A car crash can change your life in seconds — but you don’t have to face recovery alone. When you're recovering from a serious accident, the last thing you want to think about is a surprise tax bill from the IRS. Thankfully, in most cases, you won't have to. The law is firmly on your side: compensation you receive for physical injuries and the related pain and suffering is generally not taxable.

The government established this rule for a simple, compassionate reason—to help you become "whole" again without piling a new financial burden on top of your physical recovery.

Are Personal Injury Settlements Taxable in Texas?

A car crash can flip your world upside down in an instant, but you don't have to navigate the aftermath alone. After a Houston car accident lawyer secures a settlement to cover your losses, one of the first questions clients ask is, "Do I have to pay taxes on this money?" For most accident victims in Texas, the answer brings a wave of relief.

Under the Internal Revenue Code (specifically, Section 104(a)(2)), any money awarded for physical injuries is excluded from your gross income. Think of it this way: your settlement isn't a lottery win or a bonus. It’s a restoration. It's meant to put you back in the position you were in before someone else’s negligence caused you harm, not to create new, taxable income.

The Principle of Making You Whole

The core idea behind this tax exemption is fairness. Imagine you were caught in a multi-vehicle pile-up on I-45 in Houston. Your life was disrupted, and your settlement is designed to address that disruption. It would cover things like:

- Emergency room bills and hospital stays

- The cost of surgery and ongoing physical therapy

- Money to compensate for the physical pain you endured

- Emotional distress that is a direct result of your physical injuries

Because these payments are all about restoring your health and financial stability—not creating a gain—the IRS doesn't tax them.

Important Exceptions to the Rule

It’s crucial to know, however, that not every dollar in a settlement is automatically tax-free. This special status only applies to damages paid on account of physical injuries or physical sickness.

If a portion of your settlement is specifically allocated for other reasons, that part could be subject to taxes. The most common examples are:

- Lost Wages: Compensation for the income you couldn't earn while recovering is generally taxed as regular income.

- Punitive Damages: These are rare and are meant to punish the at-fault party for extreme negligence. The IRS views these as a windfall, so they are taxable. In Texas, punitive damages are governed by Chapter 41 of the Texas Civil Practice & Remedies Code.

- Interest: Any interest earned on the settlement amount is also considered taxable income.

Understanding this distinction is key to protecting your financial future. As your Houston car accident lawyer, our job isn't just to win your case. It's also to structure the settlement agreement in a way that maximizes what you take home and minimizes any potential tax liability down the road.

Understanding Your Non-Taxable Compensation

When you get a settlement after a car accident, most of that money is meant to help you get back on your feet and rebuild your life. The good news? The IRS generally agrees that this core part of your recovery shouldn't be taxed. This isn’t a lottery win; it’s a restoration for what was taken from you, and the tax code is designed to protect it.

The guiding principle is simple: if the compensation is for physical injuries and their direct consequences, it’s tax-free. Let’s break down exactly what that means for you.

Medical Expenses—Both Past and Future

The most clear-cut, non-taxable part of your settlement is the reimbursement for medical bills. This covers every single expense directly tied to treating the physical injuries you suffered in the crash.

This is a pretty broad category that includes:

- Emergency services, like the ambulance ride and ER visit.

- Hospital stays, surgeries, and other medical procedures.

- Appointments with doctors, surgeons, and specialists.

- Ongoing physical therapy, rehab, and chiropractic care.

- The cost of prescription drugs and medical gear like crutches or a neck brace.

- Any estimated costs for future medical treatments your doctors expect you'll need.

Think about it this way: imagine you’re rear-ended on I-10 and need surgery for a herniated disc. The part of your auto insurance claim settlement covering the hospital bills, surgeon’s fees, and months of physical therapy is 100% non-taxable. This ensures every dollar meant for your physical healing actually goes to that purpose.

Compensation for Pain and Suffering

Beyond the stack of medical bills, Texas law recognizes that the physical pain and mental anguish from a serious crash are very real losses. This is what we call “damages,” and it’s a critical piece of your settlement. Damages are the monetary compensation awarded to an injured person for the harm they've suffered.

