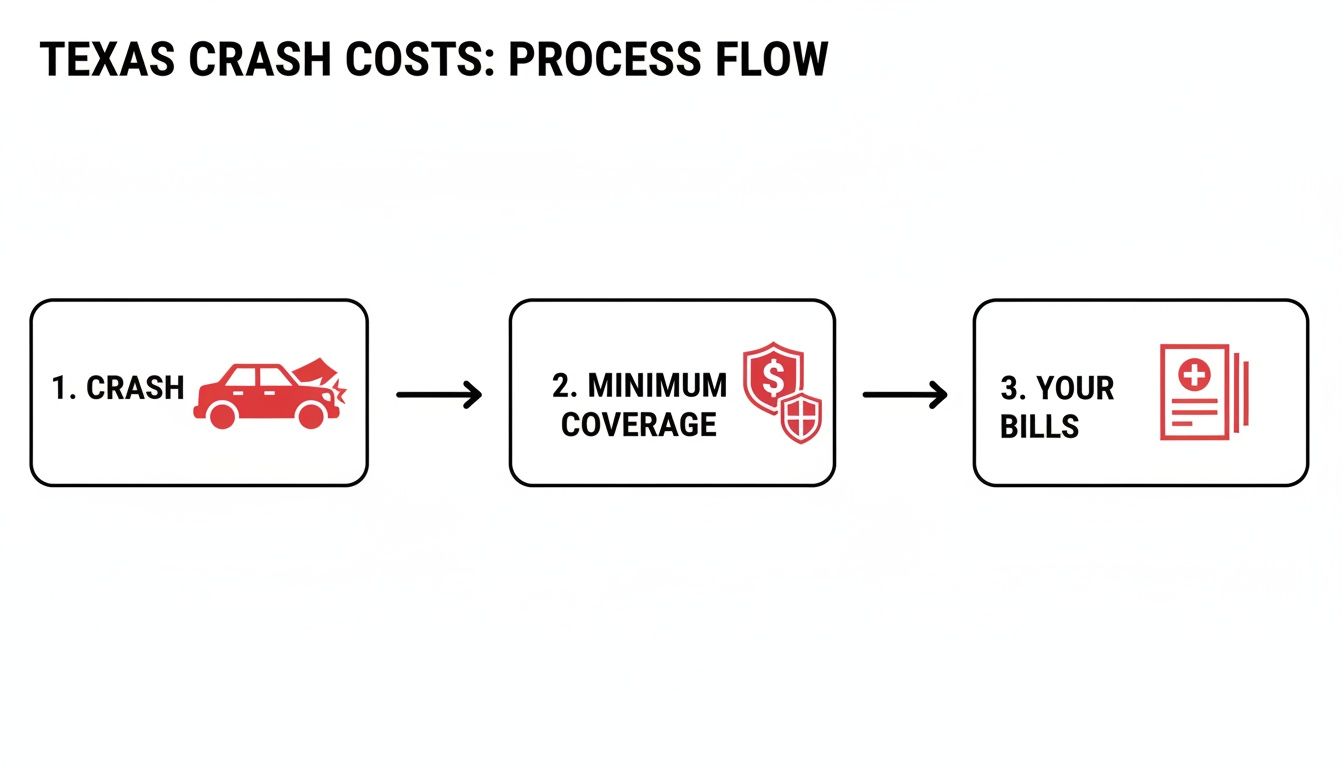

This chart shows how a serious crash can leave a massive gap between the true costs and the minimum coverage many Texas drivers carry.

As you can see, the financial shortfall can be devastating when an accident's expenses dwarf the other driver's bare-bones policy.

The Role of Offsets in Your UIM Claim

When you file a UIM claim in Texas, you will hear the term "offset." An offset is simply a credit your insurance company gets for whatever the at-fault driver's insurance paid you. They subtract that amount from your total UIM policy limit.

Let's walk through a real-world example to make it clear:

- Your Total Damages: You were rear-ended on I-10 in Houston. Your medical bills, lost wages, and pain and suffering add up to $100,000.

- At-Fault Driver’s Policy: The driver who hit you carries the Texas minimum liability coverage of just $30,000.

- Your UIM Policy: You wisely purchased $100,000 in UIM coverage.

First, you collect the full $30,000 from the other driver's insurance. Now, you turn to your own UIM policy for the rest. Your insurance company applies the $30,000 offset (the amount you already received), which means they are responsible for the remaining $70,000 of your damages.

