A car crash can change your life in seconds — but you don’t have to face recovery alone. Navigating the aftermath of a serious accident can feel overwhelming, especially when you're dealing with injuries, medical bills, and calls from insurance companies. A car accident settlement is a formal agreement that resolves your claim without going to court, where the at-fault driver's insurance company pays you for your losses—from medical bills and lost wages to your physical pain and suffering. For most people in Texas, reaching a fair settlement is the primary goal.

This guide is here to provide clear, practical steps to protect your rights and fight for the fair compensation you and your family deserve.

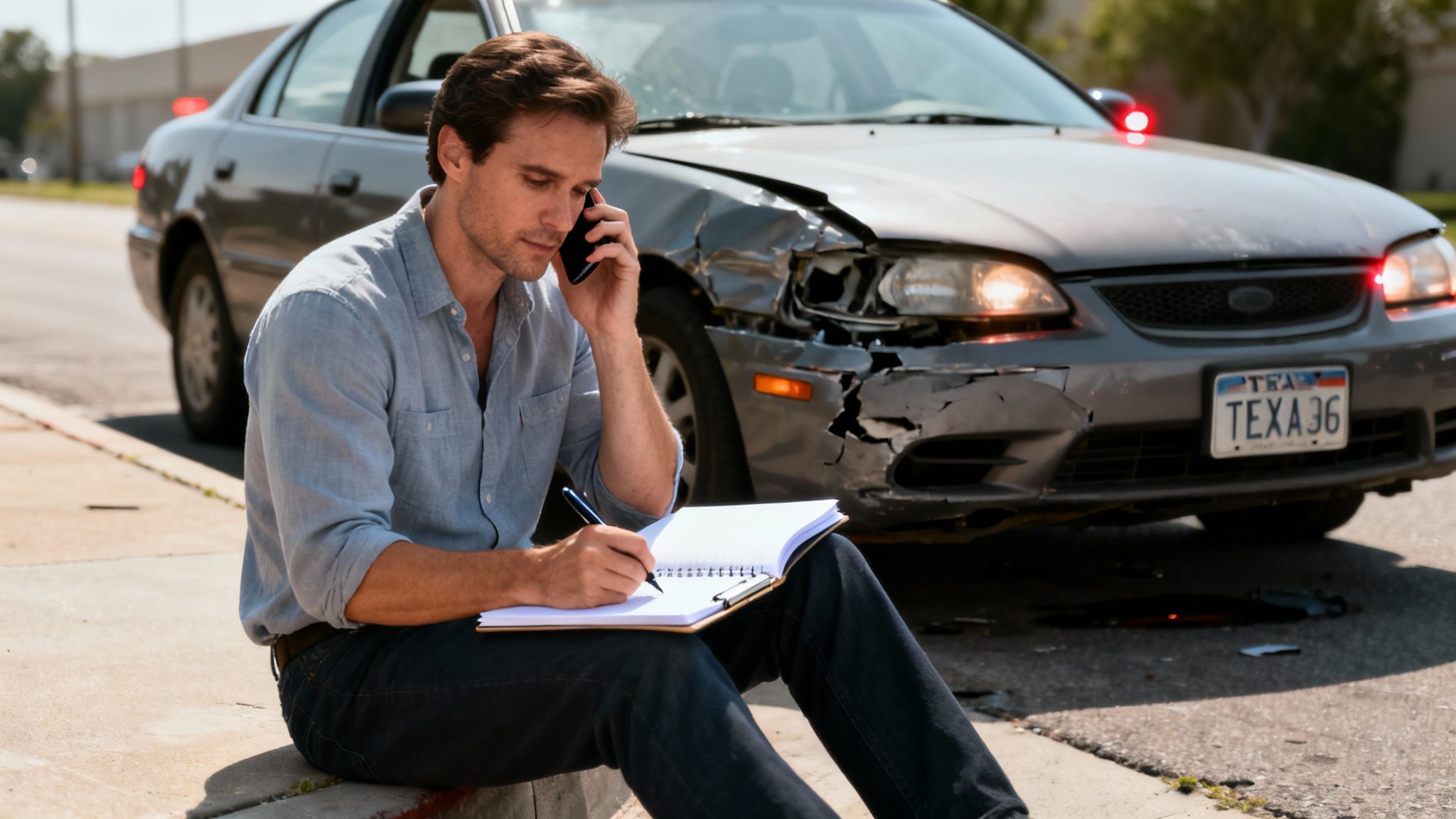

Your First Steps After a Texas Car Accident

The moments right after a crash are chaotic, but what you do next can significantly impact your physical and financial recovery. Knowing your rights from the very beginning is your most powerful tool.

What to Do Immediately After the Crash

Your first priority is always your health and safety. The actions you take at the scene build the foundation for your entire insurance claim.

- Check for Injuries and Call 911: First, check on yourself and your passengers. Report the accident to 911 and request medical help, even if injuries seem minor.

- Move to a Safe Spot: If possible, move your vehicle to the shoulder to prevent another collision. Turn on your hazard lights.

- Document Everything: Use your phone to take photos and videos of vehicle damage, license plates, the surrounding scene, and any visible injuries. The official police report is also a crucial piece of evidence.

Seeking immediate medical attention is non-negotiable. For follow-up care, Texas telehealth services can be a convenient option for connecting with a doctor from home.

Understanding What Your Car Accident Settlement is Worth

When you’ve been in a car wreck, figuring out what your case is worth can feel overwhelming. You’re hurt, the bills are piling up, and your life has been turned upside down.

In Texas, the value of a car accident settlement isn’t a random number. It’s a careful calculation of every single loss you’ve suffered—what the law calls damages. The goal is to return you to the financial position you were in before the crash. To do that, we must account for everything.

The Two Types of Damages You Can Claim

