A car crash can change your life in seconds—but you don’t have to face recovery alone. When you're ready to seek the compensation you deserve, a well-written demand letter is your first, most powerful move against the insurance company. Think of it as the formal kickoff to serious settlement talks, a tool that often helps resolve your claim without ever having to step foot in a courtroom.

Your First Step Toward Fair Compensation

Life after a car accident in Texas can be a whirlwind of pain, confusing paperwork, and mounting medical bills. It's easy to feel powerless. But the truth is, you have more control than you might realize, and it all starts with one critical document: the personal injury demand letter.

This isn't just some form letter you fill out. It’s a strategic tool. It lays out the unshakeable facts of your case, details the full extent of your injuries and financial losses, and makes a formal, calculated request for a specific settlement amount from the at-fault driver's insurance. It immediately signals to the insurance adjuster that you are organized, serious, and ready to fight for what you're owed.

Why a Strong Demand Letter Matters

Imagine this: you're trying to recover from a bad wreck in Houston, your body aches, and every day brings a new bill in the mail. This is where a strong demand letter becomes your opening salvo. It sets the tone for everything that follows.

Here’s a statistic that might surprise you: a staggering 95-96% of personal injury cases in the U.S. are settled before they ever reach a trial. For accident victims here in Texas, that number really drives home the importance of pre-lawsuit tools like a demand letter. At The Law Office of Bryan Fagan, PLLC, we’ve seen time and time again how a strategic, detailed demand can push an insurer to the negotiating table and get them to make a fair offer.

To make sure everything is in order, some people find that using legal document automation software can help keep the facts straight and the paperwork clean from the very beginning.

This flowchart gives you a bird's-eye view of the whole process, showing just how central the demand letter is.

As you can see, the demand letter acts as the crucial bridge between the chaos right after the crash and getting your claim resolved. Getting your ducks in a row from day one is absolutely essential. That's why knowing exactly what to do after a car accident builds the strong foundation you need for a compelling letter. This guide will walk you through how to draft one that makes the insurance company sit up and pay attention.

Crafting a Demand Letter That Tells Your Story

A strong demand letter is more than just a list of facts and figures. It’s a story—your story. To get an insurance adjuster in Texas to sit up and take your claim seriously, you need to build a narrative that is clear, logical, and backed by undeniable proof. This story is the bedrock of your entire personal injury claim.

Think of yourself as the author of your own recovery. The demand letter is your first and most important draft, and it has to be compelling. It needs to paint a vivid picture of what happened, exactly why the other driver is responsible, and the profound impact this accident has had on every corner of your life.

Articulating the Facts of the Accident

Your story has to start with a clear, concise, and factual account of the accident. This isn't the time for emotional language. The goal is to lay out a straightforward timeline of events that an adjuster can follow without any confusion.

Let’s take a common scenario: a Houston driver rear-ended on I-45 during evening rush hour. The narrative should detail:

- Date, Time, and Location: "On Tuesday, October 26th, at approximately 5:15 PM, I was driving my 2021 Toyota Camry southbound on Interstate 45, just south of the Woodlands exit."

- What You Were Doing: "Traffic was heavy, and I was traveling at a safe speed in the center lane, maintaining a proper distance from the car ahead of me."

- The Other Driver's Actions: "Without warning, a 2019 Ford F-150, driven by the insured party, slammed into the back of my vehicle at high speed. The force of the impact was severe, causing my car to lurch forward."

This objective description establishes the sequence of events. You aren't just saying you were hit; you're methodically setting the scene, making it incredibly difficult for the adjuster to dispute the basic facts.

Establishing Clear Liability Under Texas Law

After explaining what happened, you have to connect the dots and show why the other driver is legally at fault. This is where you link the facts directly to Texas negligence laws. In simple terms, liability is just legal responsibility for the harm someone caused. Your job is to prove the other driver’s actions (or lack thereof) were negligent.

Under the Texas Civil Practice & Remedies Code, negligence is typically shown by proving the other driver failed to act as a reasonably prudent person would have in the same situation. In our I-45 rear-end collision, you would state plainly that the other driver was at fault.

