A car crash can change your life in seconds—but you don’t have to face recovery alone. When another driver's mistake leaves you injured, bodily injury liability coverage is the part of their auto insurance that pays for your medical bills and lost wages.

Think of it as the financial safety net designed to help you heal and get your life back on track. Understanding how it works is the first step toward protecting your rights and securing the resources you need for a full recovery.

Who Is Liable in a Texas Car Accident?

A serious Texas car crash often leaves victims with physical pain, emotional trauma, and a mountain of unexpected bills. The first step toward getting your life back is understanding who is responsible for these costs. This is where the legal concept of liability comes in.

In plain English, "liability" means legal and financial responsibility. Under Texas law, the driver who is at fault for causing the accident is legally liable for the harm they caused. Bodily injury liability coverage is the specific insurance that every driver is required to carry precisely to pay for the injuries they inflict on others.

A Real-World Houston Example

Imagine you are driving on I-45 in Houston when a distracted driver runs a red light and T-bones your car. You are left with a concussion and a broken arm, leading to an ambulance ride, an emergency room visit, and weeks of missed work.

The at-fault driver’s bodily injury liability insurance is what you would file a claim against to cover all of those costs.

This is called a third-party claim because you are the "third party" seeking payment from an insurance company that isn't your own. You can learn more about this process in our guide on what a third-party insurance claim involves.

Bodily Injury Liability At a Glance

Here is a simple breakdown of what this insurance does and does not cover for an injured person.

| What It Covers For You | What It Does Not Cover |

|---|---|

| Emergency room visits | Your own vehicle repairs |

| Hospital stays and surgeries | The at-fault driver's injuries |

| Doctor's appointments | Damage to the at-fault driver's car |

| Physical therapy | Your own lost wages if you caused the wreck |

| Lost income from missed work | |

| Pain and suffering |

Essentially, it's the system designed to ensure that you, the injured victim, don’t have to shoulder the financial burden of an accident someone else caused. A Houston car accident lawyer can help you navigate this complex process and fight for the full compensation you deserve.

What Bodily Injury Liability Actually Pays For

When you hear “bodily injury,” your mind probably jumps straight to a hospital bill. But the harm from a serious car accident runs much deeper than that, and bodily injury liability coverage is designed to cover the full spectrum of those costs.

Legally, these costs are called damages, which is a plain-English term for the money an injured person needs to recover and get back on their feet. This isn’t just about the immediate medical bills; it’s about addressing the complete physical, financial, and emotional fallout from a crash caused by someone else's negligence.

Covering Your Economic Damages

The most obvious expenses are what we call economic damages. Think of these as the tangible, out-of-pocket costs with a clear price tag. They're the bills that start piling up almost immediately after an accident.

Bodily injury liability is meant to handle:

- Immediate Medical Care: This covers everything from the ambulance ride and emergency room visit to any urgent surgeries required right after the crash.

- Ongoing Treatment: Recovery is a process. This part pays for follow-up appointments with specialists, prescription drugs, and necessary medical equipment like crutches or a wheelchair.

- Rehabilitation Costs: Serious injuries often require long-term physical or occupational therapy to help you regain mobility and relearn daily tasks.

- Lost Wages: If you can't work because of your injuries, this coverage is there to replace your lost income. It can also cover a diminished earning capacity if you're left with a permanent disability that affects your career.

A Houston driver rear-ended on I-45 might face $15,000 in ER bills, $10,000 for surgery, $8,000 in lost wages, and $5,000 for six months of physical therapy. These costs add up to $38,000 in economic damages alone, quickly surpassing the state minimum coverage.

Compensating for Your Non-Economic Damages

A car crash inflicts wounds that don't show up on a medical bill. Non-economic damages are intended to compensate for the immense personal suffering and trauma that follow a serious accident—harms that are just as real and devastating as any financial loss.

This compensation can include:

- Pain and Suffering: This accounts for the actual physical pain, discomfort, and emotional distress you have to endure because of your injuries.

- Mental Anguish: It's common for accident survivors to struggle with anxiety, depression, insomnia, or even PTSD.

- Physical Impairment or Disfigurement: This provides compensation for permanent scarring, the loss of a limb, or any disability that permanently changes your quality of life.

Calculating the value of these damages is incredibly complex, which is a critical reason why having a Texas injury attorney on your side is so important. They ensure any settlement offer truly reflects the full impact—both financial and personal—the accident has had on your life. Knowing what liability insurance covers after an accident gives you the power to advocate for yourself during a difficult time.