Your losses generally fall into two categories: economic and non-economic. Both are critical for painting a full picture of what this accident has cost you.

Economic damages are the tangible costs you can prove with receipts, bills, and pay stubs.

- Medical Expenses: This covers everything from the ambulance ride and ER visit to surgery, physical therapy, and any future medical care you’ll need.

- Lost Wages: If you couldn’t work while recovering, you can claim that lost income. This also includes diminished earning capacity if your injuries prevent you from returning to your previous job.

- Property Damage: This is the cost to repair or replace your vehicle.

Non-economic damages are just as real but don’t come with a neat price tag. They compensate you for the personal, human toll the accident has taken.

For example, imagine a Houston driver is rear-ended on I-45. Their settlement must cover more than just the physical therapy bills for whiplash (economic damages). It also has to account for the chronic neck pain and the new anxiety they feel every time they get behind the wheel (non-economic damages).

These damages cover things like physical pain, emotional distress, and loss of enjoyment of life. Because these losses are so personal, having an experienced Texas injury attorney is essential to ensure they are valued correctly. You can learn more in our detailed guide on how to calculate pain and suffering damages.

Who is Liable in a Texas Car Accident?

Before you can recover compensation, you must prove liability—a legal term that simply means showing the other driver was at fault. According to Texas law, their negligence must have caused the crash.

But accidents aren't always black and white. Sometimes, more than one person shares the blame. This is where Texas's concept of comparative fault (also known as proportionate responsibility) comes into play, as outlined in the Texas Civil Practice and Remedies Code, Chapter 33.

Under this law, you can still recover damages even if you were partly to blame, as long as your share of the fault is 50% or less. However, your final settlement will be reduced by your percentage of fault. If you’re found to be 51% or more at fault, you cannot recover any compensation. This is often called the "51% bar rule."

For instance, if a jury decides your total damages are $100,000 but determines you were 20% responsible for the collision, your award gets cut by 20%. You’d walk away with $80,000.