In Texas, there is a legal presumption that the driver who rear-ends another vehicle is at fault. This is because every driver has a duty to maintain a safe following distance and be attentive to the traffic ahead.

Your letter should say that explicitly. Explain that by failing to control their speed and keep a safe distance, the other driver breached their duty of care, which directly caused the crash and your subsequent injuries. This legal framing is critical for a strong auto insurance claim.

Detailing Your Injuries and Damages

This is where the narrative shifts from the crash to its consequences. Here, you draw a straight line from the other driver's negligence to the harm you've suffered. You must give a complete picture of your injuries, both physical and emotional.

Start right after the impact. Describe the pain you felt at the scene, the trip to the ER, and the initial diagnosis. For instance, you could explain how a diagnosis of whiplash and a concussion has led to:

- Persistent neck pain and debilitating headaches.

- Difficulty concentrating and sleeping through the night.

- An inability to perform daily tasks at home or at your job.

From there, you need to provide a full accounting of your damages—the total monetary value of everything you've lost. This isn’t just about medical bills. It includes every single loss you've incurred because of the accident. A Houston car accident lawyer can be invaluable here, helping you identify and calculate all the damages to include.

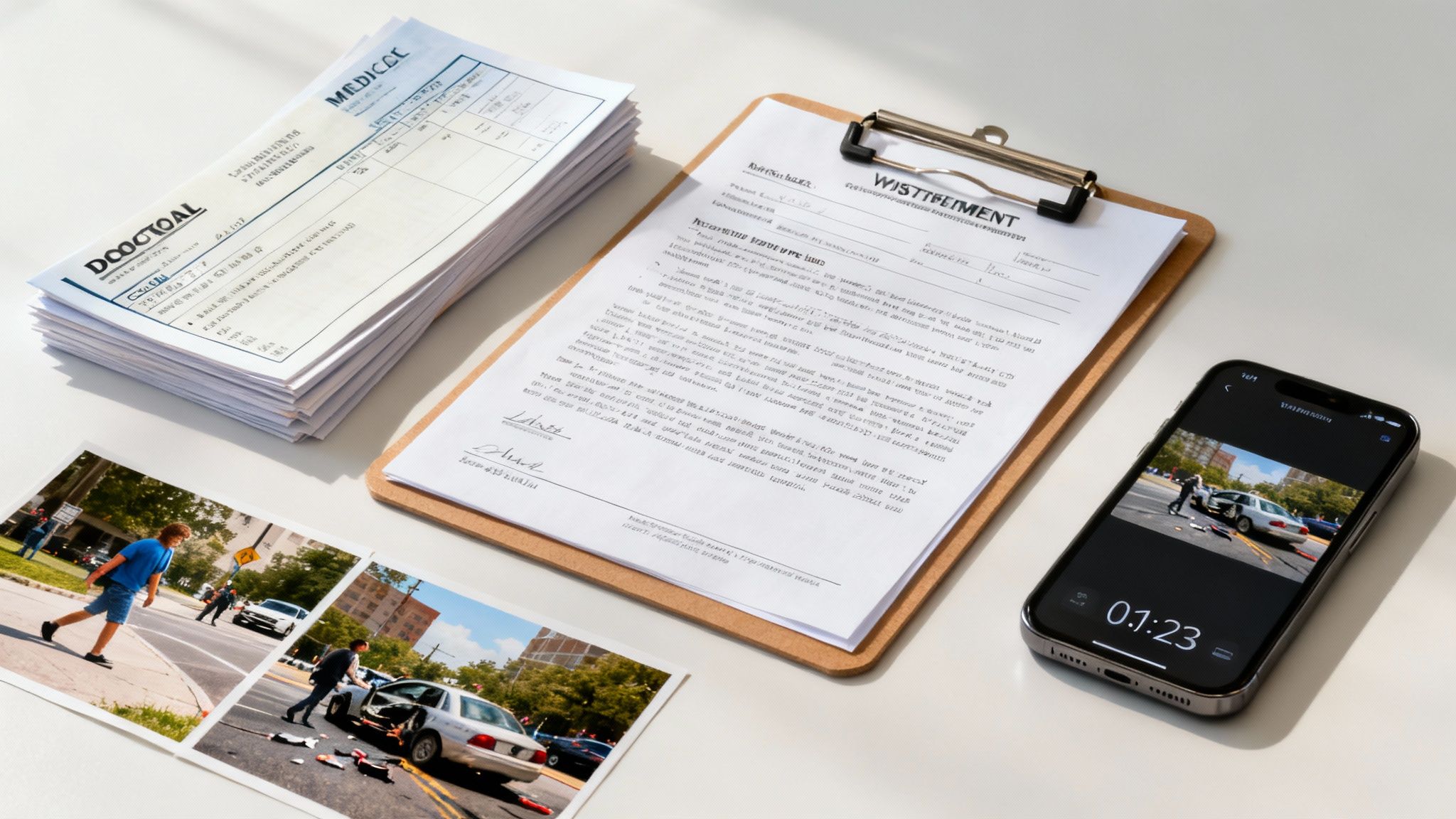

To help you organize everything you need, we've put together a checklist of the key elements that make a demand letter truly powerful.

Key Elements for a Powerful Texas Demand Letter

Use this checklist to gather the critical information and documents needed to build each section of your personal injury demand letter.

| Letter Section | Information to Include | Supporting Document Example |

|---|---|---|

| Introduction | Your name, date/location of accident, at-fault party's name, claim number. | Police Accident Report |

| Facts of the Accident | A clear, chronological account of how the incident occurred. | Witness statements, photos of the scene. |

| Liability | Explanation of why the other party is at fault, referencing traffic laws. | A copy of the relevant Texas traffic statute. |

| Injuries | Detailed description of all physical and emotional injuries sustained. | Initial ER report, doctor's diagnosis. |

| Medical Treatment | A complete timeline of all medical care, from the ER to physical therapy. | Medical records, treatment summaries. |