Remember, the at-fault driver's insurance policy isn't a blank check. A serious wreck can easily cause damages that blow past their policy limits. To learn more about what happens next, check out our guide on understanding insurance policy limits after a car accident in Texas.

Why Texas Minimum Insurance Is Often Not Enough

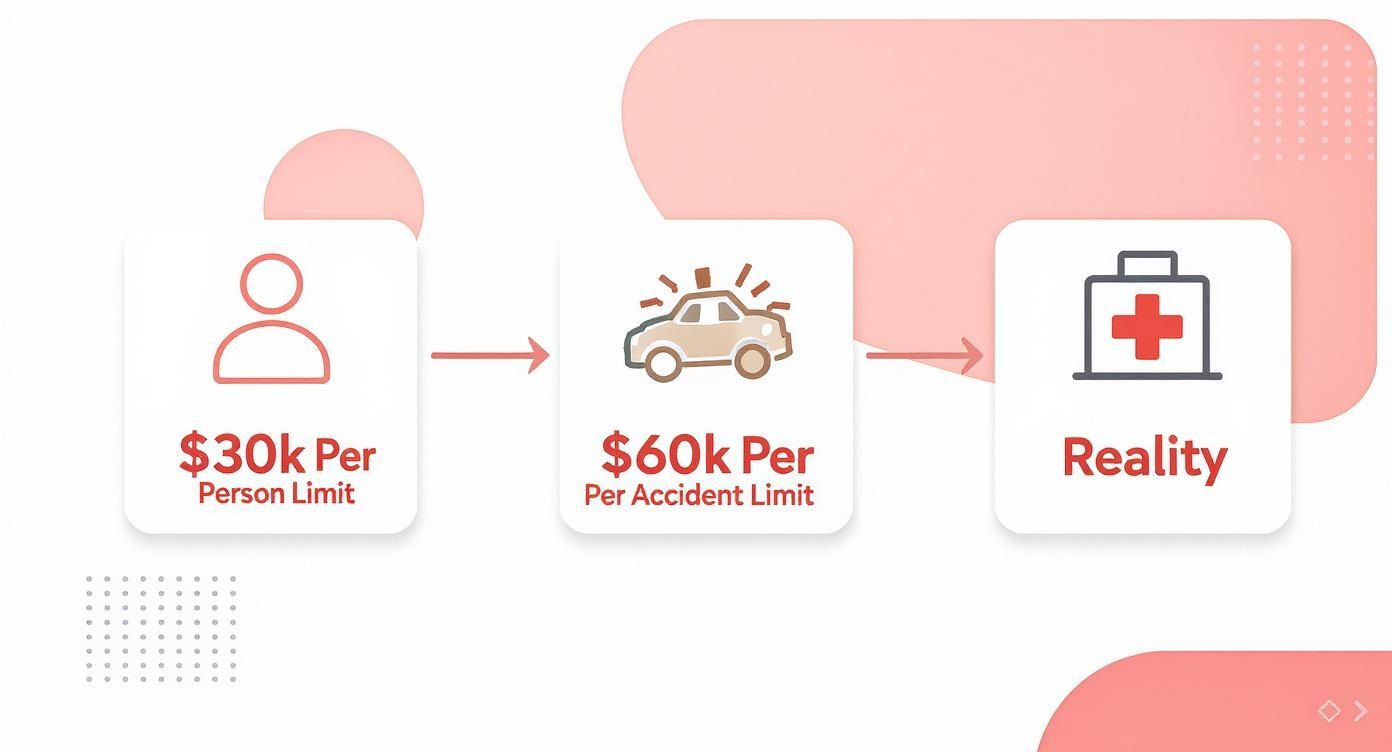

To legally drive in Texas, a person must carry a certain amount of liability insurance. You’ll often hear this called 30/60/25 coverage. It sounds technical, but the breakdown is straightforward:

- $30,000 is the absolute maximum the at-fault driver's insurance will pay for one person's bodily injuries.

- $60,000 is the total amount available for all bodily injuries in a single accident, no matter how many people are hurt.

- $25,000 is the maximum they’ll pay for property damage, like fixing your car.

While this coverage meets the legal requirement, it is dangerously inadequate in the real world. After a serious crash, these minimums can be wiped out in the blink of an eye, leaving injured families with a massive financial shortfall.

The Real Cost of a Serious Injury

Let’s look at a common scenario. You’re stopped at a light in Houston when a distracted driver slams into you from behind, causing a severe back injury. An ambulance ride, an emergency room visit, MRIs, and a consultation with a spine specialist add up quickly. If you need surgery, your medical bills could easily soar past $100,000.