How Texas Comparative Fault Affects Your Settlement

This table shows how different levels of fault can drastically change your final compensation under the Texas 51% bar rule.

| Total Damages Awarded | Your Percentage of Fault | Your Final Compensation | Explanation |

|---|---|---|---|

| $100,000 | 0% | $100,000 | You were not at fault, so you receive the full amount of your damages. |

| $100,000 | 25% | $75,000 | Your award is reduced by your 25% share of the fault ($100,000 – $25,000). |

| $100,000 | 50% | $50,000 | You were equally at fault, so your award is cut in half ($100,000 – $50,000). |

| $100,000 | 51% | $0 | Because you were more than 50% at fault, the 51% bar rule prevents any recovery at all. |

As you can see, where you land on that percentage scale is incredibly important.

Navigating the Car Accident Settlement Timeline

When you're hurt in a crash, you need help now, but the journey to getting fair compensation isn't an overnight process. Understanding the car accident settlement timeline can help you manage your expectations and make smart decisions. It's a marathon, not a sprint, and rushing can cost you dearly.

Imagine you suffered a concussion in a Houston T-bone collision. If you accepted a quick settlement before knowing the true extent of your injuries, you'd be stuck paying for any long-term medical care on your own. This is why a patient, methodical approach is so critical.

This visual gives you a bird's-eye view of the basic flow, from the crash itself to the final payout.

As you can see, the path starts with the accident, moves into the crucial stage of documenting damages, and hopefully ends with you receiving the compensation you deserve. Each step builds on the last.

Key Stages of the Settlement Process

While every car accident settlement is different, most follow a similar path. Knowing these steps helps you see the bigger picture.

- Immediate Aftermath & Medical Care: Your first priorities are seeking medical attention and reporting the accident. This creates foundational evidence: your initial medical records and the official police report.

- Filing the Initial Claim: You or your attorney will notify the at-fault driver's insurance company that you're filing a claim. This officially opens a case file.

- Investigation and Evidence Gathering: This is often the longest phase. Your legal team collects all necessary evidence—medical bills, police reports, witness statements, and photos. Meanwhile, you focus on your medical treatment until you reach Maximum Medical Improvement (MMI)—the point where your condition has stabilized.

- Drafting the Demand Letter: Once you've reached MMI and we have a clear picture of all your damages, your attorney drafts a formal demand letter. This document lays out the facts, proves liability, itemizes all your damages, and demands a specific settlement amount.

- Negotiation: The insurance adjuster will review the demand and respond with a counteroffer, which is almost always lower than your demand. This begins the back-and-forth negotiation, where your attorney will argue your case and fight against tactics to undervalue your claim.

- Settlement Agreement or Lawsuit: If negotiations succeed, both sides agree on a final number. You'll sign a release form, and the insurance company will issue your check. If the insurer refuses to be reasonable, the next step is filing a lawsuit.

In Texas, the clock is always ticking. The statute of limitations for personal injury claims is generally just two years from the date of the accident. If you miss that deadline, you lose your right to seek compensation forever.

How Long Does a Settlement Really Take?

There's no single answer, but the timeline often depends on the severity of the accident and your injuries. Most car accident settlements are resolved somewhere between 12 and 36 months after the incident.

A minor fender-bender might settle in 6 to 12 months. A more serious rear-end collision could take 12 to 24 months. For a catastrophic crash, you could be looking at 24 to 36 months or longer, as we must ensure all future medical needs are accounted for. You can discover more insights about settlement timelines and see how different factors come into play.

Decoding the Insurance Company's Strategy

After a wreck, it's easy to assume the other driver's insurance company is there to help. But their real job is to protect their bottom line by paying you as little as possible. The adjuster assigned to your case may sound friendly, but their goal is to find any reason to reduce the value of your car accident settlement or deny it outright.

Many large insurance carriers use software to value your claim, which crunches data to produce a settlement range. The problem? Software can't understand your pain or how an injury has turned your life upside down. It's designed to generate a lowball offer.

Red Flags That Devalue Your Claim

Insurance adjusters are trained to hunt for "red flags" to justify a smaller payout. Knowing what they're looking for is your first line of defense. A sharp Houston car accident lawyer knows how to counter these tactics, but you must be careful from the start.

