A car crash can change your life in seconds—but you don’t have to face recovery alone. A car accident settlement is the financial compensation you receive after a crash to cover your injuries, damaged property, and other losses. It's a formal agreement between you and the at-fault driver's insurance company designed to resolve your claim fairly, often without having to go to court. The goal is to get you the resources you need to rebuild your life.

Your First Steps After a Texas Car Accident

One second, you’re driving. The next, your life is turned upside down. The moments after a collision on a Houston freeway or a quiet neighborhood street are a blur of confusion, pain, and uncertainty.

Suddenly, you're juggling vehicle repairs, doctor’s appointments, and calls from insurance adjusters—all while trying to heal. It’s a heavy burden, and it's completely normal to feel overwhelmed.

This guide is here to bring some clarity to the chaos. Seeking a settlement for a car accident isn’t about picking a legal fight; it's about getting the financial resources you and your family need to put your lives back together. Thankfully, Texas personal injury law gives you a clear path to recover compensation when someone else’s carelessness causes you harm.

Who Is Liable in a Texas Car Accident?

To understand your settlement options, it’s important to know some key legal terms. Insurance companies use specific language, but the concepts are straightforward. Knowing them helps you protect your rights from day one.

Key Terms in a Texas Car Accident Claim

Here is a quick reference guide to the essential legal terms you'll encounter during your settlement negotiations.

| Legal Term | Plain-English Explanation |

|---|---|

| Liability | This is a legal way of saying who is at fault. To get a settlement, you must prove the other driver was legally responsible for the crash. Evidence like police reports, photos from the scene, and witness statements are crucial here. |

| Damages | This is the legal term for all the losses you suffered because of the accident. It includes concrete costs like medical bills and lost paychecks (economic damages), as well as intangible harm like your pain and suffering (non-economic damages). |

| Negligence | This is the foundation of almost every personal injury claim. It means the other driver failed to be reasonably careful—for example, by texting while driving on the I-10 or running a red light in The Woodlands—and that failure caused your injuries. Proving negligence is key to establishing liability. |

| Statute of Limitations | This is a strict legal deadline. In Texas, you generally have two years from the date of the accident to file a lawsuit (Texas Civil Practice & Remedies Code § 16.003). If you miss this window, you lose your right to seek compensation forever. |

| Comparative Fault | This Texas law, also known as proportionate responsibility, looks at whether you were partially at fault for the accident (Texas Civil Practice & Remedies Code, Chapter 33). Your final settlement can be reduced by your percentage of blame. If you're found 51% or more at fault, you cannot recover any compensation. |

Understanding these terms gives you a solid foundation as you move forward. To secure a settlement, you must show that the other driver's negligence caused the crash and your subsequent damages. Evidence is key; for instance, objective data from a GPS car tracker route history can sometimes help establish a vehicle's location and speed at the time of impact.

A fair settlement is not just about covering today's bills. It's about ensuring your financial stability for all future medical needs, lost earning potential, and the personal impact the crash has had on your life.

This guide will walk you through each stage of the settlement process, from calculating the true value of your claim to understanding Texas-specific laws that can affect your recovery. Remember, you have rights, and a Houston car accident lawyer can help you defend them.

How a Car Accident Settlement Is Valued in Texas

After a crash, the first question on your mind is likely, "What is my claim actually worth?" It's a perfectly fair question. You're suddenly facing a mountain of medical bills, you're missing time from work, and you're dealing with the physical and emotional fallout. Understanding how a settlement is valued is the first step toward getting your life back on track.

In Texas, a car accident settlement is built around "damages"—all the losses you've suffered. These damages fall into two main categories: economic and non-economic. Think of them as the tangible costs versus the very real, but less tangible, human costs of the crash.

Calculating Your Economic Damages

Economic damages are the straightforward, out-of-pocket expenses you can prove with a paper trail of receipts, bills, and pay stubs. These form the concrete foundation of your settlement because they represent your direct financial losses.

These damages typically include:

- Medical Bills: This covers everything from the ambulance ride and emergency room visit to surgeries, physical therapy, prescription drugs, and any future medical care you are expected to need.

- Lost Wages: If your injuries kept you out of work, you are owed compensation for that lost income. This also extends to any loss of future earning capacity if the injuries permanently impact your ability to do your job.