Under Texas law, your insurance company is entitled to this offset. However, an experienced Houston car accident lawyer will ensure this is calculated fairly so you receive every dollar you are entitled to under your policy.

Stacking Policies in Texas

You might have heard about "stacking" insurance policies. In some states, stacking allows you to combine the UIM coverage from multiple vehicles on your policy to create a larger pool of funds after a crash.

However, it's very important to know that Texas law generally does not permit stacking.

If you own two cars, each with $50,000 in UIM coverage, you can’t stack them to create a $100,000 UIM limit for a single wreck. The policy limit for the specific vehicle you were in at the time of the accident is usually the maximum you can recover.

This no-stacking rule makes it even more critical to buy enough UIM coverage for each vehicle you own. To learn more about how claims against your own insurer differ from claims against another driver's, you can read about first-party vs. third-party insurance claims. A Texas injury attorney can help you manage both claims to ensure the process is as smooth and fair as possible.

What Damages Can I Recover in a UIM Claim?

Figuring out what your claim is truly worth is a critical step. When you file a UIM claim, you are asking your own insurance company to pay for the full scope of your losses.

Legally, these losses are called “damages,” and they cover much more than just the initial hospital bill. Insurance adjusters will try to minimize this number, but a skilled Houston car accident lawyer knows how to build a case proving the total financial and personal cost of the crash. You deserve to fight for what you’re owed, not just what the insurance company wants to pay.

Economic Damages: Your Financial Losses

First are the economic damages. These are the tangible, out-of-pocket financial losses you’ve suffered because of the accident. These are the costs you can show with a receipt, invoice, or pay stub.

Common economic damages include:

- Medical Expenses: This covers everything from the ambulance ride and ER visit to surgery, physical therapy, prescriptions, and any future medical care you may need.

- Lost Wages: If your injuries forced you to miss work, you have the right to be reimbursed for the income you lost while recovering.

- Loss of Earning Capacity: For severe injuries that prevent you from returning to your old job—or working at all—you can claim damages for the future income you have lost the ability to earn.

- Property Damage: This is the cost to repair or replace your vehicle and any other personal property damaged in the collision.

These costs add up quickly, especially when serious injuries are involved.

Non-Economic Damages: The Human Cost

Next are the non-economic damages. These are the invisible injuries—the personal losses that don’t come with a price tag but are just as real and devastating. Texas law recognizes that the true harm from a crash goes far beyond your wallet and allows you to demand compensation for this human toll.

Non-economic damages cover things like:

- Pain and Suffering: The physical pain and discomfort you’ve been forced to endure.

- Mental Anguish: The emotional fallout—trauma, anxiety, fear, and depression that can linger long after the crash.

- Physical Impairment: Compensation for losing the ability to use a part of your body or perform daily activities.

- Disfigurement: Compensation for scars or other permanent changes to your appearance.

Because these damages are subjective, insurance companies fight hard to downplay their value. A skilled Texas injury attorney can clearly show how these losses have truly impacted your life.

A Houston driver rear-ended on I-45 may face mounting medical bills and rehab costs that far exceed the at-fault driver's minimum insurance policy. This underinsured nightmare is a reality in Texas, where so many drivers are uninsured. Learn more about your legal options when hit in Richardson.

Real-World Example: A Dallas UIM Scenario

Let’s see how this works in a real-world situation. Imagine a Dallas family is T-boned by a driver who ran a red light. The mother is seriously hurt, needing surgery and months of rehabilitation.

Here’s a breakdown of how her total damages add up:

- Total Damages: After calculating her medical bills ($80,000), lost wages ($15,000), and the value of her pain and suffering ($55,000), her total claim is worth $150,000.

- At-Fault Driver's Policy: The at-fault driver only has the Texas minimum liability limit of $30,000.

- Your UIM Coverage: Thankfully, the family has a $250,000 UIM policy.

The at-fault driver's insurance pays its full $30,000. Now, the family can file a UIM claim with their own insurer for the remaining $120,000 they are owed. Without that UIM coverage, they would face a crushing financial burden.

Steps to File a UIM Insurance Claim in Texas

The moments after a car crash are chaotic. When you're hurt, dealing with a complex auto insurance claim is the last thing you want. This practical, step-by-step advice can help you protect your rights and avoid common mistakes.

The path to accessing your underinsured motorist coverage in Texas is very specific. If you miss a step or a deadline, you could give your own insurance company a reason to deny a claim you paid for and rightfully deserve.

Practical Advice After a Crash

Your actions at the crash scene and in the following days are critical. These initial steps build the foundation for any successful insurance claim.