Common red flags they look for include:

- Delay in Seeking Medical Treatment: If you wait to see a doctor, they'll argue your injuries weren't that serious or were caused by something else.

- Inconsistencies in Your Story: They will pick apart everything you say, using any slight difference between your statements, the police report, and medical records against you.

- Pre-Existing Injuries: They will try to claim your current pain is from an old issue, even if the collision made it much worse.

- Gaps in Treatment: If you miss physical therapy appointments, they will argue you weren't seriously hurt or weren't committed to your recovery.

One of their favorite tactics is asking for a recorded statement. You are not legally required to give one and shouldn't without talking to an attorney. Adjusters use these recordings to ask tricky questions designed to damage your claim. For a deeper dive into handling these calls, check out our guide on how to deal with insurance adjusters.

Your Financial Safety Net: UM and UIM Coverage

What happens if the driver who hit you has no insurance or only the minimum required coverage? This is why Uninsured/Underinsured Motorist (UM/UIM) coverage is so critical in Texas.

UM/UIM is coverage you buy as part of your own auto insurance claim. It’s your personal safety net that kicks in when the at-fault driver's insurance can't cover all your losses.

Think of UM/UIM coverage as your personal insurance policy against irresponsible drivers. It ensures you and your family aren't left with overwhelming medical debt and lost income simply because the other driver broke the law by driving without adequate insurance.

Let’s say a driver in Houston runs a red light and leaves you with $100,000 in medical bills. If they only carry the Texas state minimum of $30,000 for liability, their insurance will pay that amount, leaving you with a $70,000 shortfall. This is where your UIM coverage saves the day. You can file a claim with your own insurance company to cover that remaining balance.

Costly Mistakes That Can Weaken Your Claim

Knowing what not to do after a Texas car crash is just as important as knowing the right steps to take. In the stress that follows a collision, it's easy to make a simple mistake that an insurance adjuster will use against you. These missteps can cost you thousands, but they are completely avoidable.

Admitting Fault or Apologizing at the Scene

It's human nature to be polite, and you might feel an urge to say, "I'm so sorry." But you must resist. Never admit fault in any way, even if you think you might be partially to blame.

Determining legal liability in Texas is a complex process based on evidence, not a roadside apology. An adjuster will twist a simple "I'm sorry" into a full admission of guilt. Stick to the facts only and let the police and your Texas injury attorney handle the legal conclusions.

Posting on Social Media After the Accident

After an accident, your social media profiles become a goldmine for the insurance company. They will dig through your accounts, looking for anything to use against your injury claim.

A photo of you at a family cookout or a comment about feeling "okay" can be twisted to argue your injuries aren't as severe as you claim. The safest play is to stop posting entirely until your case is closed. Also, ask friends and family not to tag you in posts.

Accepting the First Settlement Offer

The insurance company will likely call with a quick, lowball offer, hoping you’re worried about bills and will take the fast cash. This first offer is almost always a fraction of what your claim is actually worth.

If you accept it, you sign away your right to seek any more money for this accident—forever. What if your injuries worsen or you need surgery? You’ll be on your own. The best response is to politely decline and have an experienced Houston car accident lawyer review any offer before you consider accepting.

To protect your rights, sidestep these common traps:

- Signing Documents Without a Legal Review: Never sign anything from an insurance company without your lawyer reading it first.

- Giving a Recorded Statement: You are not required to give a recorded statement to the other driver’s insurer.

- Minimizing Your Injuries: Don’t tell anyone you "feel fine." The full extent of injuries like whiplash or a concussion often doesn't appear for days or weeks.

How a Lawyer Can Maximize Your Settlement

Trying to negotiate a car accident settlement on your own is like stepping into the ring with a professional fighter. The insurance company has a team of experts, unlimited resources, and years of experience. Their only goal is to pay as little as possible.

Hiring a personal injury attorney from The Law Office of Bryan Fagan, PLLC, levels the playing field. It puts a champion in your corner.

The moment you hire us, we become your shield. Our team takes over all communication with insurance adjusters, protecting you from their high-pressure tactics. Your only job is to focus on getting better.