- Property Damage: This is the cost to repair or replace your vehicle and any other personal items, like a laptop or phone, that were destroyed in the wreck.

For example, imagine a Houston driver is rear-ended on I-45, resulting in a herniated disc that requires surgery and months of physical therapy. Their economic damages would include the $50,000 in medical bills, $15,000 in wages lost during recovery, and the $8,000 to fix their car. Keeping meticulous records of these costs is crucial.

Valuing Your Non-Economic Damages

While economic damages add up your financial losses, non-economic damages compensate you for the human cost of the collision. These losses are deeply personal and don't come with a neat price tag, but they are just as real and critical to your recovery.

Non-economic damages are the legal system’s way of acknowledging that the impact of a crash goes far beyond your bank account. They address the physical pain, the emotional distress, and the sheer disruption to your everyday life.

Common non-economic damages include:

- Pain and Suffering: This is compensation for the physical pain and discomfort you've had to endure because of your injuries.

- Mental Anguish: This addresses the emotional trauma—the anxiety, depression, fear, or even PTSD that so often follows a serious wreck.

- Physical Impairment: If the crash left you with a long-term or permanent disability, like a limp or chronic pain that prevents you from enjoying hobbies you once loved, you can be compensated for this loss of quality of life.

Calculating the value of these damages is more subjective, and it's often where having an experienced Texas injury attorney makes a world of difference. Your lawyer knows how to gather evidence from medical experts, therapists, and your own story to build a powerful case for the compensation you truly deserve.

Settlement values can swing wildly based on the specific facts of each case. For a deeper dive into the factors that influence the final number, you can read about how much your car accident claim may be worth.

Nationally, the average settlement for a car accident involving injuries is around $30,416, but that figure can be misleading. A Texas-specific analysis found a median value of $12,281, which gives a more realistic picture of typical cases by filtering out the massive, multi-million-dollar awards that skew the average.

