A car crash can change your life in seconds—but you don’t have to face recovery alone. You're hurt, overwhelmed, and trying to figure out how to cover your mounting bills. The first step toward financial recovery is an insurance claim, but you’ll immediately run into two terms: a first-party claim and a third-party claim. Understanding the difference is crucial for protecting your rights and getting the full compensation you deserve.

Who Is Liable in a Texas Car Accident?

After a serious wreck in Houston, the type of insurance claim you file dictates the entire recovery process. Each path comes with its own set of rules, timelines, and potential hurdles. The key difference lies in who you are filing a claim with.

A first-party claim is when you turn to your own insurance company for benefits you’ve already paid for. You are the "first party" in this relationship. This usually involves coverage like:

- Personal Injury Protection (PIP): This helps cover your initial medical bills and lost wages right away, no matter who caused the accident.

- Collision Coverage: This pays to repair or replace your vehicle after a crash.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is your safety net when the at-fault driver has no insurance or not enough to cover all your damages.

On the other hand, a third-party claim is filed against the insurance company of the driver who hit you. Here, you are the "third party" demanding compensation because their driver's liability—or legal responsibility due to negligence—caused your injuries and losses.

If you want to get a better handle on how different policies work, it helps to check out resources on understanding car insurance options.

First-Party vs Third-Party Claims at a Glance

It’s easy to get confused when you're just trying to focus on healing. This table breaks down the fundamental differences between filing with your insurer versus the at-fault driver's. One of the most important first-party benefits you should know about is how underinsured motorist coverage in Texas works to protect you.

| Claim Characteristic | First-Party Claim | Third-Party Claim |

|---|---|---|

| Who You File With | Your own insurance company. | The at-fault driver's insurance company. |

| Basis of Claim | Your contractual policy benefits (PIP, Collision, UM/UIM). | The other driver's legal negligence (liability). |

| Proving Fault | Not required for PIP or Collision; required for UM/UIM. | Always required; you must prove the other driver was at fault. |

| Relationship | You have a contract with your insurer (duty of good faith). | Adversarial; their goal is to pay as little as possible. |

| Available Damages | Limited to your specific policy coverage amounts. | Full range of damages (medical bills, lost income, pain & suffering). |

As you can see, the relationship dynamic is a huge factor. Your own insurer has a duty to treat you fairly, but the other driver's insurer has a duty to its shareholders—which means minimizing your payout. This distinction alone often determines how smoothly (or not) your claim will go.

Steps to File a First-Party Insurance Claim

When you file a first-party insurance claim, you’re turning to your own insurance company. You're asking them to pay out on a policy you've been paying premiums for. After a Texas car accident, this is often the quickest path to getting money for your immediate bills while the bigger questions of fault are still being worked out.

The process means you're tapping into specific coverages within your auto policy. Because you have a contract with your insurer, they have a direct legal duty to you. This is a fundamental difference in the first-party vs. third-party claim dynamic.

Common Types of First-Party Claims

After a wreck, you can lean on your own policy in a few critical ways. Each coverage is designed to help with a different part of your recovery.

- Personal Injury Protection (PIP): In Texas, every auto policy includes PIP unless you specifically reject it in writing. It's designed to cover your initial medical bills and a percentage of your lost income, no matter who caused the crash.

- Collision Coverage: This is what pays to fix or replace your car after an accident. You’ll have a deductible to pay, but it lets you get your vehicle repaired without having to wait for the other driver's insurance to accept liability.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: Think of this as your financial safety net. If the at-fault driver has no insurance or fled the scene (a hit-and-run), your UM coverage kicks in. If their policy is too small to cover all your damages (the total of your losses), your UIM coverage can bridge the gap.

Picture this: you’re seriously injured by a hit-and-run driver on I-10 in Houston. With no at-fault driver to pursue, your UM/UIM policy becomes the main—and sometimes only—way to get compensation for your medical treatments and other losses.

By law, your insurance company owes you a “duty of good faith and fair dealing.” This means they must investigate your claim and pay what you're rightfully owed in a timely and fair manner. They can't legally put their own profits ahead of their contractual promises to you.

