A car crash can change your life in seconds—but you don’t have to face recovery alone. In the chaotic aftermath, one of the most stressful questions is always, "How am I going to pay for all of this?" The good news is yes, your health insurance is a vital lifeline for covering medical bills after an accident.

Your First Question After a Crash: Does Health Insurance Pay?

A common misconception we see all the time is people thinking they have to wait for the at-fault driver's insurance to pay their doctors. That’s not just wrong—it’s a dangerous belief that can delay critical care.

While the other driver’s insurance is ultimately responsible for your costs, their claims process can drag on for months, sometimes even years. You can't put your health on hold waiting for a settlement check. Your health insurance is the bridge that gets you the care you need now, covering everything from the emergency room visit to surgery and physical therapy without delay.

Think of it as your first line of defense. Using your health plan ensures you can focus on healing instead of watching a mountain of medical bills pile up. You’ll still have to deal with your policy’s terms, of course, but taking this first step is crucial for protecting both your physical and financial future.

Why Using Your Health Insurance Is So Important

In the hours and days after a wreck, getting immediate medical attention is everything. Hesitating because you're worried about money can make your injuries worse and complicate your recovery. This is why using your health insurance isn't just a financial choice—it’s a health decision.

The stakes are incredibly high. A detailed analysis showed a direct link between having health insurance and surviving a serious crash, finding that accident victims without it faced significantly higher mortality rates. In stark contrast, those with private insurance saw a 37% reduction in mortality. The takeaway is clear: immediate access to quality care can literally be a matter of life and death.

To get the most out of your coverage, you need to understand the basics, like your health insurance deductible. You will have to cover your plan’s copays and deductibles upfront, but don't worry—a skilled Texas injury attorney can fight to get every one of those dollars reimbursed for you in the final settlement.

A common misconception is that you must wait for the at-fault driver’s insurance to pay your doctors. This is incorrect and dangerous. Your health comes first, and your health insurance is the tool that protects it immediately after a crash.

The insurance puzzle can feel complicated, but it boils down to a few key points:

- Immediate Access to Care: Your health plan lets you see doctors, specialists, and therapists right away.

- Financial Protection: It keeps massive medical bills from hitting your credit or going to collections while your auto insurance claim is being sorted out.

- Peace of Mind: Knowing your bills are being handled allows you to focus on the one thing that truly matters—getting better.

If you’ve been hurt in a crash in the Houston area, you don’t have to figure this out alone. At The Law Office of Bryan Fagan, PLLC, our Houston car accident lawyers handle the complex insurance details so you can concentrate on your recovery.

Who Pays for What After a Texas Car Accident

Navigating which insurance pays for what can feel like a maze. To make it simpler, here’s a quick-reference table breaking down who typically pays for different expenses after a car accident in Texas.

| Expense Type | Primary Payer | Secondary Payer |

|---|---|---|

| Initial Medical Bills | Health Insurance | Personal Injury Protection (PIP) / MedPay |

| Lost Wages | Personal Injury Protection (PIP) | At-Fault Driver's Insurance |

| Vehicle Repairs | At-Fault Driver's Insurance | Your Collision Coverage |

| Long-Term Medical Care | Health Insurance | At-Fault Driver's Insurance (Settlement) |

| Pain and Suffering | At-Fault Driver's Insurance | Your UM/UIM Coverage |

| Deductibles & Copays | At-Fault Driver's Insurance (Reimbursed) | Your UM/UIM Coverage |

This table provides a general guide, but every case is unique. The interplay between these policies can get complicated, especially when dealing with subrogation and liens, which is why having an experienced Texas injury attorney on your side is so important.