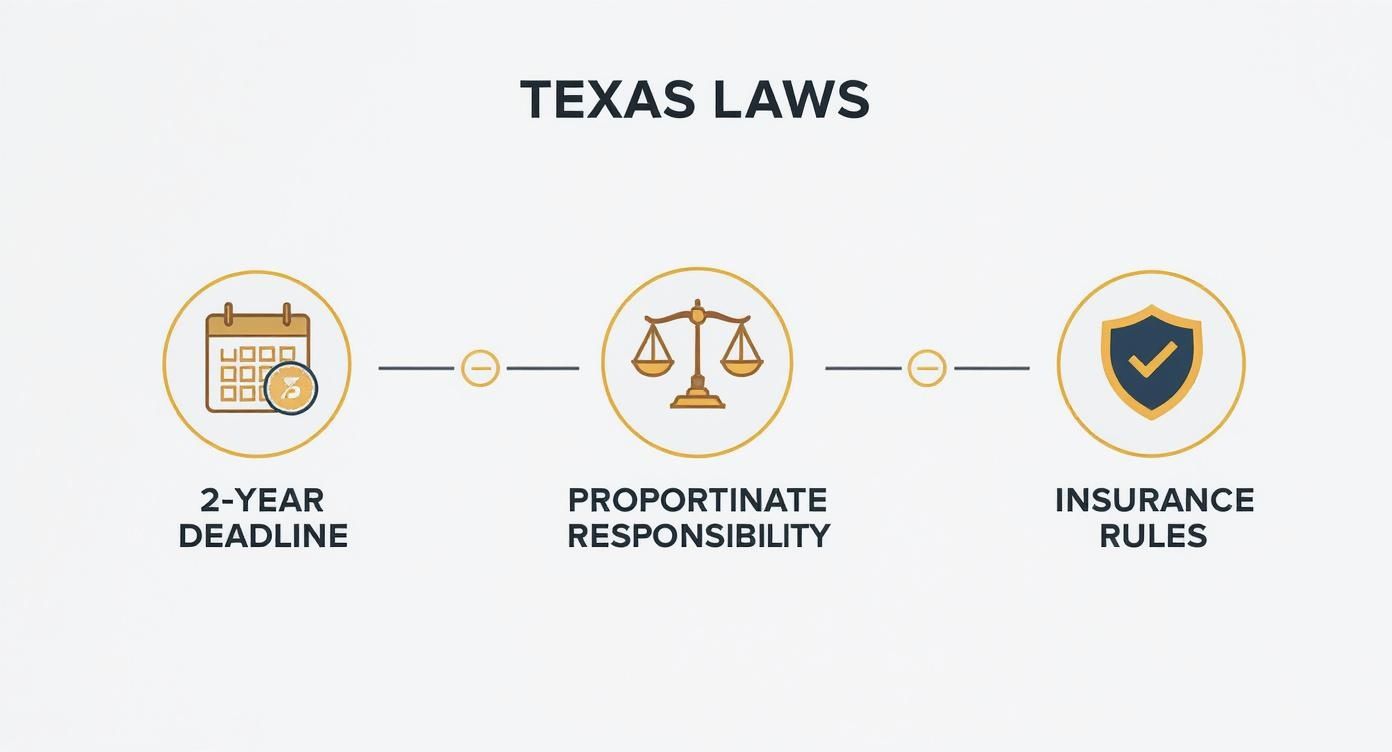

Understanding the Texas Laws That Impact Your Settlement

Knowing what your claim is worth is just the first piece of the puzzle. To get a fair settlement for a car accident, you have to understand the Texas laws that govern every negotiation. These rules create a structured and fair process for both you and the insurance company.

The Rule of Proportionate Responsibility

This is one of the most important laws in any Texas car accident case. Proportionate responsibility, also called comparative fault, is detailed in Chapter 33 of the Texas Civil Practice & Remedies Code. This law addresses situations where more than one person shares blame for a crash.

The rule is straightforward: the amount of money you can recover is reduced by your percentage of fault. For example, if you were found to be 20% at fault for a wreck and your total damages were $100,000, your settlement would be reduced by $20,000, leaving you with $80,000.

However, Texas law includes a strict cut-off.

The 51% Bar Rule: In Texas, if you are found to be 51% or more responsible for the accident, you are barred from recovering any compensation. Insurance adjusters are experts on this rule and will often try to shift as much blame as possible onto you to reduce or deny your claim.

The Two-Year Statute of Limitations

In the legal world, deadlines are critical. A statute of limitations is a non-negotiable deadline for filing a lawsuit. In Texas, you generally have just two years from the date of the car accident to file a personal injury lawsuit.

If you miss that two-year window, your right to seek compensation through the courts is gone forever.

This deadline gives the insurance company significant leverage. If you let time drag on, they have less incentive to offer a fair settlement because they know your legal options are about to expire. Acting quickly is the best way to protect your rights and show the insurer you’re serious about your claim.

Uninsured and Underinsured Motorist Coverage

What happens if the driver who hit you has no insurance or carries a minimum policy that won't cover your medical bills? This is a common problem on Texas roads. This is where your own auto insurance claim can be a lifesaver, thanks to two specific types of coverage:

- Uninsured Motorist (UM) Coverage: This protects you when you’re hit by a driver who has no liability insurance.

- Underinsured Motorist (UIM) Coverage: This applies when the at-fault driver has insurance, but their policy limits are too low to cover the full cost of your damages.

For instance, if a driver in San Antonio T-bones you, causing $75,000 in damages, but they only have the Texas state minimum of $30,000 in liability coverage, your UIM coverage could step in to cover the $45,000 gap.

Understanding your own policy is just as important as dealing with the other driver's. A Texas injury attorney can review your coverage to ensure you are accessing every available source of compensation.

Steps to File an Insurance Claim

When you're hurt and watching medical bills pile up, waiting for a settlement for a car accident can feel unbearable. It’s natural to want a quick resolution, but the settlement process is a journey.

Knowing what to expect at each stage can reduce stress and give you confidence that your claim is moving forward correctly. Every case is unique; a minor fender-bender might settle in a few months, while a complex case with severe injuries can take a year or more. The timeline is almost always guided by your physical recovery.

The Phases of a Car Accident Claim

Here are the practical, step-by-step phases of a typical claim:

- Initial Treatment and Investigation: In the immediate aftermath, your focus is on getting medical care. Your legal team will gather critical evidence—the police report, witness statements, scene photos, and your initial medical records.