What to Expect From Your Insurer

Even though your insurance company has a duty to you, never forget they are a business trying to protect their bottom line. The first-party claim process isn't always a walk in the park. The adjuster will investigate the accident, comb through your medical records, and evaluate the damage to your vehicle.

They'll likely ask you for a recorded statement or request broad access to your entire medical history. Be careful here. It's wise to speak with a Houston car accident lawyer before you hand over information that could be twisted to limit or deny your claim.

Disputes often pop up over the real value of your claim. An adjuster might claim a certain medical treatment wasn't necessary or make a lowball offer for your totaled car. This is precisely when having an experienced attorney in your corner is non-negotiable. A lawyer can fight for you, making sure the insurer honors its own policy and pays the full benefits you deserve. If they act in "bad faith" by unreasonably delaying or denying a valid claim, a Texas injury attorney can hold them accountable.

Pursuing a Third-Party Insurance Claim

When another driver's negligence leaves you injured, a third-party insurance claim is the most direct route to getting the compensation you deserve. Unlike a first-party claim where you deal with your own insurance company, this process means you file against the at-fault driver's policy. You are the "third party" in this scenario, seeking payment from their insurer.

This isn't like calling your own agent. The relationship here is immediately adversarial. The other driver's insurance company has a legal duty to protect its policyholder and its own bottom line—not you. Their goal is simple: pay as little as possible.

Proving Liability and Damages Under Texas Law

To even get a foot in the door with a third-party claim, you have to prove liability. In plain English, liability means legal responsibility. In Texas, this means showing clear evidence that the other driver was negligent and that their actions directly caused the crash and your injuries. It's a much heavier lift than a simple, no-fault PIP claim with your own insurer.

Once you establish who was at fault, you can demand damages—the legal term for the financial compensation you're owed for your losses. A third-party claim opens the door to a much wider range of compensation, including:

- All past and future medical bills.

- Lost wages and any impact on your future earning ability.

- Physical pain and emotional suffering.

- Physical impairment and permanent disfigurement.

- The cost to repair or replace your vehicle.

This is a critical difference. Third-party claims let you recover money for things like pain and suffering, which your own PIP or collision coverage simply won't touch.

The Adversarial Nature of Third-Party Claims

Picture this: a family is hit by a commercial truck on Loop 610 in Houston, leaving them with devastating injuries. To cover lifelong medical needs, they must file a third-party claim against the trucking company’s massive insurance provider. That insurer will instantly assign a claims adjuster whose entire job is to poke holes in the family's case and minimize the payout.

The other driver’s insurance adjuster is not your friend. They are a trained negotiator working to minimize their company’s financial exposure. Anything you say can and will be used against you to reduce your settlement.

That adjuster will likely try to get you to admit you were partly at fault, suggest your injuries aren't that serious, or push you to accept a quick, lowball offer before you even know the full extent of your damages. This is why understanding how to negotiate an insurance settlement is so important, but it's a fight you shouldn't have to wage alone.

Hiring a Texas injury attorney completely levels the playing field. We take over all communication with the adjuster, gather the evidence needed to build an undeniable liability case, and calculate the true, full value of your damages. We fight to make sure the negligent party is held accountable so you can focus on what really matters—healing.

Comparing First-Party and Third-Party Claim Differences

After a car accident, one of the first and most critical decisions you'll make is whether to file a first-party claim, a third-party claim, or even both. The path you choose has a huge impact on the evidence you need, the money you can recover, and the legal fight you might face. Getting this right is key to protecting yourself.

At its core, the first party vs third party debate is about relationships and obligations. A first-party claim is between you and your own insurance company—a relationship built on a contract. A third-party claim, on the other hand, is an adversarial process where you have to prove someone else was negligent.

Proving Fault and Establishing Liability

The need to prove who caused the wreck is the biggest difference between these two claim types. This one factor often decides how fast you get paid and what kind of evidence your attorney needs to start collecting right away.