How Your Auto and Health Insurance Policies Work Together

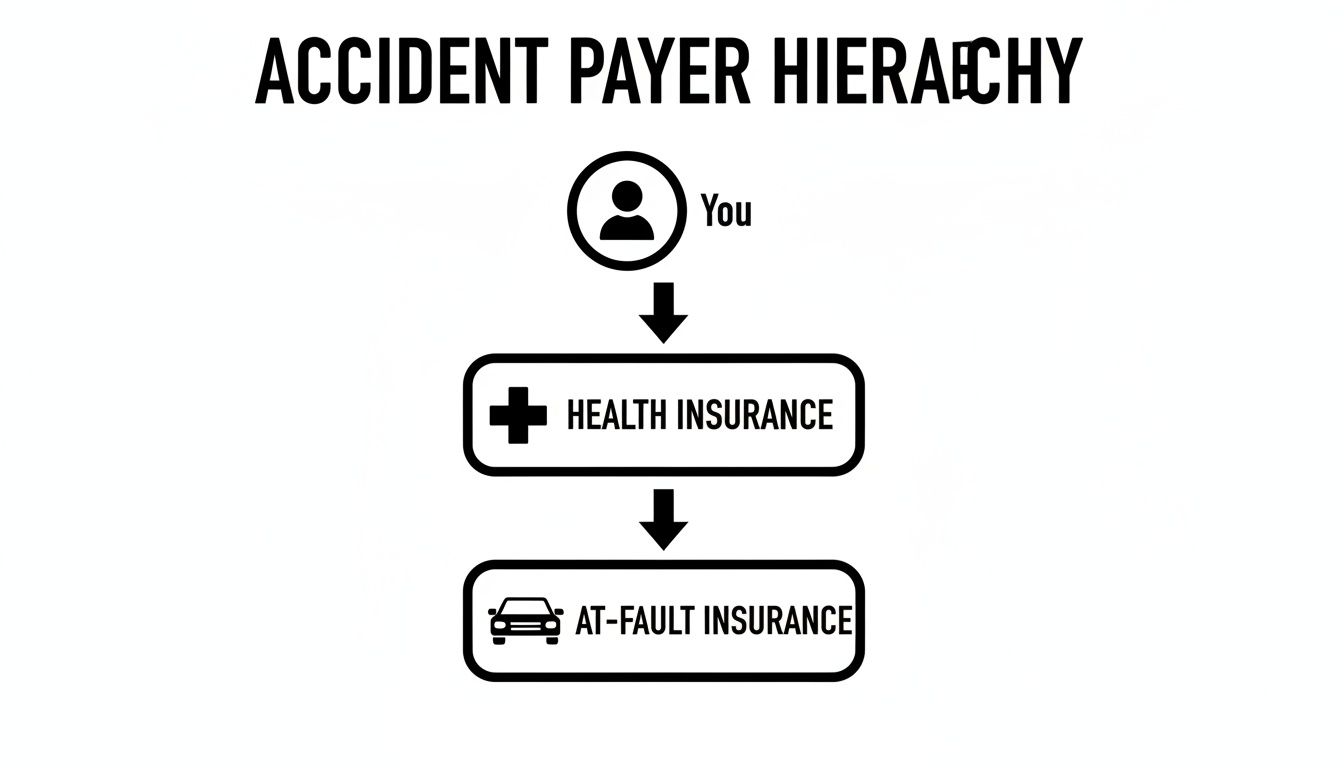

Figuring out which insurance policy pays for what after a car crash can feel like untangling a knot. But there's a clear order to it—a layered system designed to get your medical bills paid quickly so you can focus on getting better. Let’s walk through how it works, starting with the first line of defense: your own auto policy.

In Texas, your car insurance can include coverage that’s meant to handle your immediate medical costs. This is where Personal Injury Protection (PIP) or Medical Payments (MedPay) coverage comes in. These are add-ons to your own policy that cover medical bills and sometimes lost wages, no matter who was at fault for the accident.

Your Auto Policy Is the First Layer of Protection

Think of your PIP or MedPay as the first responder for your medical expenses. Imagine you’re a Houston driver caught in a multi-car pile-up on I-10. Your $5,000 in PIP coverage would be the first money used to pay for that initial trip to the emergency room and any immediate X-rays or scans.

Tapping into this coverage first is a smart move. It's built for exactly this scenario, giving you a quick way to handle those initial bills without having to wait for the insurance companies to argue over who’s at fault. The problem is, PIP and MedPay limits are often low and can get used up fast, especially if your injuries are serious. That’s when your health insurance steps up to the plate.