- Reaching Maximum Medical Improvement (MMI): This is a key milestone. MMI is the point where your doctors determine that your condition has stabilized and you’ve healed as much as possible. Only after you reach MMI can your legal team get a full and accurate picture of the long-term costs of your injuries.

- The Demand Letter: Once the full extent of your damages is known, your attorney drafts a comprehensive demand letter. This formal document is sent to the insurance company and lays out the facts, proves the other driver’s liability, and demands a specific settlement amount.

- Negotiation: The insurance adjuster will review the demand and respond, almost always with a lowball counteroffer. This begins a period of back-and-forth negotiation where your lawyer will fight for a fair number.

- Settlement Agreement: If an agreement is reached, you will sign a settlement release. This document officially closes the case and ends your claim. In exchange for the payment, you agree not to pursue further legal action for this accident.

The infographic below shows how different Texas laws and procedures come together to shape your settlement journey.

As you can see, legal deadlines, fault rules, and insurance policies all have a major say in how your claim unfolds.

Why Rushing a Settlement Is a Mistake

Patience is incredibly difficult when you’re facing financial pressure, but settling your case too early is one of the biggest mistakes you can make.

If you accept a quick offer before reaching MMI, you could be left paying for future surgeries, physical therapy, or long-term care out of your own pocket. The insurance company walks away, and you’re stuck with the bills.

The average timeline for settling car accident cases varies. Simple cases might settle within 6 to 12 months, but collisions causing serious harm often take 24 to 36 months to resolve. For a more detailed breakdown, you might be interested in our guide on how long it takes to settle a car accident claim. An experienced Houston car accident lawyer at The Law Office of Bryan Fagan, PLLC can manage this process, letting you focus on recovery while we handle the fight for the compensation you deserve.

Recognizing and Responding to Lowball Settlement Offers

One of the first calls you’ll likely get after a crash is from the other driver’s insurance adjuster. They might sound friendly and concerned, and they will probably make a quick settlement offer. While fast cash is tempting, this is almost always a red flag.

Insurance companies are for-profit businesses. Their primary goal is to protect their bottom line by paying out as little as possible. That early, lowball offer isn't goodwill; it's a calculated strategy to close your case for pennies on the dollar before you understand the full extent of your injuries and what your claim is truly worth.

Common Pressure Tactics to Watch For

Insurance adjusters are trained negotiators who use a specific playbook. Spotting these tactics is your first line of defense in protecting your right to a fair settlement for a car accident.

Watch for these classic moves:

- Rushing You into a Statement: They will often push for a recorded statement right away. You have no legal obligation to provide one. They are experts at twisting your words to minimize or deny your claim later.

- Downplaying Your Injuries: An adjuster might say, "It sounds like you’re not too badly hurt," or suggest your pain isn't as serious as you think. This is a deliberate tactic to justify a low offer.

- Creating a False Sense of Urgency: You might hear that the offer is "for a limited time only." This is pure pressure, designed to force you into a quick decision before you can speak with an attorney.

- Requesting Excessive Paperwork: Some adjusters will ask you to sign a blanket medical authorization, giving them access to your entire medical history. They are digging for a pre-existing condition they can blame for your pain.

For a deeper dive into their playbook, learn more about how to deal with insurance adjusters in our comprehensive guide.

How to Politely Decline a Lowball Offer

You never have to accept an unfair offer. When an adjuster gives you a low number, the best response is calm, firm, and simple.

A strong response is: "Thank you for the offer, but I am still evaluating the full extent of my damages. I will not discuss a settlement until my medical treatment is complete."

This polite refusal shows them you won't be rushed, keeps the door open for real negotiations, and buys you time to understand the true value of your case.

A Houston car accident lawyer at The Law Office of Bryan Fagan, PLLC can take over all communication with the insurance company, handle the negotiations, and fight to ensure any settlement for your car accident is fair.

When to Hire a Texas Car Accident Lawyer

Figuring out what to do after a car wreck is overwhelming. While you might handle a simple fender-bender with no injuries on your own, many situations demand the skill of an experienced professional. An attorney’s job is to protect your rights and level the playing field against a powerful insurance company.

Knowing when to call a lawyer can mean the difference between a fair settlement for your car accident and walking away with a fraction of what you deserve. Hiring a lawyer sends a clear signal that you're serious about recovering the full compensation you're owed under Texas law.