With a first-party claim, proving fault isn't always the main issue. If you use your Personal Injury Protection (PIP) coverage for immediate medical bills, it’s a “no-fault” benefit. Your insurer pays up to your policy limit, no matter who was responsible. It’s designed to get you quick financial help when you need it most.

A third-party claim, however, is all about liability. Under Texas law, you can't get a dime from the other driver's insurance company unless you prove their carelessness caused your injuries. This means gathering solid evidence, like:

- The official police report from the accident.

- Photos and videos of the damaged vehicles and the crash scene.

- Statements from anyone who witnessed the collision.

- Testimony from accident reconstruction experts, if the crash is complex.

For example, if a Houston driver rear-ended on I-45, a third-party claim requires your Texas injury attorney to show clear proof of their negligence to hold them accountable for your losses.

The most important thing to remember is that in a third-party claim, the burden of proof is 100% on you. The other driver’s insurer won’t lift a finger to help you build your case—in fact, they will actively look for ways to tear it down.

Available Damages and Potential Compensation

The amount and types of compensation you can get also vary wildly between first-party and third-party claims. For families facing mounting medical bills and lost income after a serious crash, this is often the most important distinction.

In a first-party claim, the damages you can recover are strictly capped by your own insurance policy. Your PIP, Collision, and UM/UIM coverages all have specific limits. You can't recover a penny more than the coverage you paid for, even if your actual costs are much higher.

A third-party claim, however, allows you to demand compensation for the full scope of your economic and non-economic damages under Texas law. This can include money for:

- Economic Damages: All of your medical bills (past and future), lost wages, and any impact on your ability to earn a living down the road.

- Non-Economic Damages: Physical pain, mental anguish, emotional distress, disfigurement, and the loss of enjoyment of life.