-

Report the Crash and Get Medical Help: Always call 911. A police report creates an official record of what happened. More importantly, get checked out by paramedics or go to the ER. Adrenaline can mask serious injuries. Documenting your injuries from the start is crucial.

-

Notify Both Insurance Companies: You need to inform both the at-fault driver’s insurance company and your own carrier about the accident. When you call your insurer, let them know you may need to open a UIM claim later. Stick to the basic facts and never admit fault.

-

Talk to a Lawyer Before Giving a Recorded Statement: Adjusters from both companies will ask for a recorded statement. You are not obligated to give one to the at-fault driver's insurer. Even with your own company, it’s wise to speak with a Houston car accident lawyer first. Adjusters are trained to ask questions designed to minimize your claim.

How to Deal with Insurance Companies

Filing a UIM claim is not as simple as sending your insurer your medical bills. Texas law requires a specific sequence of events.

The most important rule is this: you must first settle your claim with the at-fault driver. This means you need a settlement offer for their entire liability policy limit. For example, if the driver who hit you has a $30,000 policy, you need a written offer for the full $30,000 before your UIM coverage can be used.

Here is a common trap: Before you accept that settlement, you must get written permission from your own insurance company. If you take the at-fault driver's money without your insurer's consent, you could lose your right to make a UIM claim.

This is a devastating mistake many accident victims make. An experienced Texas injury attorney will manage this entire process, making sure every legal requirement and deadline, like the two-year statute of limitations, is met. The statute of limitations is a legal time limit for filing a lawsuit. As you gather sensitive documents for your claim, it's also wise to use secure document sharing practices to keep your private information safe.

A massive pileup on I-35 in Austin during rush hour is a terrifyingly common scenario. The driver who caused it all is often underinsured, and their tiny policy is exhausted almost immediately. Meanwhile, you're facing surgeries and lost wages. In Texas, where roughly one in seven drivers is uninsured, UIM is a lifeline. You can learn more about Texas uninsured driver statistics to see just how critical this coverage is.

Why You Need an Attorney for Your UIM Claim

When you make an underinsured motorist (UIM) claim, you’re turning to your own insurance company—the one you’ve paid premiums to for years. It’s natural to think they’ll have your back.

Unfortunately, that is rarely the case. The moment you file a UIM claim, your relationship with your insurer changes. You are no longer just a customer; you are a potential expense. Their goal is to protect their profits by paying as little as possible.

Suddenly, you are not on the same team. You're facing a financial opponent, and the best way to level the playing field is with an experienced Houston car accident lawyer fighting for you.

How Insurance Companies Deny UIM Claims

Insurance companies have a playbook of tactics designed to reduce or deny legitimate UIM claims. Their adjusters are skilled negotiators trained to protect the company's bottom line.

Some of the most common strategies we see include:

- Disputing Injury Severity: The adjuster might downplay your injuries or suggest they were caused by a pre-existing condition.

- Arguing Comparative Fault: They will look for any reason to shift blame onto you. Under the Texas Civil Practice & Remedies Code, specifically Chapter 33, if you are found more than 50% at fault (comparative fault), you cannot recover any money.

- Offering a Lowball Settlement: They may make a fast, low offer, hoping your financial stress will push you to accept far less than your claim is worth.

- Delaying Your Claim: They know that dragging out the process can wear you down. By creating endless hurdles, they hope you’ll get frustrated and take a low offer out of exhaustion.

Your insurance company has a team of lawyers working to minimize your payout. You deserve to have a dedicated Texas injury attorney in your corner, fighting just as hard to protect your rights.

An experienced lawyer knows these tactics. We build a powerful case from day one, armed with solid medical evidence and a complete accounting of your damages. We handle all communication, shielding you from the adjuster's pressure and forcing them to take your claim seriously. Your job is to focus on healing. Let us handle the fight.

Contact a Houston Car Accident Lawyer Today

The moments after an accident are chaotic, but you don't have to figure it all out alone. If you've been hurt by an underinsured driver, legal help is available. The dedicated team at The Law Office of Bryan Fagan, PLLC is here to protect your rights and fight for the full compensation you deserve.

Contact us today for a free, no-obligation consultation to get your questions answered. Let us handle the legal battle so you can focus on what matters most—your recovery. We can help you pursue your auto insurance claim and fight for a fair settlement or wrongful death compensation. You pay nothing unless we win your case. Visit us at https://houstonaccidentlawyers.net to learn more.