| Damages (Economic) | Itemized list of all financial losses: medical bills, lost wages, property damage. | Invoices, pay stubs, repair estimates. |

| Damages (Non-Economic) | Description of pain, suffering, emotional distress, and loss of enjoyment of life. | Personal journal entries, letters from family. |

| Demand for Settlement | A specific, total dollar amount you are demanding as compensation. | A final calculation spreadsheet. |

By meticulously gathering these documents, you arm yourself with the proof needed to back up every claim you make in your letter.

A complete demand letter will detail every single loss, ensuring the insurance company understands the true, total cost of this accident on your life. This sets the stage perfectly for demanding fair compensation that covers every part of your recovery.

How to Calculate the Full Value of Your Claim

Figuring out what your claim is really worth is one of the most critical—and confusing—parts of the entire process. Insurance adjusters are trained professionals, and their job is to pay out as little as possible. They will almost always start with a lowball offer, banking on the hope that you don't grasp the true value of everything you've lost.

To push back effectively, you need to walk in with a rock-solid understanding of your total losses before you even think about writing that demand letter.

Under Texas law, the compensation you can pursue is legally known as damages. These fall into two main buckets, and you have to account for both if you want your demand to reflect the accident's true impact on your life.

Tallying Your Economic Damages

Economic damages are the straightforward, tangible costs you've incurred because of the accident. These are the losses with a clear price tag—the ones you can prove with receipts, bills, and pay stubs.

Think of these as the black-and-white numbers of your claim. They form the foundation of your settlement demand because they're easy to calculate and very hard for an insurer to dispute when you have the paperwork to back them up.

Make sure your list of economic damages includes:

- All Medical Expenses: This is everything. From the ambulance ride and ER visit to your ongoing physical therapy, prescriptions, specialist co-pays, and any medical equipment you needed.

- Future Medical Costs: If your injuries will require long-term care, like a future surgery or years of therapy, you must include these projected costs. A Houston car accident lawyer can consult with medical experts to get a realistic forecast of these expenses.