Health Insurance Steps In as the Secondary Payer

Once your PIP or MedPay runs out, your health insurance plan takes over as the "secondary" payer. It's there to cover everything that comes next—follow-up visits with specialists, any necessary surgeries, physical therapy, and other long-term rehabilitation. This coordination between policies ensures you don't face a gap in your medical care just because one coverage limit was reached.

Of course, you’ll still have to cover your health plan’s usual copays and deductibles. But don't worry—these out-of-pocket costs are considered damages. An experienced Houston car accident lawyer will meticulously track every dollar you spend to include it in the total compensation we demand from the at-fault driver's insurance company. You can learn more about how these claims work in our guide to first-party vs third-party insurance claims.

This diagram shows the typical pecking order for who pays for your medical treatment after a crash.

As you can see, the system is designed for you to use your own insurance to get immediate care, while the ultimate financial responsibility lands where it belongs: on the at-fault driver's insurance.

How the Policies Coordinate in a Real-World Scenario

Let's break it down with a step-by-step example:

- The Accident: A Houston driver gets rear-ended on I-45 and is rushed to the hospital. The initial ER bill comes to $7,000.

- Primary Payer (PIP/MedPay): You have $5,000 in PIP coverage. Your auto insurer pays that $5,000 directly to the hospital, which leaves a $2,000 balance.

- Secondary Payer (Health Insurance): You submit the remaining $2,000 bill to your health insurance company. They apply their negotiated rates and your deductible, then pay the rest.

- Final Responsibility (At-Fault Driver): The other driver’s liability insurance is ultimately on the hook for all these costs. Your attorney will file a claim against their policy to recover the full $7,000. That money is then used to pay back your PIP carrier, your health insurer, and you for any money you paid out of pocket.

This layered system is designed to get your bills paid fast and keep them from going to collections. It protects your credit score while we handle the legal side of things, letting you focus on healing instead of fighting with bill collectors.

Juggling this coordination of benefits is tricky, and insurance companies aren't always eager to cooperate. At The Law Office of Bryan Fagan, PLLC, we handle all these communications for you. We make sure each policy pays its fair share so you can get the seamless medical care you deserve.

Who Is Liable in a Texas Car Accident?

Even with your own insurance ready to help, the Texas legal system comes down to one simple idea: the person who caused the wreck is the one who should pay for the damage. This is where we get into liability and negligence. To get you the full compensation you deserve, we have to prove the other driver was legally at fault.

In plain English, negligence means someone failed to act with reasonable care, and that failure hurt someone else. Texting while driving, running a red light, or speeding are all examples of negligence. Liability is the legal and financial responsibility for the harm caused by that negligence. Our job as your Texas injury attorney is to draw a straight line from the other driver's careless actions to the crash that caused your injuries.

How Texas Law Splits the Blame

Texas uses a legal rule called "proportionate responsibility," also known as modified comparative fault. You can find this law in Chapter 33 of the Texas Civil Practice & Remedies Code.

Imagine a judge or jury dividing up 100% of the blame for the crash, giving each person involved a percentage. This rule is critical because it directly controls how much compensation you can receive.

Here’s how it works:

- If you are 50% or less at fault: You can still recover compensation from the other driver. However, your total award will be reduced by your percentage of fault.

- If you are 51% or more at fault: You are legally barred from recovering any money from the other party.

Let's use a real-world example: A Houston driver is rear-ended on I-45. A jury decides the other driver was 90% at fault for following too closely. However, they also find you were 10% at fault because one of your brake lights was out. If your total damages add up to $100,000, your final payment would be reduced by your 10% of fault, leaving you with $90,000.

In Texas, your ability to get paid is directly linked to your percentage of the blame. Even being a tiny bit responsible can shrink your settlement, which is exactly why the other driver's insurance adjuster will fight tooth and nail to pin the fault on you.