If the driver who hit you only has the minimum $30,000 in bodily injury coverage, that's all their insurance company is required to pay. You are now personally responsible for the remaining $70,000, and that’s before you even account for the wages you lost while out of work.

This isn't a far-fetched scenario—it’s a tragically common reality. A single night in a Texas hospital can cost thousands. The state's minimum insurance laws have not kept pace with the soaring cost of modern medical care.

When Multiple People Are Injured

The situation gets even worse when several people are hurt in the same wreck. Imagine three people in your car are injured, and their medical bills come out to $25,000, $30,000, and $35,000.

Even though the total medical cost is $90,000, the at-fault driver's minimum policy has a hard cap of $60,000 for the entire accident. On top of that, no single person can get more than the $30,000 per-person limit. This forces multiple victims to fight over a small pot of money, guaranteeing that no one gets the full amount they need to recover.

The concept of mandatory minimums is standard across the country. Other states might require $25,000 per person and $50,000 per accident, but as we've seen, these amounts are often just as insufficient. You can see how different states structure their auto insurance requirements on doi.sc.gov to get a broader perspective.

Protecting Yourself from Underinsured Drivers

So, what are your options when the other driver's insurance runs out? This is where your own policy becomes your most important financial shield. The single best tool you have is Uninsured/Underinsured Motorist (UM/UIM) coverage.

This is optional coverage you add to your own policy, and it was designed for exactly these kinds of nightmares.

- Uninsured Motorist (UM) Coverage kicks in when you’re hit by a driver with no insurance at all.

- Underinsured Motorist (UIM) Coverage fills the gap when the at-fault driver has insurance, but their limits are too low to cover your damages.

Going back to our back-injury example, if you had $100,000 in UIM coverage, you could file a claim with your own insurance company for the $70,000 that the other driver’s policy couldn’t cover. It’s a critical safety net that ensures one accident doesn't lead to your financial ruin. We strongly recommend you learn more about underinsured motorist coverage in Texas to see how it can protect you and your family.

A trusted Texas injury attorney can help you navigate both the at-fault driver's policy and your own UIM claim to fight for the full compensation you deserve.

Steps to File an Insurance Claim

After being hurt in a car crash, dealing with an insurance claim can feel overwhelming. It’s a formal process, but you don’t need to be a legal expert to understand it. Knowing the basic steps can empower you to protect your rights from the very beginning.

Filing a bodily injury liability claim is the official way of asking the at-fault driver's insurance company to pay for your damages. This process starts the moment the accident happens and doesn't end until you either agree to a settlement or your case is resolved in court. Every step matters.

Your First Steps Are Critical

The hours and days right after a crash are the most important for both your health and your potential claim. Your priorities should be:

-

Seek Medical Attention: Your well-being is the top priority. Get checked by a doctor right away, even if you feel okay. Some serious injuries, like concussions, don't show symptoms immediately. This also creates an official medical record linking your injuries to the accident.

-

Report the Accident: Always call 911 from the scene. A police report is powerful evidence in an auto insurance claim, providing an unbiased account of what happened.

-

Gather Evidence at the Scene: If you are physically able, use your phone to take pictures of everything—vehicle damage, your injuries, skid marks, and the surrounding area. Get the names and phone numbers of any witnesses.

Taking these initial actions builds a strong foundation for your claim and helps counter insurance company tactics aimed at downplaying your injuries or shifting blame.

Understanding Texas Negligence and Fault Laws

To receive compensation, you must prove the other driver was negligent. In Texas, negligence simply means they failed to act with reasonable care, and their failure caused you harm. A driver texting instead of watching the road is a classic example.

Texas also uses a rule called proportionate responsibility, also known as "comparative fault."

Under the Texas Civil Practice & Remedies Code, Chapter 33, you can recover damages even if you were partially to blame, as long as you were 50% or less at fault. Your final compensation is simply reduced by your percentage of fault.

For example, if a jury finds you were 10% at fault for a crash with $50,000 in damages, you could still recover $45,000. However, if you're found 51% or more at fault, you get nothing. Insurance adjusters often use this rule to push blame onto you to lower their payout.

The image below shows the minimum insurance limits in Texas, which is where most claims begin.

As you can see, the state-mandated $30,000 per person limit can be used up quickly by the real-world costs of a single hospital visit after a serious injury.