- Lost Wages: Add up every single dollar you lost from being out of work. This includes your salary or hourly pay, but also any overtime, bonuses, or commissions you missed out on.

- Loss of Future Earning Capacity: This is a big one. If your injuries keep you from returning to your old job or limit your ability to earn a living down the road, that's a massive financial loss that needs to be calculated.

- Property Damage: This usually means the cost to repair or replace your vehicle, but don't forget other personal property destroyed in the crash, like a laptop, phone, or car seat.

Understanding Non-Economic Damages

While economic damages cover your financial setbacks, non-economic damages are meant to compensate you for the human cost of the accident. This is for the immense physical and emotional suffering you've been forced to endure. These losses don't come with an invoice, but they are just as real—and often have a much deeper impact on your life.

These damages are more subjective, which is precisely why insurance companies will try to downplay or ignore them. Don't let them. They are a critical part of your claim's total value.

Under Texas Civil Practice & Remedies Code, Chapter 41, non-economic damages are fully recognized as legitimate losses. The law intends for this compensation to account for the decline in your quality of life caused by someone else's negligence.

Calculating these damages is far more complex. Common types include:

- Pain and Suffering: For the physical pain, discomfort, and agony your injuries have caused.

- Mental Anguish: This covers the emotional trauma—the depression, anxiety, fear, flashbacks, or PTSD that followed the crash.

- Physical Impairment: If you've lost the use of a limb or can no longer enjoy hobbies or activities you once loved, from playing with your kids to going for a run, you deserve compensation for that loss.

- Disfigurement: For permanent scarring or other visible changes to your appearance caused by the accident.

Because these damages are so personal and tough to put a number on, it helps to learn more about how to calculate pain and suffering damages. Having an experienced Texas injury attorney in your corner is essential for building a compelling case for these non-economic losses.

Your final demand amount in the letter should be a single, total figure that combines both your economic and non-economic damages. This number is your goal—the full and fair compensation you need to move forward. When you present a well-supported and comprehensive calculation, it sends a clear message to the adjuster: you’ve done your homework, and you won’t be lowballed.

Gathering the Evidence That Wins Your Case

A demand letter is just a piece of paper without solid proof to back it up. You have to remember an insurance adjuster’s job is to protect their company's money, and that means they're trained to poke holes in every part of your claim. But when you hit them with a mountain of undeniable evidence, it gets a lot harder for them to justify a lowball offer.

Think of each document as a brick in a wall. A single receipt isn't much, but when you stack it with police reports, doctor's notes, and photos, you build an airtight case. Getting this part right is your best defense against an unfair settlement.

The Non-Negotiable Documents for Your Claim

To put together a demand package that an adjuster has to take seriously, you need to collect the documents that tell the whole story of the accident and what came after. They won’t just take your word for it—they need to see official records.

Here are the absolute essentials you must include:

- The Official Police Report: This is usually the first thing an adjuster will ask for. It’s a neutral, third-party account of what happened, often noting who the officer believes was at fault. You can learn how to get your copy in our guide to obtaining an accident report in Houston, TX.

- Complete Medical Records: This is the heart of your injury claim. You need everything—from the first ER visit to prescriptions, physical therapy notes, and specialist consultations. These records are what tie your injuries directly to the crash.

- Photos and Videos: Visual proof is incredibly persuasive. Get clear photos of the accident scene, the damage to all the cars, and your injuries as they heal. Bruises, cuts, casts—document it all. Dashcam footage? That can be a complete game-changer.

- Witness Statements: A credible witness who backs up your story adds serious weight to your claim. Make sure to get their name and number at the scene and ask if they’d be willing to write down what they saw.

Illustrating the Real-World Impact

Let's imagine you were hit by a car in a crosswalk here in Texas. Your demand letter becomes so much stronger when you weave these elements together. You can match the police report—which states the driver failed to yield—with a witness statement confirming you had the right-of-way.

Then, you add your orthopedic surgeon's detailed report explaining the long-term prognosis for your leg fracture, right alongside every single medical bill. This strategy turns your claim from a simple request into a proven narrative of someone else's negligence and its consequences on your life.