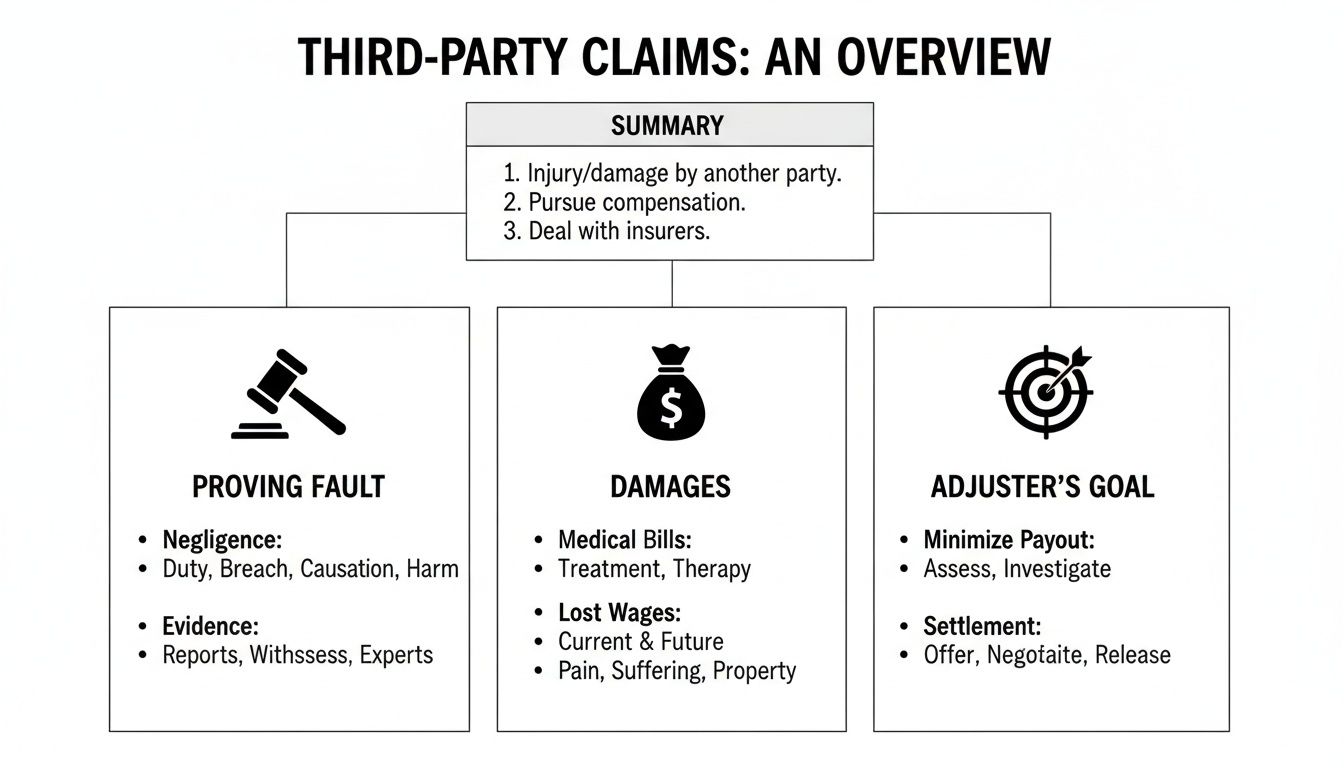

The infographic below breaks down the key parts of a third-party claim, from proving fault to the types of damages available—and the adjuster’s goal of paying you as little as possible.

As you can see, while a third-party claim takes more work, it opens the door to far more complete compensation that reflects the true human cost of an accident.

To make these differences even clearer, here's a side-by-side comparison.

How First-Party and Third-Party Claims Compare

This table breaks down the key distinctions you'll encounter, from proving your case to who you'll be dealing with.

| Key Aspect | First-Party Claim (Your Insurer) | Third-Party Claim (At-Fault Party's Insurer) |

|---|---|---|

| Proof of Fault | Often not required (e.g., PIP is "no-fault"). You just need to show a covered loss occurred. | Absolutely essential. You must prove the other party’s negligence caused your injuries. |

| Relationship | Contractual. Your insurer has a duty of "good faith and fair dealing" to you as their policyholder. | Adversarial. Their insurer has no duty to you. Their goal is to protect their client and their own profits. |

| Compensation | Limited to your policy's specific coverage limits (e.g., PIP, Collision, UM/UIM amounts). | Can include the full range of economic and non-economic damages allowed under Texas law. |

| Adjuster's Goal | To process the claim according to your policy terms, but still aiming to minimize their payout. | To challenge your claim, dispute liability, and pay as little as possible—ideally, nothing. |

Understanding these dynamics is crucial. When you file a third-party claim, you're not just asking for help—you're entering a fight where the other side is financially motivated to deny you justice.

Important Legal Deadlines

Finally, you need to be aware of the different timelines for each claim type. Missing a deadline can completely destroy your chance of getting the money you deserve.

For most first-party claims, your insurance policy itself will spell out how quickly you have to report the accident and file your claim. These contractual deadlines can be surprisingly short, sometimes just a few weeks or months. If you miss them, your own insurer could have a reason to deny your claim.

For all third-party personal injury claims in Texas, the deadline that matters most is the statute of limitations. The statute of limitations is a strict legal deadline for filing a lawsuit. According to the Texas Civil Practice & Remedies Code, Chapter 16, you typically have just two years from the date of the crash to file a lawsuit against the at-fault driver. If you miss that two-year window, you lose your right to seek compensation in court forever.

This two-year deadline is strict and also applies to any lawsuit seeking wrongful death compensation. It's one of the biggest reasons to contact a car accident lawyer right away. We can make sure all evidence is saved and every legal deadline is met, protecting your right to a fair recovery from the very beginning.

Choosing the Right Claim Strategy for Your Situation

After a car crash, the decisions you make can feel monumental. There’s no single “right” answer for every situation; it's about choosing the path that best protects you and your family based on the specific facts of your case. The choice between a first-party vs. third-party claim can make all the difference in how fast your bills get paid and whether you recover the full compensation you’re owed.