Proving the Other Driver Was to Blame

The at-fault driver's insurance company isn't on your side. Their goal is to shift as much blame as possible onto you to either reduce your payout or deny your auto insurance claim completely. This is precisely why having a sharp Houston car accident lawyer is so important. We immediately start our own investigation to dig up the evidence needed to prove the other driver's negligence and protect your right to fair compensation.

This isn't a simple process. We often have to:

- Gather critical evidence like the official police report, photos and videos from the scene, and witness statements.

- Bring in accident reconstruction experts to analyze crash dynamics and vehicle damage to tell the true story.

- Subpoena cell phone records to prove the other driver was texting, calling, or otherwise distracted.

- Track down traffic camera or dashcam footage that captured the moments leading up to the crash.

By building an undeniable, evidence-based case, we shut down the insurance company's tactics. We make it clear who is truly liable for your injuries, allowing us to fight for every penny you're entitled to under Texas law. We make sure a small mistake doesn't cost you the recovery you need and deserve.

Understanding Subrogation and Your Health Insurance Lien

After a serious car accident, you might breathe a sigh of relief when your health insurance starts paying your medical bills. But there’s a critical detail many accident victims don’t discover until much later: your health insurance company will want its money back. This process has a legal name: subrogation.

In simple terms, subrogation is your health insurer's right to recover what it paid for your medical care. Think of it like a loan. Your health plan covers your treatment costs upfront so you can get the care you need. Once you receive a settlement from the at-fault driver, the insurer places a claim, known as a lien, against that money to get reimbursed.

This concept can come as a complete shock. Most people assume their settlement is meant to cover their pain, lost wages, and future needs—not just to repay an insurance company. This is where things can get incredibly complicated for accident victims trying to handle a claim on their own.

How Different Health Plans Affect Your Settlement

The strength of your health insurer's lien often depends on the type of plan you have. This single detail can dramatically change how much of your settlement money you actually get to keep.

- ERISA Plans: Many employer-sponsored health plans are governed by a federal law called the Employee Retirement Income Security Act (ERISA). These plans often have very strong, federally protected reimbursement rights that are tough to challenge without an experienced lawyer.

- Private and ACA Plans: Health plans bought privately or through the Affordable Care Act (ACA) marketplace are usually governed by Texas state laws. This can sometimes offer more flexibility for negotiating down the lien amount.

- Medicare and Medicaid: Government-funded plans like Medicare and Medicaid also have automatic lien rights. They must be repaid from any settlement you receive.

No matter what type of plan you have, you can’t just ignore a subrogation claim. Failing to address a lien can create serious legal and financial problems for you down the road.

Why Lien Negotiation Is a Job for an Attorney

This is where the value of an experienced Houston car accident attorney becomes crystal clear. We don't just fight the at-fault driver's insurance company; we also go to bat for you against your own health insurer. Our job is to negotiate these liens down, arguing for reductions based on attorney fees, case costs, and other legal principles.

A successful lien negotiation means more of the settlement money stays where it belongs: in your pocket, helping you rebuild your life. An insurance adjuster won't do this for you—their only goal is to close your case for as little money as possible.

The economic fallout from a crash can be devastating. Research shows that the total economic cost of motor vehicle crashes in the U.S. reached a staggering $340 billion in a single year, highlighting the massive financial burden placed on victims. This figure includes not just medical bills but lost productivity and lifelong care needs. The Law Office of Bryan Fagan, PLLC, fights to ensure your settlement covers the complete financial picture of your recovery, not just what an insurance company paid out.

Successfully managing medical bills and insurance payments is a complex job. Our team has extensive experience in this area, and you can learn more by checking out our guide on who pays medical bills after a Texas car accident. We handle these negotiations so you can focus on what really matters: healing.

What Compensation Can You Recover After a Crash?

When you're hurt in a serious accident, the costs go far beyond the first stack of medical bills that land in your mailbox. Texas law recognizes this and allows you to seek compensation—what the legal world calls “damages”—for the total impact the crash has had on your life. Figuring out what "full compensation" really means is the first step toward getting the resources you need to actually recover.