Clear Signs You Need an Attorney

If your accident involves any of the following, your next call should be to a Houston car accident lawyer:

- Serious Injuries: If you or anyone in your vehicle suffered more than minor bumps and bruises, you need an attorney. It's incredibly difficult to calculate the true long-term costs of medical treatment and future lost income on your own.

- Disputed Fault: Is the other driver blaming you? Is the police report vague or incorrect? An attorney is essential to investigate and gather the evidence needed to prove liability.

- A Lowball Offer: Insurance companies almost always start with a low offer. A lawyer knows how to properly value your claim and will take over negotiations to fight for what's right.

- Uninsured/Underinsured Driver: Dealing with your own insurance company for a UM/UIM claim can be just as frustrating. A lawyer ensures your own provider treats you fairly.

- Wrongful Death: If you have tragically lost a family member in a crash, you need a compassionate and skilled Texas injury attorney to navigate the complexities of a wrongful death claim and secure the compensation your family deserves.

The stakes in these cases are high. In 2022 alone, motor vehicle incidents resulted in over 5.2 million medically consulted injuries, with distracted driving being a factor in nearly 290,000 of them. Learn more about these car accident statistics and see how they can influence your claim.

The Role of Your Legal Advocate

Hiring a lawyer lifts the entire burden off your shoulders so you can focus on one thing: getting better.

An attorney acts as your investigator, your advocate, and your guide through a complex legal system. They manage every detail, from collecting evidence and interviewing witnesses to handling all communications with the insurance company, freeing you to prioritize your recovery.

A dedicated lawyer will meticulously build your case by:

- Investigating the Accident: They’ll immediately gather police reports, track down witness statements, and preserve crucial evidence.

- Calculating Your True Damages: Your attorney will consult with medical and financial experts to determine the full value of your losses.

- Negotiating Aggressively: Armed with evidence, they will counter the insurance company's lowball tactics and fight for a settlement that covers all your needs.

- Preparing for Trial: While most cases settle out of court, having a trial-ready attorney shows the insurer that you won't accept an unfair offer.

If you’ve been injured, don’t try to take on the insurance company by yourself. The Law Office of Bryan Fagan, PLLC, is here to provide the support and aggressive representation you need.

Common Questions About Car Accident Settlements

After a wreck, your mind is probably racing with questions. Here are some plain-English answers to the questions we hear most often from injured Texans.

Do I Have to Pay Taxes on My Car Accident Settlement in Texas?

For the most part, no. The IRS states that money you receive from a settlement for a car accident to cover your physical injuries and medical bills is not considered taxable income. This also applies to money for property damage.

However, if part of your settlement is specifically for lost wages, that portion might be taxed. The same applies to punitive damages (awarded under Chapter 41 of the Texas Civil Practice & Remedies Code), which are rare and meant to punish extreme recklessness. It's smart to review the final settlement with your Texas injury attorney.

What Happens If We Can’t Agree on a Settlement Amount?

If the insurance company won't offer a fair amount, the next step is often to file a personal injury lawsuit. This sounds intimidating, but it's a strategic move that increases pressure on the insurer.

Filing a lawsuit doesn't mean you're heading to court tomorrow. The vast majority of lawsuits still settle long before a trial ever begins, often in a process called mediation.

Your attorney handles all the complex legal work, using the lawsuit as leverage to continue negotiating from a position of strength.

Will My Health Insurance Get Part of My Settlement?

This often surprises people. If you used your health insurance to pay for medical care after the crash, your insurance company may have a legal right to be paid back from your settlement. This is called "subrogation."

A skilled Houston car accident lawyer knows how to handle this. A key part of their job is to negotiate with the health insurance company to reduce the amount you have to repay. This critical step can significantly increase the amount of money that goes into your pocket.

The road to recovery can feel long and lonely, but you don’t have to walk it by yourself. The Law Office of Bryan Fagan, PLLC is here to cut through the confusion and fight for the justice and compensation you deserve. We handle the legal battle so you can focus on what matters most: your health and your family.

For a free, no-obligation consultation to discuss your rights and legal options, contact our compassionate team today at https://houstonaccidentlawyers.net. We are here to help.