Compensation for pain and suffering is there to acknowledge the human cost of an accident—the daily discomfort, the loss of enjoyment of life, and the physical hardship you're forced to endure. Because these damages come directly from your physical injuries, the IRS does not see them as taxable income.

This is one of the most important protections for accident victims. It means the money intended to make up for your personal suffering isn't chipped away by taxes. Figuring out the true value of these damages is complex, and our team has years of experience proving it. For a deeper dive, check out our guide on how to calculate pain and suffering damages.

Emotional Distress and Loss of Consortium

Emotional distress—like anxiety, depression, or PTSD—is another very real consequence of a traumatic car wreck. When it comes to taxes, the key is its connection to a physical injury. If your emotional distress is a direct result of the physical harm you suffered, any money you receive for it is also tax-free.

Similarly, if a family member makes a claim for loss of consortium—meaning the accident has damaged their relationship with you because of your injuries—that compensation is also generally non-taxable. It all flows from the physical harm caused by the at-fault driver.

Bottom line: if the damage is tied to a physical injury, the compensation is protected. This lets you and your family focus completely on healing without worrying about a tax bill.

Which Parts of a Settlement Are Taxable?

While the core of your settlement—the money for your physical injuries and pain—is safe from the IRS, not every dollar is. It’s critical to know which parts are considered taxable income so you can plan your finances and avoid a nasty surprise when April rolls around.

Think of it this way: the government generally won’t tax money meant to make you whole again after a physical injury. But when a part of the settlement looks more like regular income or a financial windfall, that’s when the IRS takes notice. Understanding these distinctions is the key to protecting your recovery.

Punitive Damages

In some rare cases, a court might award punitive damages. This only happens when the at-fault party's actions were shockingly reckless or malicious, like a drunk driver causing a catastrophic pile-up on I-10. In Texas, liability, or legal responsibility, for punitive damages requires proving gross negligence.

Unlike compensation for your medical bills, punitive damages aren't about paying you back for your losses. They exist to punish the defendant and send a clear message to the community that such behavior will not be tolerated. Because of this, the IRS views punitive damages as a gain, and they are fully taxable as income.

Compensation for Lost Wages

If your injuries kept you out of work, a good chunk of your settlement is likely meant to cover those lost wages—the salary, tips, and bonuses you missed out on while recovering.

The IRS rule here is simple: if you would have paid taxes on that income had you earned it on the job, you’ll pay taxes on the settlement money that replaces it. Your regular paycheck has taxes taken out, and the portion of your settlement that stands in for those paychecks is treated the same. This applies to both the wages you’ve already lost and any future earning ability you've lost due to a permanent disability.

Interest Earned on a Settlement

Finally, any interest your settlement earns is taxable. This usually pops up in two common scenarios:

- Delayed Judgments: If there's a long gap between when a court awards a judgment and when you actually get paid, the amount may grow with interest. That interest is taxable.

- Structured Settlements: Sometimes, a large settlement is paid out in installments over several years instead of in one big check. The money is often invested in an account where it earns interest. That interest income is considered taxable, just like the interest you'd earn from your bank's savings account.