A well-supported demand letter doesn’t just state facts; it proves them. It systematically dismantles the insurance company’s ability to argue against your claim's validity or value.

This level of detail is critical, especially since most personal injury cases in Texas settle out of court. Your demand letter is your primary negotiating tool. With a well-supported claim, you force the insurance company to take your case seriously. Having rock-solid evidence like eyewitness testimony can make all the difference in achieving a fair settlement that provides for your recovery and acknowledges your pain and suffering, which could otherwise be a struggle to obtain rightful wrongful death compensation for your family if the worst occurs.

By putting together a comprehensive evidence package, you’re not just writing a letter; you’re building a fortress around your claim. This forces the insurance company to come to the table and negotiate in good faith, dramatically improving your chances of getting the full and fair compensation you deserve.

Knowing When It's Time to Call a Lawyer

You've done everything right so far. You've gathered your thoughts, documented your injuries, and even drafted a demand letter. That's a huge step, and for some straightforward cases, it might be enough.

But let's be realistic. Insurance companies are not in the business of making your life easy. Their primary goal is to protect their bottom line, which means paying out as little as possible. The moment they sense a weakness or an opportunity to downplay your claim, they'll pounce. This is the critical juncture where a DIY approach can backfire, and knowing when to hand the reins to a seasoned personal injury attorney is the smartest move you can make.

Red Flags That Mean You Need Legal Help Now

Some situations dramatically complicate a personal injury claim, tipping the scales in the insurance company's favor if you're alone. If you see any of these signs, it's time to stop talking to the adjuster and start talking to a Texas injury attorney.

- They're Blaming You. If the adjuster even hints that you were partially at fault for the accident, this is a major red flag. They're laying the groundwork to use Texas's “comparative fault” rule against you, which could drastically reduce—or completely eliminate—your compensation.

- Your Injuries are Serious or Long-Lasting. A few stitches and a follow-up visit are one thing. But when you're facing future surgeries, long-term physical therapy, or permanent impairment, calculating your claim's true value is incredibly complex. You need an expert who can accurately forecast these future costs.

- A Commercial Vehicle Was Involved. A collision with a semi-truck or delivery van is not a standard car accident claim. You're suddenly up against a commercial carrier with deep pockets and aggressive corporate lawyers. This is a battle you don't want to fight alone.

- You Get a Lowball Offer or an Outright Denial. An insultingly low offer is a classic tactic to see if you'll settle for pennies on the dollar. A flat-out denial is the insurance company's way of saying, "Prove it." In either case, they're daring you to fight back.

Cases involving complex medical questions or professional negligence add another layer of difficulty. Understanding when you might need a medical malpractice expert witness is just one piece of a puzzle that a skilled lawyer knows how to solve.

How an Attorney Changes the Game

Hiring a lawyer isn't just about getting legal advice; it fundamentally shifts the power dynamic. Insurance adjusters are trained to use pressure tactics on unrepresented victims. Those tactics stop working the second an experienced attorney is on the case.

An attorney becomes your shield and your sword. They shield you from the stress of constant calls and frustrating negotiations, handling all communication. At the same time, they use their legal expertise as a sword to aggressively pursue the maximum compensation you are owed.

When The Law Office of Bryan Fagan takes on your case, we don't just send a letter. We launch a full-scale effort to build an undeniable claim.

- We conduct a full-blown investigation. We track down every piece of evidence, interview witnesses, and bring in accident reconstruction experts if needed to prove the other party's liability.

- We calculate your true damages. We collaborate with medical and financial experts to make sure every single loss—past, present, and future—is accounted for in your demand.

- We take over all negotiations. We handle the endless back-and-forth, shutting down the insurance company's games and pushing for a settlement that actually reflects what you've been through.

- We prepare for trial from day one. If the insurer refuses to be reasonable, our willingness to go to court often persuades them to offer a fair settlement. We are always ready to fight for you in front of a jury.

The Landmine of Texas Comparative Fault Laws

One of the biggest traps in Texas personal injury law is comparative fault, also known as proportionate responsibility. You can find it in Chapter 33 of the Texas Civil Practice & Remedies Code.