Your Bodily Injury Claim Checklist

Following these practical, step-by-step tips can make all the difference in protecting your rights after a Texas car accident.

| Action Step | Why It's Critical | Insider Tip |

|---|---|---|

| Get Immediate Medical Care | Establishes a direct link between the crash and your injuries. Delays can be used against you. | Always tell the doctor every symptom, no matter how minor it seems. This creates a complete record. |

| File an Official Police Report | Provides a neutral, third-party account of the accident, which is vital for proving fault. | Review the report for accuracy once it's available. If you spot an error, contact the police department to request a correction. |

| Notify Your Own Insurer | Fulfills your contractual obligation to your insurance company, even if you weren't at fault. | Keep the conversation brief and stick to the facts. Don't speculate on fault or the extent of your injuries. |

| Document Everything | Photos, witness info, medical bills, and lost wage records create a powerful evidence file. | Start a dedicated folder or digital file immediately. Keep every receipt and document related to the accident. |

| Decline a Recorded Statement | Protects you from the adjuster's tactics to twist your words and assign you partial fault. | You can politely say, "I am not prepared to give a recorded statement at this time." You are not required to give one. |

| Consult a Car Accident Attorney | An expert can value your claim, handle the insurance company, and fight for full compensation. | Most reputable personal injury attorneys offer a free consultation, so there's no risk in getting professional advice. |

This checklist is a strategic plan to put you in the strongest possible position to get the compensation you need and deserve.

Why You Should Never Give a Recorded Statement Alone

Soon after the crash, the other driver’s insurance adjuster will call. They’ll sound friendly and helpful. They will almost certainly ask you for a recorded statement about the accident. You should politely decline until you have spoken with an attorney.

Adjusters are trained to ask tricky, leading questions designed to get you to say something they can use against you. They can twist an innocent comment to make it sound like you admitted fault or that your injuries aren't as bad as you claim. Giving a statement without legal guidance is a risk you don't need to take.

An experienced Houston car accident lawyer can take over all communications with the insurance company for you. They know how to protect your rights, present the evidence strategically, and fight to make sure you're treated fairly.

Navigating Common Insurance Company Tactics

After a serious wreck, you hope the insurance company will do the right thing. Unfortunately, insurance companies are for-profit businesses, and their adjusters are trained negotiators whose job is to protect the company's bottom line by paying out as little as possible.

Understanding their playbook is your first defense. Knowing what to expect can help you level the playing field.

The Lowball Settlement Offer

One of the most common tactics is the quick, lowball settlement offer. An adjuster might call you just days after the crash, sounding concerned and offering a check for a few thousand dollars to "help with immediate bills."

It can feel like a lifeline, but it's often a trap. When you accept a settlement, you sign away your right to seek any more money in the future. They are counting on your financial stress and that you don't yet know the true, long-term cost of your injuries—including potential surgery or months of missed work.

Never accept a settlement offer until you know the full extent of your injuries and have a clear prognosis from your doctor. A fast offer is almost always an unfair offer.

Using Recorded Statements Against You

Adjusters will ask for a recorded statement to "get your side of the story." Their real goal is to get you on record saying something they can twist to deny or reduce your claim.

They use carefully worded questions designed to get you to:

- Admit partial fault: "So you were maybe a little distracted just before the impact?"

- Downplay your injuries: "You're feeling a bit sore, but you're doing okay, right?"

- Contradict yourself: They will compare your statement to the police report and medical records, looking for any inconsistency to argue you are not credible.

You have no legal obligation to give a recorded statement to the other driver's insurance company. You can, and should, politely decline until you've spoken with a Houston car accident lawyer.

The Problem of Policy Limits

Even if the other driver is clearly 100% at fault, there’s a hard cap on how much their insurance will pay, known as their policy limits. Coverage is usually split into a "per-person" limit and a "per-accident" limit. For example, a policy with $100,000 per person and $300,000 per accident limits will pay a maximum of $100,000 to any single injured person, but no more than $300,000 total for the entire incident. You can find more details on how bodily injury coverage is structured on nextinsurance.com.

An adjuster will never offer you a dollar more than these policy limits, no matter how severe your injuries are.

Don't Let the Clock Run Out

Finally, insurance companies know that time is on their side. In Texas, you have a strict deadline to file a lawsuit, called the statute of limitations.

Under the Texas Civil Practice & Remedies Code, you generally have just two years from the date of the accident to either settle your claim or file a lawsuit. If you miss this two-year window, your right to seek compensation is lost forever. Some adjusters will deliberately drag out negotiations, hoping you'll miss this critical deadline.