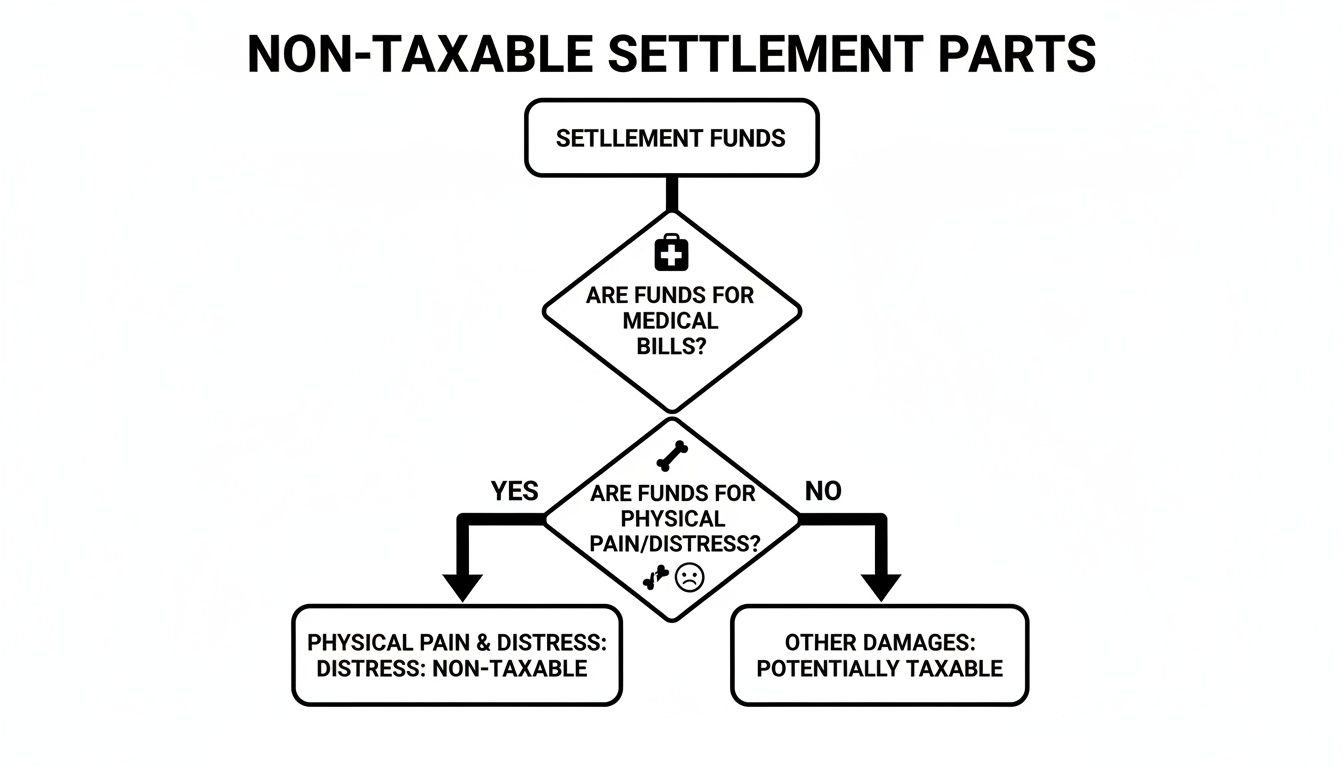

This chart breaks down the most common non-taxable parts of a settlement, which, for most personal injury clients, make up the largest portion of their financial recovery.

As you can see, the money directly tied to your physical recovery—from ambulance rides and hospital stays to the pain and suffering you endured—is shielded from taxes.

Ultimately, handling the tax side of a settlement is a crucial final step. An experienced Texas injury attorney doesn’t just fight to get you the most compensation possible; they also work to structure the final agreement in a way that protects your financial future. At The Law Office of Bryan Fagan, PLLC, we guide you through every complex detail, making sure you know exactly what to expect. Don't try to navigate this alone. Contact us today for a free consultation to discuss your case and protect your rights.

How Legal Fees and Medical Deductions Affect Your Taxes

Let’s be honest—untangling the financial details of your settlement can feel like a second job, especially when it comes to taxes. Two of the most common questions we get are about how attorney’s fees and old medical bills affect what you might owe the IRS. Getting this right is critical for your financial stability long after the case is closed.

A big misconception is that you only worry about taxes on the final check you get after your lawyer is paid. That’s not how the IRS sees it. They look at the gross settlement amount—the full number before anyone takes a cut. So if your settlement includes taxable money, like for lost wages or punitive damages, your tax bill is calculated on that bigger, pre-fee total.

Unraveling Attorney Fees and Your Taxes

When a settlement includes taxable income, the IRS typically expects you to report the entire taxable portion. This is true even though a big chunk of it goes straight to your attorney for their contingency fee.

It’s a confusing rule, but think of it this way: the legal fees are an expense you paid to get that taxable income. While you used to be able to deduct those legal fees, recent tax law changes have made that nearly impossible for most personal injury clients.

The most important takeaway here is to never assume your attorney’s fees are deductible from a taxable award. You absolutely need to run this by a qualified tax professional who knows the latest IRS rules and can look at the specifics of your case.

If you want to learn more about how law firms are paid in injury cases, we break down car accident lawyer fees and explain how contingency agreements work to protect you.