Here's how it works: if you're found to be partially at fault for the accident, your settlement is reduced by that percentage. For example, if you're awarded $100,000 but a jury decides you were 20% responsible, your award drops to $80,000.

Here’s the real kicker: if you are found to be 51% or more responsible, you get nothing. Zero. Adjusters love to use this rule to their advantage, trying to pin any amount of blame on you to save their company money. A skilled lawyer knows how to dismantle these arguments and protect your right to a full recovery.

If you're dealing with a difficult adjuster, facing a long recovery, or simply feel in over your head, you don't have to navigate this alone. Contact The Law Office of Bryan Fagan for a free, no-obligation consultation. We will listen to your story, explain your legal options, and show you how we can fight for you. You pay absolutely nothing unless we win your case.

Common Questions About Personal Injury Demand Letters

Going through the aftermath of a Texas car accident can feel like navigating a maze. When it's time to draft a demand letter, you need clear, straightforward answers. Here are some of the most common questions we hear from accident victims just trying to get back on their feet.

When Is the Right Time to Send a Demand Letter?

Timing is everything, and sending a demand letter too soon can be a costly mistake. You absolutely need to wait until you've finished all your medical treatment or reached what's known as Maximum Medical Improvement (MMI).

MMI is the point where your doctors agree your condition has stabilized and you've recovered as much as you're likely to. Why is this so important? Because sending a letter before you hit MMI means you won't have a clue what your final medical bills will be, or if you'll need ongoing care down the road. Once you accept a settlement, that's it—you can't go back and ask for more money if complications pop up later.

At the same time, you can't wait forever. You have to keep an eye on Texas's statute of limitations, which is the legal deadline to file a lawsuit. For most personal injury claims, you have just two years from the date of the accident to file a lawsuit. It's crucial to get your demand letter sent well before that deadline to leave time for negotiations.

Can I Write the Demand Letter Myself?

Legally, sure, you can write and send a demand letter on your own. But honestly, it's a path loaded with potential pitfalls. Insurance adjusters are professional negotiators, and their entire job is to pay out as little as possible. They are trained to spot weaknesses in a claim from a mile away.

A single poorly worded sentence, a miscalculation of your damages, or leaving out key evidence can tank your settlement offer. For instance, if you demand an unrealistic amount without the documentation to back it up, the adjuster may just dismiss your claim as not serious.

Hiring an experienced Texas injury attorney completely levels the playing field. A lawyer knows exactly how to frame the story, calculate every penny of your damages (including pain and suffering), and signal to the insurance company that you're ready for a courtroom battle if they don't make a fair offer.

What Happens After the Insurance Company Gets My Letter?

Once the adjuster receives your demand package, the ball is in their court. Typically, one of three things will happen next:

- They Make a Counteroffer: This is the most common response. Don't be surprised when the adjuster comes back with an offer that's significantly lower than what you demanded. This is just the opening move that kicks off the negotiation process.

- They Reject Your Demand: Sometimes, the insurer will deny your claim outright. They might argue their client wasn't at fault or, more frustratingly, that your injuries weren't caused by the accident.

- They Ask for More Information: An adjuster might also request more documentation to "evaluate" your claim before making any offer. This can sometimes be a legitimate request, but it can also be a stalling tactic.

No matter how they respond, remember this: you do not have to accept an unfair offer. If negotiations hit a wall, the next step is to file a personal injury lawsuit. A Houston car accident lawyer can handle this entire process for you, protecting your rights and fighting for what you're truly owed.

The road to recovery is complicated enough without having to fight an insurance company. If you're feeling overwhelmed, getting the runaround, or just aren't sure what your claim is worth, the team at The Law Office of Bryan Fagan, PLLC is here to step in.

Contact us today for a free, no-obligation consultation to talk about your case. We work on a contingency-fee basis, which means you pay absolutely nothing unless we win for you. Let us fight for the justice and compensation you deserve. Learn more at https://houstonaccidentlawyers.net.