Understanding your options is the first step toward regaining control. Each accident presents a unique set of challenges, and knowing which claim to file—and when—is critical for both your financial and physical recovery.

Scenario 1: The Other Driver Is Clearly At Fault and Has Insurance

This is the most straightforward scenario. When another driver is clearly negligent—maybe they blew through a red light or rear-ended you on I-45 in Houston—your primary path to full compensation is a third-party claim against their insurance company. This is the only way to recover the full range of damages, including all your medical bills, lost wages, and pain and suffering.

But there’s a catch: third-party claims take time. The other driver’s insurer will investigate everything, and they won’t pay a dime until they officially accept liability. This process can drag on for months, leaving you drowning in bills.

This is where a hybrid approach often works best. You can immediately open a first-party claim with your own insurer to access your Personal Injury Protection (PIP) benefits. This gets money in your hands quickly for medical care and lost income without having to prove fault. While you’re getting that immediate help, your Houston car accident lawyer can build a powerful third-party claim to secure a full and fair settlement down the road.

Scenario 2: The At-Fault Driver Is Uninsured or Fled the Scene

What if the driver who hit you has no insurance, or worse, it was a hit-and-run? In this frightening situation, a third-party claim is off the table because there’s no at-fault insurer to pursue. This is precisely why having Uninsured/Underinsured Motorist (UM/UIM) coverage is so essential in Texas.

Your only path to recovery here is a first-party UM/UIM claim filed with your own insurance company. You’re essentially asking your insurer to step into the shoes of the at-fault driver’s insurance and cover your damages. It’s critical to remember that even though it’s your own insurer, a UM claim still requires you to prove the other driver was at fault and that your damages are what you say they are.

Scenario 3: Fault Is Unclear or Disputed

Accidents are chaotic. Sometimes it isn’t immediately clear who’s to blame. The other driver might lie, or witnesses could have conflicting stories. When liability is disputed, you can bet the other driver's insurance company will deny your third-party claim outright.

In this situation, you should immediately turn to your first-party benefits. File a collision claim to get your car repaired and use your PIP benefits for your medical bills. This allows you to get the help you need now, without waiting for a lengthy and frustrating fault investigation to play out.

While you use your first-party coverage, your attorney gets to work. We will launch a thorough investigation, gathering the evidence needed to prove the other driver was negligent under Texas’s comparative fault rules and force their insurer to the table.

Understanding Subrogation: If you use your own insurance first (like collision or PIP) and we later prove the other driver was at fault, your insurance company can seek reimbursement from the at-fault party's insurer. This process, called subrogation, ensures the responsible party ultimately pays, but it allows you to get help right away.

Choosing the right strategy can feel overwhelming when you’re just trying to heal. At The Law Office of Bryan Fagan, we analyze the unique details of your case and advise you on the best path forward, ensuring you are protected at every single turn.

Why an Experienced Car Accident Lawyer Is Essential

Whether you’re filing a first-party or third-party claim, there’s one thing you can count on: the insurance company is a business. Its main goal is to protect its bottom line, which means paying out as little as possible. An experienced Texas injury attorney from The Law Office of Bryan Fagan is the advocate you need to make sure you're treated fairly.

Insurance companies come to the table with teams of adjusters and lawyers trained to minimize what you recover. They know every nuance of Texas law and will use it to their advantage. You deserve someone in your corner who’s just as knowledgeable and fights only for you.

Protecting You in Third-Party Claims

When you file a third-party claim against the at-fault driver's insurance, the burden of proof is entirely on you. Your attorney's job is to build a rock-solid case for liability. Here’s how we do it:

- Gathering Critical Evidence: We immediately get to work securing police reports, tracking down and interviewing witnesses, and preserving evidence from the crash scene before it’s lost forever.

- Proving Negligence: We take that evidence and use it to clearly establish that the other driver breached their duty of care, which directly caused your injuries and damages.

- Fighting Comparative Fault Arguments: It’s a common tactic for adjusters to try and shift some of the blame onto you to reduce their payout under Texas’s comparative fault rule (Texas Civil Practice & Remedies Code, Chapter 33). We aggressively shut down these arguments to protect the full value of your claim.