The Tax Benefit Rule Explained

Another key concept you need to know is the “tax benefit rule.” This rule only matters if you’ve already deducted medical expenses from your taxes in a previous year for the same injuries.

Here’s a simple, real-world scenario to make it click:

- Year 1: A driver gets hurt in a wreck on the Sam Houston Tollway and pays $15,000 out of pocket for medical care. When she files her taxes, she itemizes her deductions and writes off that $15,000. This lowers her taxable income for that year, saving her money.

- Year 2: Her personal injury case finally settles, and the insurance company pays her back for that exact $15,000 in medical costs.

Because she already got a "tax benefit" from that deduction in Year 1, the IRS says she now has to report that $15,000 reimbursement as taxable income in Year 2. You can’t get the same tax break twice.

Now, this rule only applies if you itemized your deductions and specifically claimed those medical costs. If you just took the standard deduction, you didn't get a "tax benefit," so the reimbursement for those medical bills would remain tax-free.

These complex rules are a perfect example of why having a skilled Houston car accident lawyer is so important. We don’t just fight for a fair settlement—we work to structure it in a way that avoids these kinds of tax headaches down the road, setting you up for a more secure financial future.

Why The Language in Your Settlement Agreement Is So Important

The words used in your settlement agreement aren't just legal formalities—they have a massive impact on your real-world financial recovery. Simply taking a lump-sum check from an insurance company without clear, protective language is a huge mistake. A well-structured agreement is your best defense against a surprise tax bill, and getting that language right is a critical part of what a skilled Houston car accident lawyer does for you.

Think of this document as the official story of your recovery. It’s what tells the IRS exactly why you received that money and which specific losses it’s meant to cover. If that story isn’t crystal clear, you’re leaving the door wide open for the IRS to question the funds, potentially hitting you with taxes you never should have had to pay.

Allocating Funds to Protect Your Recovery

Our job is to negotiate an agreement that specifically allocates the funds to non-taxable categories. We fight to make sure the document explicitly states that the payments are for:

- Compensation for your physical injuries.

- Reimbursement for your past and future medical bills.

- Damages for the physical pain and suffering you went through.

This isn’t just about winning your case; it's about protecting the money you rightfully deserve. The settlement agreement becomes your proof for the IRS, creating a clear paper trail that justifies why the bulk of your recovery is tax-free.

How Structured Settlements Can Affect Your Taxes

For cases involving very large awards or clients with long-term medical needs, a structured settlement can be a great option. Instead of getting one big check, you receive a series of guaranteed payments over time. This can provide incredible financial stability for you and your family for years to come.

But there’s a tax detail you need to know. While the underlying settlement for your physical injuries stays tax-free, the payments are usually funded by an annuity that earns interest.

That interest is considered investment income and is taxable. The principal amount of your payments is safe, but any growth it earns over the years has to be reported to the IRS.

This is another area where the specific language of the agreement is absolutely vital. A properly drafted structured settlement can be an excellent tool for long-term security, but it has to be set up correctly to minimize your tax burden. Our team often works alongside financial experts to make sure any structure is designed to serve your best interests, both now and down the road.

At the end of the day, the details matter. A smart legal strategy means thinking about and planning for the tax implications of your recovery from day one. You can learn more about what to expect in our guide to the car accident settlement process.

Practical Steps for Managing Your Settlement Taxes

Once you’ve navigated the legal maze of a personal injury claim, managing the financial side of your settlement is the final piece of the puzzle. It can feel like a whole new challenge, but with a clear plan, you can handle it with confidence and protect the recovery you fought for.

Think of these steps as your financial to-do list after the case is won. Following them will help you avoid unpleasant surprises from the IRS and ensure your settlement provides the long-term stability you deserve.

Start with Documentation and Organization

The best defense against tax headaches is a good offense, and that starts with organization. From day one, you should be keeping a detailed file of every single expense related to your accident and recovery.

- Medical Records: This is huge. Hold onto every single bill, receipt, and explanation of benefits from hospitals, doctors, physical therapists, and pharmacies.

- Lost Income: Gather pay stubs, letters from your employer, or old tax returns that clearly show the income you couldn't earn because you were out of work.