The financial fallout from a car crash isn’t just a local problem; it’s a global one. These accidents cost countries roughly 3% of their gross domestic product, placing an enormous burden on families just trying to get by. Non-fatal injuries, especially, create a ripple effect of financial strain from ongoing treatment and lost time at work.

Economic Damages: The Losses You Can See and Count

First up are the tangible, calculable financial hits you've taken. These are known as economic damages, and they’re often the most straightforward part of an auto insurance claim because you can point to a bill or a pay stub.

Our job is to meticulously track down and document every single expense you've incurred because of someone else's negligence. This isn't just a handful of receipts; it's a complete financial picture that includes:

- All Medical Expenses: From the ambulance ride and the emergency room visit to surgeries, hospital stays, physical therapy, and any future medical care you'll need down the road.

- Lost Wages: If you couldn’t work while you were laid up and recovering, we fight to get back every dollar of income you lost.

- Lost Earning Capacity: Sometimes, an injury is so severe it prevents you from returning to your old job or earning the same living you did before. We seek compensation for this future financial loss, which can be life-altering.

Of course, it’s not just about medical bills. A totaled car is another huge economic loss. That's why understanding total loss vehicle calculations is so important—it helps ensure you get a fair payout for your property damage, not just what the insurance company first offers.

Non-Economic Damages: The Human Cost

Just as critical is the second category: non-economic damages. These are meant to compensate you for the deep, personal losses that don’t come with a neat price tag. This is where we account for the human cost of the crash.

These losses are very real, and Texas law confirms your right to be compensated for them. It’s an acknowledgment that an injury is so much more than a set of medical bills—it’s a massive disruption to your entire life.

Think about a construction worker injured in a Dallas T-bone collision. He's not just facing a mountain of medical debt. He’s also lost months of income and can no longer enjoy hobbies like fishing or even just playing with his kids without pain. We fight for compensation that covers all of it, including:

- Pain and Suffering: For the physical pain, discomfort, and hardship you've been forced to endure.

- Mental Anguish: For the emotional distress, anxiety, fear, and trauma caused by the accident and its aftermath.

- Loss of Enjoyment of Life: For being robbed of the ability to participate in activities and hobbies you once loved.

- Disfigurement: For permanent scarring or physical changes that serve as a constant reminder of the crash.

Putting a dollar amount on these kinds of losses is complex, but it's absolutely essential for reaching a fair settlement. To get a better sense of how this works, you can check out our detailed guide on how a car accident injury settlement is calculated here in Texas.

Why You Need an Experienced Houston Car Accident Attorney

Trying to navigate the maze of auto insurance claims, health insurance liens, and Texas personal injury law on your own is a heavy burden to carry. It's especially difficult when your main focus should be on recovering from your injuries. In a situation like this, hiring an experienced attorney isn't a luxury—it's a necessity to protect your rights and your financial future.

Let’s be clear: an insurance adjuster's primary job is to protect their company's bottom line, not yours. They often use confusing tactics and industry jargon to minimize what they have to pay out or even try to shift the blame onto you. A skilled Houston car accident lawyer steps in as your advocate, managing every communication and shielding you from the pressure of aggressive adjusters.

We Handle the Legal Complexities So You Can Heal

From the moment you hire us, we take over the difficult tasks that can easily overwhelm an accident victim. Our team immediately starts gathering the critical evidence needed to build a strong case and prove the other driver's liability. We meticulously calculate the full scope of your damages—from every medical bill and lost paycheck to your pain and suffering—to make sure nothing is overlooked.

One of the most valuable roles we play is fighting to reduce or eliminate health insurance subrogation liens. This single action can dramatically increase the amount of money you actually take home from your settlement.

Dealing with insurance companies is only part of the battle. The legal process itself is riddled with deadlines and complex procedural rules that can completely sink a claim if they aren't handled perfectly. For instance, the Texas statute of limitations generally gives you only two years from the date of the accident to file a lawsuit. If you miss that deadline, your right to seek compensation is lost forever.