Building Your Strongest Case

A fair settlement is built on more than just a stack of medical bills. A skilled Texas injury attorney meticulously builds a case that proves the full extent of your losses—not just what you've already paid, but what this injury will cost you in the future.

Here’s how we do it:

- Gathering Critical Evidence: We immediately work to collect police reports, witness statements, medical records, and photographic evidence to prove liability.

- Calculating Total Damages: We don't stop at your current bills. We often consult with medical and financial experts to project the costs of future surgeries, physical therapy, and your diminished ability to earn a living.

- Leveraging Negotiation Experience: We know every trick in the insurance adjuster's playbook. We know how they devalue claims, and we know how to fight back, arguing your case from a position of strength to demand the maximum compensation you're entitled to. This is especially critical in cases involving wrongful death compensation, where the stakes are highest for grieving families.

And you don't have to worry about how to afford top-tier legal help.

At The Law Office of Bryan Fagan, PLLC, we work on a contingency fee basis. This means you pay absolutely no upfront fees. We only get paid if we win your case. This removes all financial risk, so you can get the expert help you need, right when you need it most.

You Don’t Have to Do This Alone

A car crash is an overwhelming ordeal. You deserve a legal partner who will treat you with compassion while aggressively fighting for your rights. Our team is here to walk you through every step, answer every question, and carry the legal burden so you can focus on what matters: healing.

If you or a loved one has been injured, don't try to face the insurance companies by yourself. Contact The Law Office of Bryan Fagan, PLLC, today for a free, no-obligation consultation. Let us show you how we can help you get the settlement you deserve.

Common Questions About Accident Settlements

Going through a car accident settlement can bring up a lot of questions. It's a confusing and stressful time. Let's walk through some of the most common concerns we hear from our clients in Texas.

How Much Is My Texas Car Accident Settlement Worth?

This is the number one question on everyone's mind, and the honest answer is: every case is different. The final value depends on several key factors:

- The total cost of your medical care, both now and in the future.

- How much income you've lost from being unable to work.

- The severity of your injuries and their impact on your daily life (pain and suffering).

- The clarity of the evidence proving the other driver's liability.

An experienced Texas injury attorney will analyze the specific details of your situation to give you a realistic idea of what your claim could be worth.

Do I Have to Go to Court to Get a Settlement?

Probably not. The vast majority of car accident claims in Texas are resolved through negotiations between your lawyer and the insurance company, never seeing the inside of a courtroom.

Sometimes, filing a lawsuit is necessary to show the insurance company we are serious about not accepting a lowball offer. Even then, very few cases go to a full trial. Our goal is always to secure a fair settlement without the added time, cost, and stress of a court battle.

Can I Still Get a Settlement If I Was Partially at Fault?

Yes, in many cases, you can. Texas operates under a rule called “modified comparative fault.” As defined in the Texas Civil Practice and Remedies Code, you can recover money as long as you are found to be 50% or less at fault for the crash.

Just remember, your final settlement will be reduced by your assigned percentage of fault. For instance, if your total damages are $100,000 but you are found to be 20% responsible, your award would be cut by $20,000, leaving you with $80,000.

How Long Do I Have to File a Claim in Texas?

This is critical. Texas has a strict deadline for filing a personal injury lawsuit, known as the statute of limitations. For nearly all car accident claims, you have just two years from the date of the wreck to file your lawsuit.

If you miss that two-year window, you lose your right to seek any compensation forever. That's why it is so important to speak with a Houston car accident lawyer as soon as possible after a wreck—to protect your rights from day one.

The aftermath of a car wreck is tough, but you don’t have to go through it on your own. At The Law Office of Bryan Fagan, PLLC, our team is ready to provide the compassionate support and tough representation you need to get the best possible outcome. We take on the legal fight so you can focus on what matters most: healing.

Don't wait to get the help you deserve. Contact us today for a free, no-obligation consultation to talk about your case and learn how we can fight for you. Visit us at https://houstonaccidentlawyers.net.