- Other Expenses: Don't forget the smaller things. Keep track of any out-of-pocket costs, like gas for trips to medical appointments or necessary modifications to your home.

This isn't just paperwork for your legal case; it’s your proof. This documentation creates a crystal-clear record that justifies why your settlement funds should be non-taxable.

Work Closely with Your Attorney and a Tax Professional

You’re not in this alone. Your legal and financial team is your most powerful asset.

First, your Houston car accident lawyer plays a critical role in drafting the final settlement agreement. We work to include protective language that specifically allocates the funds to non-taxable categories, such as physical injuries and pain and suffering. This document is your primary evidence if the IRS ever comes knocking.

Before you sign any final agreement, it is absolutely critical to consult with a qualified tax professional, like a Certified Public Accountant (CPA). They can review your specific financial situation, analyze the settlement terms, and provide personalized advice on how to report everything correctly.

An attorney’s job is to secure your recovery. A CPA’s job is to help you protect it.

Understand and Handle Tax Forms

If any part of your settlement is considered taxable income, you’ll probably get a tax form from the defendant or their insurance company in the mail. Don't panic. The two most common ones you might see are:

- Form 1099-MISC: This is often used to report payments for things like lost wages. You might also get one if a portion of the settlement was paid directly to your attorney.

- Form 1099-INT: You’ll receive this if your settlement earned any interest. This is common with structured settlements that pay out over time or if there was a long delay in payment.

Getting one of these forms does not mean your entire settlement is taxable. It just signals that a specific portion needs to be reported. Your tax advisor will use these forms, along with your settlement agreement and expense records, to file your return accurately.

If your settlement results in a significant increase in your net worth, it may be time to think bigger. Exploring advanced high net worth tax strategies can help you protect and grow that capital for the long haul. Proactive planning is what turns a one-time settlement into a foundation for a secure future. At The Law Office of Bryan Fagan, PLLC, our commitment is to guide you through every stage, ensuring you’re well-prepared for life long after your case is closed.

Navigating the tax questions that pop up after a car accident settlement can feel like one final, confusing hurdle. We get it. To make things a little clearer, here are some straightforward answers to the questions we hear most often from our clients.

Will I Get a 1099 for My Settlement?

Maybe, but not always. It really depends on what the money is for.

The at-fault party's insurance company is required to send you a Form 1099 if any part of your settlement is considered taxable income. This typically includes things like compensation for lost wages or punitive damages. However, if your entire settlement is for non-taxable damages—like your physical injuries and the related pain and suffering—you might not receive one at all.

But here’s the critical part: you’re still responsible for reporting any taxable income to the IRS, whether you get a form or not. This is exactly why having a clearly itemized settlement agreement is so important.

Are Wrongful Death Settlements Taxed Differently?

Wrongful death settlements generally play by the same tax rules as personal injury cases. The core principle doesn't change: compensation is tax-free as long as it’s for physical injuries or sickness.

In a wrongful death claim, it usually breaks down like this:

- Tax-Free: Money recovered for the medical bills your loved one incurred or for their pain and suffering before they passed away is not taxable.

- Taxable: Any portion of the settlement intended to replace the income your loved one would have earned is considered taxable income for the family members who receive it.

Our wrongful death compensation attorneys handle these sensitive cases with the compassion and dedication they deserve, always focused on structuring the settlement to protect your family’s financial future.

Does It Matter if My Case Settles or Goes to a Jury Trial?

Nope. From a tax perspective, it makes no difference whether your case settles out of court or is decided by a jury. The IRS cares about what the money is for, not how you received it.

That said, a jury verdict can sometimes make the tax side of things a bit simpler. A verdict often includes a detailed breakdown of the damages awarded, which makes it much easier to separate the taxable and non-taxable parts. The underlying tax laws, however, remain exactly the same.

Figuring out the tax implications of your settlement is the last step in closing a very difficult chapter. You’ve been through more than enough, and you shouldn’t have to tackle this alone. The compassionate Houston car accident lawyers at The Law Office of Bryan Fagan, PLLC are here to fight for every penny you deserve and guide you through all the complicated details that follow.

Contact us today for a free, no-obligation consultation to protect your rights and your future. Visit us at https://houstonaccidentlawyers.net.