An experienced Texas injury attorney manages all deadlines and handles every phone call with the adjuster, taking this pressure off your shoulders so you can focus on healing.

How a Car Accident Lawyer Can Help You

After a crash, you shouldn't have to fight an insurance company. Your focus needs to be on your recovery. That's where an experienced Texas personal injury attorney comes in—to handle the complex legal battle for you and protect your rights. Think of your attorney as your advocate, negotiator, and shield against the insurance adjuster’s tactics.

Their goal is to level a playing field that is tilted in the insurer's favor. A skilled lawyer pushes back by building a powerful, evidence-based case designed to secure the full and fair compensation you and your family deserve.

Taking the Burden Off Your Shoulders

From the moment you hire a lawyer, you can breathe and focus on what truly matters: healing. A dedicated legal team takes over every detail of your auto insurance claim, including:

- Managing All Communications: We handle every call and email from the insurance adjuster, stopping them from pressuring you into a lowball settlement or twisting your words.

- Conducting a Thorough Investigation: We immediately gather critical evidence like the police report, witness statements, and traffic camera footage to prove the other driver’s liability.

- Calculating the True Value of Your Claim: We work with medical and financial experts to document the full scope of your damages—not just current medical bills, but also future care, lost earning capacity, and the pain and suffering you've endured.

Your only job should be focusing on your recovery. Let a professional handle the legal complexities, deadlines, and negotiations.

Fighting for a Fair Outcome

Armed with a strong case, your attorney will negotiate aggressively with the insurance company. They will present a detailed demand package that clearly outlines your damages and makes an undeniable argument for a fair settlement.

Most importantly, if the insurance company refuses to make a fair offer, a seasoned trial attorney is prepared to take your case to court. Often, the credible threat of a lawsuit is the leverage needed to bring an insurer to the table to negotiate in good faith, fighting for the injury or wrongful death compensation your family deserves.

The Houston car accident lawyers at The Law Office of Bryan Fagan, PLLC, are here to provide that strength. Contact us today for a free, no-obligation consultation to learn how we can help you and your family move forward.

Common Questions After an Injury Accident

It's completely normal to have a million questions running through your mind after a serious car wreck. You're trying to heal while juggling medical bills and worrying about what comes next. Here are some straightforward answers to the questions we hear most often from people in your exact situation.

What if the Other Driver's Insurance Isn't Enough to Cover My Medical Bills?

This is an incredibly common—and stressful—scenario. In Texas, drivers are only required to carry a bare minimum of $30,000 in bodily injury liability coverage, which can be exhausted quickly after a serious injury. If your medical costs blow past that number, you have options.

Your best bet is often your own Uninsured/Underinsured Motorist (UIM) coverage. This is exactly what it was designed for: to step in and cover the gap when the at-fault driver’s policy falls short. If you don’t have UIM coverage, a good lawyer will start digging for other potential sources of recovery, like seeing if the other driver has personal assets that could help pay for your damages.

Can I Get Compensation if I Was Partially at Fault for the Crash?

Yes, in most cases, you can. Texas operates under a rule called proportionate responsibility, which you might also hear called modified comparative fault. The law (Texas Civil Practice & Remedies Code, Chapter 33) states that you can still recover damages, as long as a jury or judge finds you 50% or less at fault for the accident.

There’s a catch, though. Your final compensation will be reduced by whatever percentage of fault is assigned to you. For instance, if you have $100,000 in damages but are found to be 10% to blame, your award would be cut by 10%, leaving you with $90,000. This rule is precisely why insurance adjusters will fight tooth and nail to shift even a tiny bit of blame onto you—every percentage point saves them money.

How Long Do I Have to File an Injury Claim in Texas?

In Texas, the clock starts ticking on the day of the crash. The legal deadline for filing a personal injury lawsuit is known as the statute of limitations, and for most car accident claims, you have two years.

This two-year window is non-negotiable. If you fail to either settle your claim or file a formal lawsuit by that deadline, your right to seek compensation is gone forever, no matter how strong your case is.

An experienced Houston car accident lawyer takes this pressure off your shoulders. They manage all the critical deadlines and legal filings, ensuring your rights are protected so you can focus all your energy on getting better.

A car crash can change your life in seconds—but you don’t have to face recovery alone. The compassionate legal team at The Law Office of Bryan Fagan, PLLC is here to listen, deal with the insurance companies, and fight for the full compensation you deserve. We can help you understand your rights and recovery options after a crash. Contact us today for a free, no-obligation consultation.