Imagine you were T-boned by a distracted driver at a Houston intersection. Their insurer might try to argue you were speeding, even if it’s not true. A skilled lawyer can pull traffic camera footage and bring in expert analysis to dismantle that claim and prove the other driver was 100% at fault.

Insurance companies are not on your side. Their adjusters are trained negotiators whose job is to challenge your claim and protect their profits. An attorney levels the playing field, forcing them to negotiate in good faith.

Your Advocate in First-Party Claims

You might think you don't need a lawyer when dealing with your own insurance company, but it's surprising how often disputes arise in first-party UM/UIM claims. Your insurer can still try to delay, underpay, or flat-out deny your claim without a good reason.

A Houston car accident lawyer makes sure your insurer honors its legal and contractual obligations to you. If they act in “bad faith” by refusing to pay a valid claim without a reasonable basis, we can hold them accountable. We protect your rights and fight for the very benefits you’ve been paying for. Finding the right legal partner is a huge step in your recovery, and understanding how to choose a personal injury lawyer can give you the confidence to make the right choice.

Don’t Face the Insurance Companies Alone

A car accident can leave you feeling completely powerless, but you have the right to demand fair compensation. The legal system is complicated, and the stakes are far too high to go into this battle on your own. You only get one shot to secure the settlement you need to put your life back together.

The compassionate attorneys at The Law Office of Bryan Fagan are here to take that weight off your shoulders. We will handle every legal detail, from gathering evidence to negotiating aggressively, so you can focus on what really matters: your health and your family. Contact us today for a free, no-obligation consultation to discuss your case and learn how we can help you get the justice you deserve.

Answering Your Top Questions About Texas Accident Claims

When you're dealing with the fallout from a car wreck, questions pile up fast. Understanding the difference between a first-party vs. third-party claim is a huge step, but what about the other details? Here are some clear, plain-English answers to the questions we hear most often from people just like you.

Can I File Both a First-Party and a Third-Party Claim?

Absolutely. In fact, it's often the smartest move you can make. You can immediately file a first-party claim with your own insurer to tap into your Personal Injury Protection (PIP) coverage. This gets money flowing quickly for medical bills and lost paychecks, so you aren't left waiting while the fault investigation drags on.

At the same time, a skilled attorney can be building a powerful third-party claim against the at-fault driver's insurance. This is how you pursue full compensation for all your damages, including the pain and suffering your own policy will never cover. Running these two claims in parallel ensures you get immediate relief while still fighting for the maximum settlement you're owed.

How Does Texas Comparative Fault Affect My Claim?

Texas operates under a rule called “modified comparative fault,” found in Texas Civil Practice & Remedies Code, Chapter 33. In plain English, comparative fault is the legal process of assigning a percentage of blame to everyone involved in an accident. This law means you can still recover money as long as you are 50% or less at fault for the accident. The catch? Your final settlement gets cut by whatever percentage of fault is assigned to you.

So, if you're awarded $100,000 but are found 10% responsible for the crash, you'll only receive $90,000. The other driver's insurance adjuster will do everything they can to pin blame on you to slash their payout. This is precisely why you need an experienced Texas injury attorney in your corner to prove the other driver was the one at fault.

What if My Own Insurer Denies My First-Party Claim?

When your own insurance company denies a valid claim without a good reason, they could be acting in “bad faith.” Your insurer has a legal obligation to treat you fairly. Wrongfully denying a UM/UIM or PIP claim isn't just bad service—it's a serious breach of their duty to you.

If you feel your insurance company has unfairly denied your claim, you need to talk to a lawyer right away. You might have a case for a separate bad faith lawsuit against your insurer, on top of your original accident claim.

A car crash can throw your entire life into chaos, but you don't have to navigate it alone. The dedicated attorneys at The Law Office of Bryan Fagan, PLLC are here to answer every question and fight for your rights. Contact us today for a free, no-obligation consultation to find out how we can help you secure the justice and compensation you deserve.