Let's look at a real-world example. Imagine a Houston driver is rear-ended on I-45 and suffers a serious back injury. Her health insurance covers $80,000 for her surgery and physical therapy, then immediately places a lien for that full amount on any future settlement. The at-fault driver's insurance offers a quick $100,000 settlement, which might sound fair at first.

But after paying back that $80,000 lien and other costs, she'd be left with very little to cover her lost income and immense pain. An experienced Texas injury attorney would not only fight for a settlement that reflects the true value of her suffering but would also negotiate that $80,000 lien down, potentially saving her tens of thousands of dollars.

Your Advocate in the Fight for Justice

The Law Office of Bryan Fagan, PLLC, handles every legal detail so you can dedicate all your energy to your physical and emotional recovery. We are your protectors and your partners in seeking justice. If you’ve been injured in a crash, you don't have to face this fight alone.

Contact us today for a free, no-obligation consultation to discuss your case. We work on a contingency fee basis, which means you pay absolutely nothing unless we win your case. Let us put our experience to work for you.

Steps to File an Insurance Claim After a Car Accident

When you're reeling from a crash, your mind is a whirlwind of questions and worries. The whole insurance maze can feel impossible to navigate, but you're not the first person to feel this way. Here are some plain-English answers to the questions we get asked most often by accident victims across Texas.

What if the Driver Who Hit Me Has No Insurance or Not Enough?

This is a scary thought, but it happens all the time on Texas roads. It’s the exact reason your own car insurance policy has Uninsured/Underinsured Motorist (UM/UIM) coverage.

Think of it as your personal safety net. When the at-fault driver's insurance is missing or just isn't enough to cover your bills, your UM/UIM coverage steps in to fill the gap. It can pay for your medical expenses, lost income, and other damages, right up to your own policy limits. While you'll still use your health insurance for immediate medical care, a skilled Texas injury attorney can file a UM/UIM claim to make sure you get the compensation you paid for and deserve.

Should I Give My Health Insurance Information to the Other Driver's Insurance Company?

Be very, very careful here. Never give your health insurance details or sign any kind of medical release form for the other driver's insurance adjuster without talking to a lawyer first.

Handing over that information gives them a key to unlock your entire medical history. Adjusters are trained to dig for anything—a past injury, a pre-existing condition—that they can use to argue your injuries weren't caused by the crash. Your attorney should be the one handling every single conversation with the other side. It’s the best way to protect your privacy and the true value of your claim.

Key Takeaway: Let your lawyer be the gatekeeper. They will manage all communication with the at-fault driver's insurance to prevent your private medical history from being twisted and used against you.

Do I Still Have to Pay My Health Insurance Deductibles and Co-pays?

Yes, at least for now. As you get treatment for your injuries, you are still on the hook for your normal health plan deductibles and co-pays. This is why it’s critical to keep a record of every single receipt and "Explanation of Benefits" statement you receive.

Every dollar you pay out-of-pocket is considered a part of your economic damages. Our team will meticulously track these expenses so they can be included in the total compensation we demand from the at-fault driver's insurance. A fair settlement is meant to make you whole again, and that includes reimbursing you for every cent you had to spend because of someone else's negligence.

Can My Health Insurance Company Refuse to Pay for My Accident-Related Bills?

Generally, no, they can't. Your health insurance policy is a contract. It obligates them to cover necessary medical care, no matter what caused the injury. That said, we all know insurance companies can find creative reasons to delay or deny claims.

If you run into any trouble or get an outright denial, you need to call an experienced car accident lawyer right away. We can get a copy of your policy, challenge the denial, and fight on your behalf to make sure your insurer holds up its end of the bargain. This lets you focus on getting the treatment you need while we handle the fight to hold the responsible driver accountable.

The aftermath of a car wreck is a tangled mess of insurance claims and legal questions, but you don’t have to sort it out by yourself. The Law Office of Bryan Fagan, PLLC is here to answer your questions and fight for every dollar of compensation you deserve. Contact us today for a free, no-pressure consultation to see how our Houston car accident lawyers can help protect your rights and start putting your life back together. Visit us at https://houstonaccidentlawyers.net.